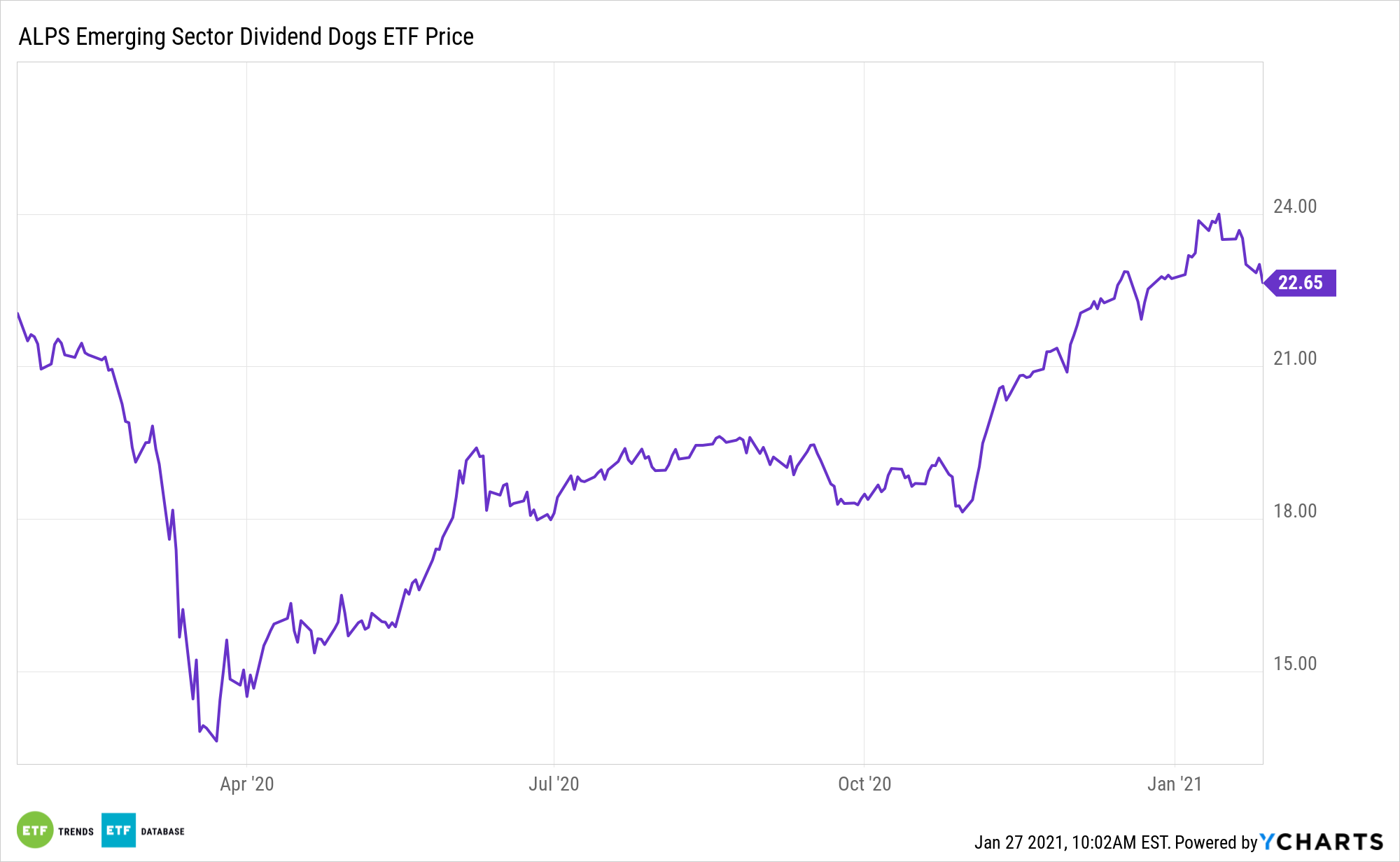

Emerging markets equities are expected to build on a strong finish to 2020 this year, and investors can be compensated for their faith in the asset class with the ALPS Emerging Sector Dogs ETF (NYSEArca: EDOG).

EDOG tracks the performance of the S-Network Emerging Sector Dividend Dogs Index. The index is comprised of the highest paying stocks, or “Dividend Dogs,” from the S-Network Emerging Markets Index, which holds large-cap, emerging market stocks. The Dividend Dogs include the five stocks in each of the ten Global Industry Classification Standard sectors that make up the S-Network Emerging Markets.

EDOG has a value tilt and features some exposure to commodities producers – themes that could serve the fund well in 2021.

“Since commodities produced in emerging markets are often priced in U.S. dollars, we expect continued U.S. dollar weakness and strong commodity prices to help keep many emerging market stocks buoyant,” notes Morgan Stanley Wealth Management. “Plus, emerging market inflation is low while many countries’ finances are healthy, supporting continuing positive indicators around global currency dynamics.”

Emerging Markets Analysis

As noted above, EDOG has a value tilt and that could be a favorable at a time when that factor is expected to come back into style.

“Looking first at bonds, in a world where $17 trillion of developed-market sovereign debt effectively offer negative yields, emerging-market fixed-income securities remain a bastion of positive real yields. On the equity side, current price-to-earnings ratios, at 16.2 times forward earnings estimates, offer comparative bargains against the S&P 500’s current forward ratio of nearly 23 times,” according to Morgan Stanley.

It may not be a smooth near-term ride, but EDOG is positioned to be deliver stout performance for investors in 2021.

“To be sure, emerging-market gains may slow as vaccine rollouts hit short-term bumps, but we see bigger forces at work supporting relative outperformance over the next several years. Investors should consider redeploying any gains in the long outperforming U.S. market toward actively managed emerging markets funds, with an emphasis on Asia,” adds Morgan Stanley.

Other emerging markets dividend ETFs include the ProShares MSCI Emerging Markets Dividend Growers ETF (CBOE: EMDV), iShares Emerging Markets Dividend ETF (DVYE), and WisdomTree Emerging Markets Equity Income Fund (NYSEArca: DEM).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.