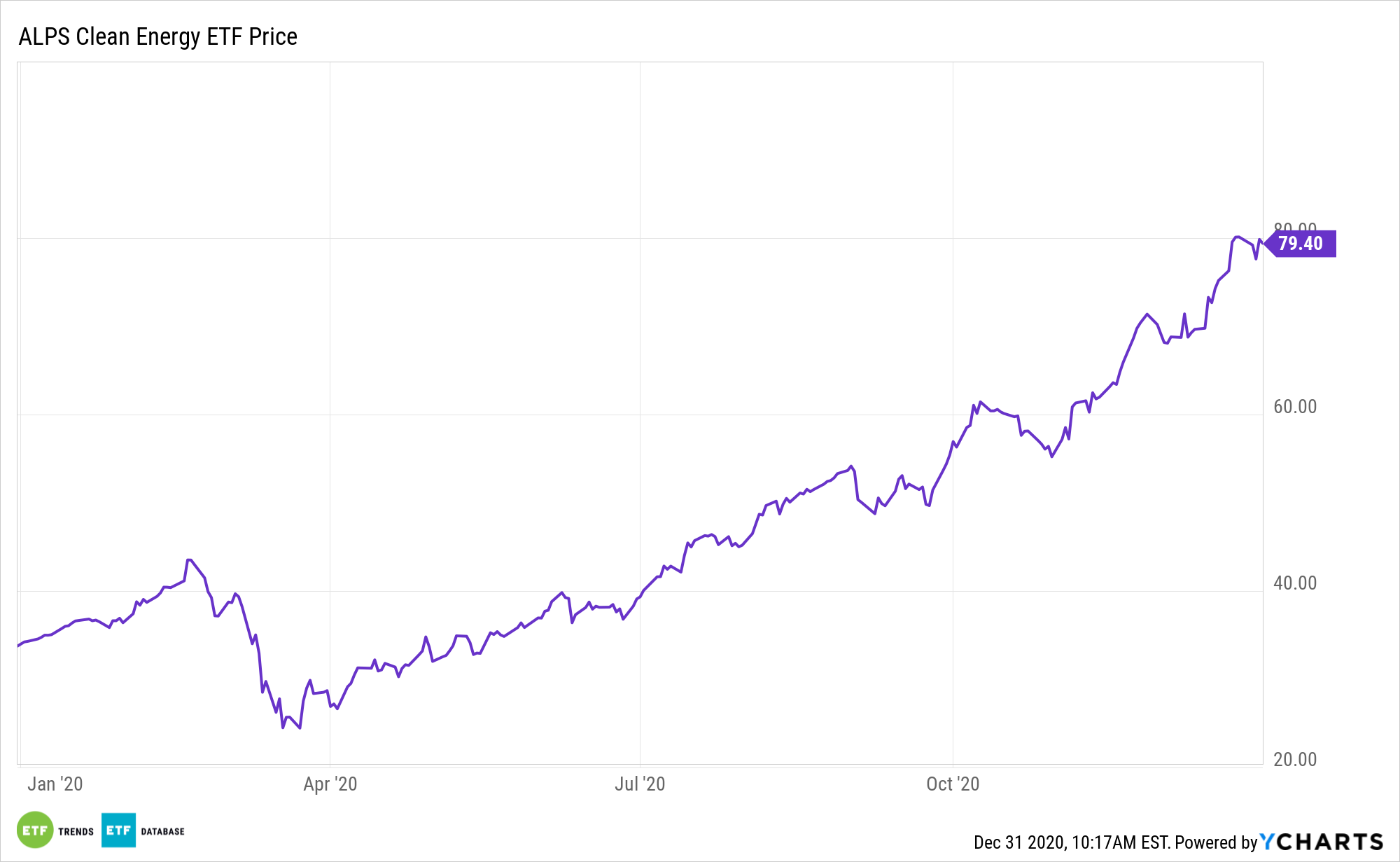

The ALPS Clean Energy ETF (ACES) emerged as one of this year’s best-performing exchange traded funds, regardless of asset class. That’s saying something when you consider that many other renewable energy funds more than doubled.

ACES follows the CIBC Atlas Clean Energy Index. That benchmark is comprised of U.S.- and Canada-based companies that primarily operate in the clean energy sector. Constituents are companies focused on renewables and other clean technologies that enable the evolution of a more sustainable energy sector.

More than 120 clean energy names now trade on major exchanges, and now have combined market values of $1.5 trillion, according to analysts at Raymon James.

“With 123 clean-tech companies now trading in US markets, the choice for investors is ‘practically limitless,’ the analysts wrote in a report published Wednesday. About half of those companies — from wind giants to electric-car makers — trade on a well-known exchange and are worth more than $1 billion in market value, they said,” reports Business Insider.

ACES, Clean Energy Stocks Are Just Getting Started

Even with its stellar 2020 showing, ACES enters 2021 with ample tailwinds. Traditional sources of energy like oil are constantly being challenged by alternative sources as more green initiatives become mainstream, which makes alternative energy ETFs an option when investors want exposure to the energy sector.

“The wind and solar industries — and, increasingly, companies involved in energy storage — are also investible, Raymond James said. Public firms in the battery supply chain have historically only included lithium suppliers, the firm said, but now batterymakers like QuantumScape are going public via blank check companies,” adds Business Insider.

Currently, coal and renewables account for roughly the same percentage of power consumption in the U.S., but the latter is poised to overtake the former, particularly as renewable costs decline. In fact, it’s likely that by 2030, new solar and wind farms will cost less than coal-fired plants. Photovoltaic costs plunged 82% over the previous decade, indicating it’s reasonable to expect solar will eventually be more cost-efficient than coal.

Another important factor in the ACES equation is that its components having international exposure, which is meaningful at a time when so many market observers are discussing sliding energy investment. That may be the case when it comes to fossil fuels, but plenty of ex-US markets are bolstering renewable allocations.

Other alternative energy ETFs include the First Trust Global Wind Energy ETF (FAN) and the SPDR Kensho Clean Power ETF (CNRG).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.