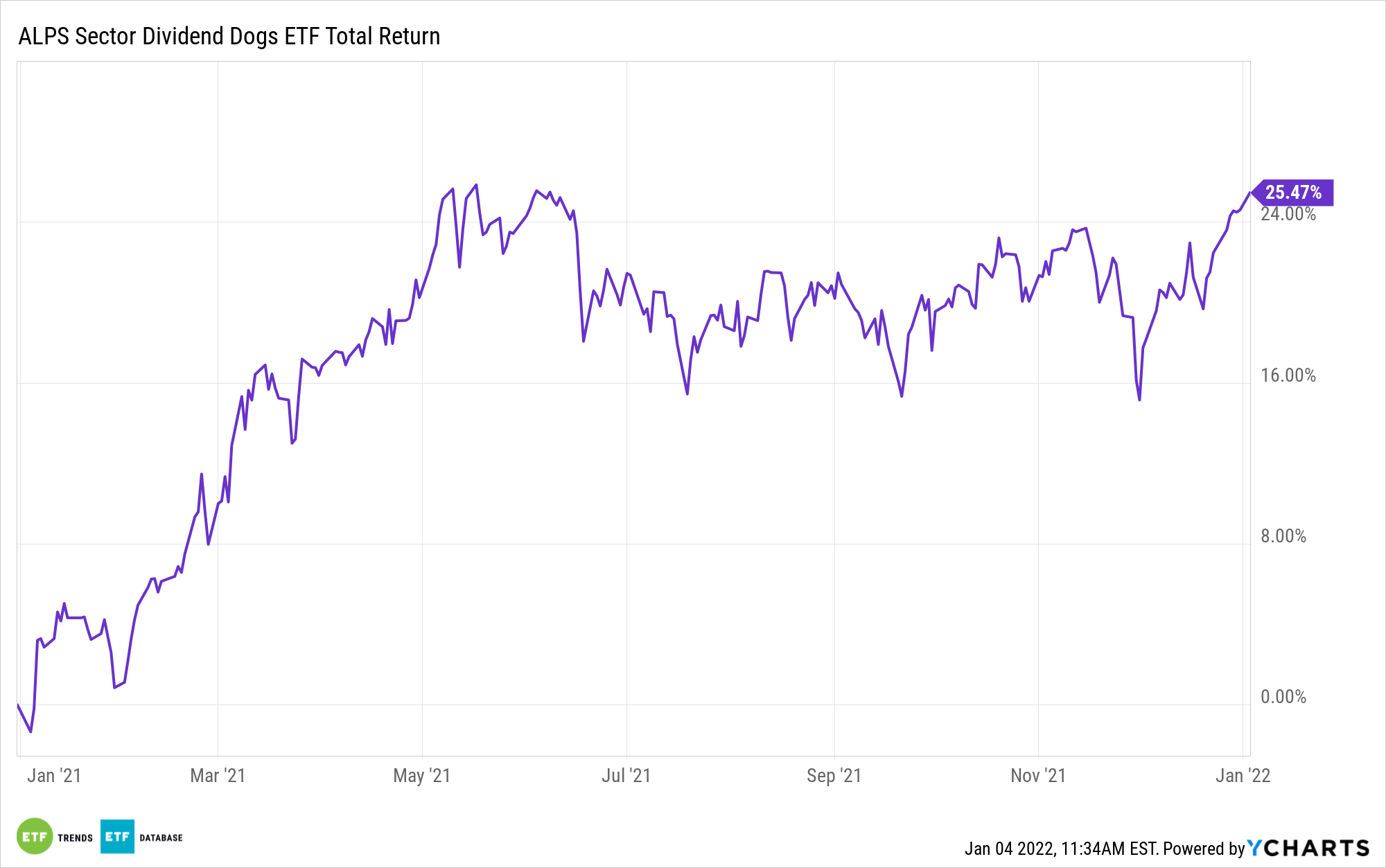

The ALPS Sector Dividend Dogs ETF (SDOG) finished 2021 with a gain of just over 20% and a dividend yield of 3.17%, or more than double the comparable metric on the S&P 500.

When it comes to the latter number, SDOG’s methodology matters. The exchange traded fund follows the S-Network Sector Dividend Dogs Index, which is comprised of the five highest-yielding stocks from 10 of the 11 S&P 500 sectors.

From there, SDOG’s components and sector exposures are equally weighted. That methodology proved useful last year due to widespread strength across all sectors.

“It’s not too often that S&P 500 Index industry groups do this well. In fact, it’s the first time that all 11 sectors will finish with double-digit gains, according to data compiled by Bloomberg going back to 2001. The S&P 500 Energy Index is the year’s biggest winner, advancing more than 47% after being the worst performer in 2020 with a loss of more than 37%,” reports Sophie Caronello for Bloomberg.

As Bloomberg notes, 2021 was the first time since 2019 that all of the S&P 500 sectors finished the year in the green, but in 2019, not all generated double-digit returns.

Regarding SDOG, its 2021 showing is impressive because the ALPS fund features no exposure to real estate stocks, and real estate was the second-best sector, behind only energy. Speaking of energy, that was an obvious advantage for SDOG in 2021. The fund has a 9.54% weight to that sector compared to just 2.66% in the S&P 500.

SDOG is also significantly overweight to the materials and utilities sectors relative to the S&P 500. While the latter lagged the broader market this year, it is a prime source of equity income and lower volatility. The S&P 500 Materials Index returned a solid 25.17% last year. Those two sectors combine for 20.25% of SDOG’s weight compared to just over 5% of the S&P 500.

SDOG could remain compelling this year amid expectations that oil prices will continue rising and due to the fact that cyclical value stocks — SDOG’s bread and butter — sport lower equity duration than their growth counterparts. That could help SDOG prove sturdy in the face of rising interest rates.

Other high-dividend ETFs include the SPDR S&P Dividend ETF (SDY), the iShares Select Dividend ETF (NYSEArca: DVY), and the iShares Core High Dividend ETF (HDV).

For more news, information, and strategy, visit the ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.