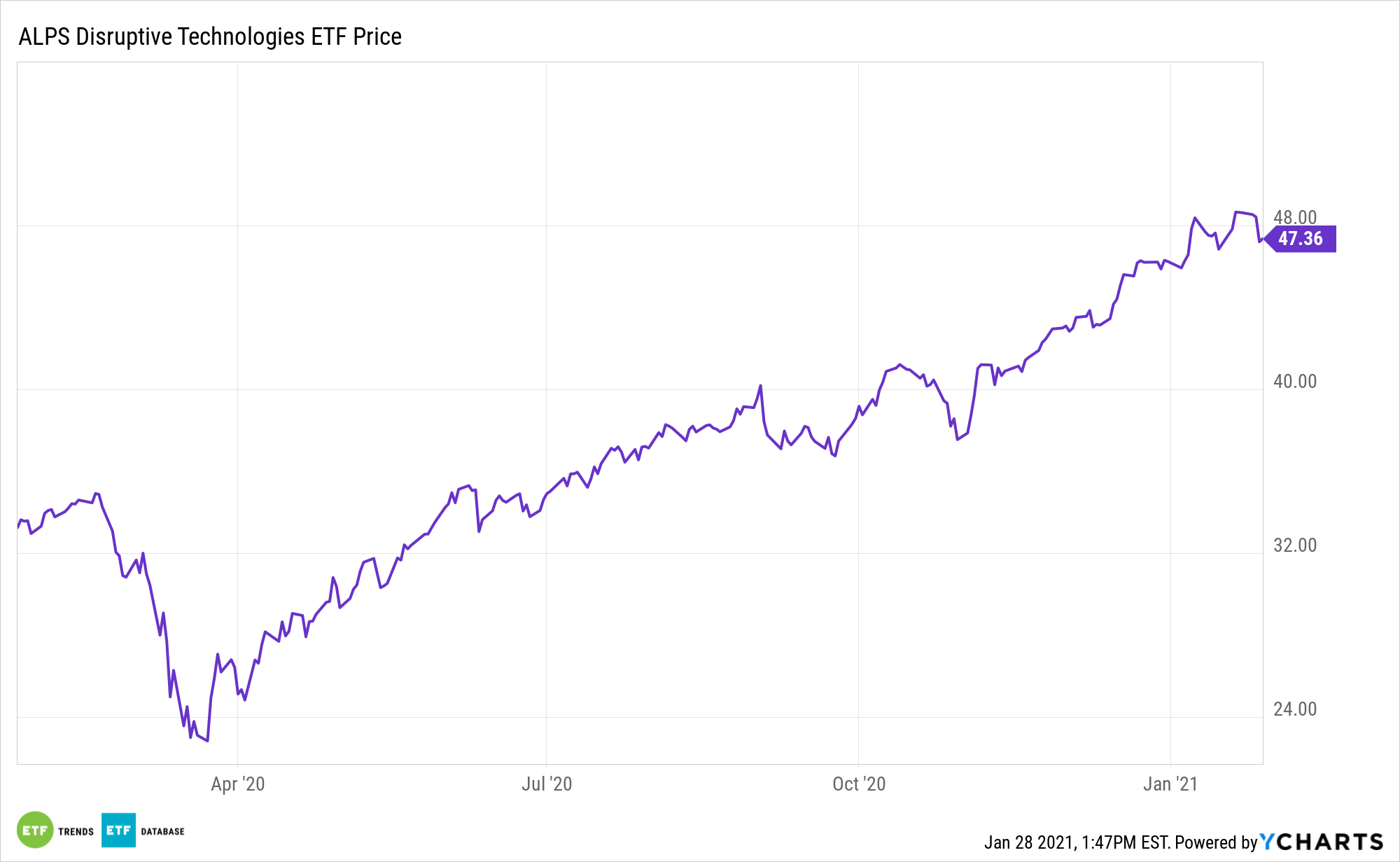

Disruptive growth and innovation are now the cornerstones of many investment strategies. The ALPS Disruptive Technologies ETF (CBOE: DTEC) is a prominent example.

DTEC is a relevant consideration over the near-term and over longer holding periods, because significant disruption is already happen in a myriad of industries. Data confirm disruptive and thematic strategies deliver for investors.

“This notion of potential higher growth has coincided with outsized returns, as investors seek out those potential high-growth prospects. In 2020, 67% of thematic ETF strategies outperformed the S&P 500 Index– by an average rate of 37% (56% to 18%),” according to State Street research.

DTEC tracks the Indxx Disruptive Technologies Index, which identifies companies using disruptive technologies across ten thematic areas, including Healthcare Innovation, Internet of Things, Clean Energy and Smart Grid, Cloud Computing, Data and Analytics, FinTech, Robotics, and Artificial Intelligence, Cybersecurity, 3D Printing, and Mobile Payments.

DTEC Holdings Will Shine this Year

DTEC holdings benefit from the shifting bases of technology infrastructure to the cloud, enabling mobile, new, and local services, such as companies that rely on or benefit from the increased use of shared technology, infrastructure, and services, internet-based products and services, new payment methods, big data, the internet of things, and social distribution and media.

Many high growth companies aren’t yet profitable, and while that can be concerning for investors, the risk is often worth the reward.

“Some view this as an issue, given that while growth rates are high, profitability is not yet there. However, to a degree, this reflects the early-stage maturation of some of the firms – a trait synonymous with more entrepreneurial enterprises,” writes State Street.

Highlighting the allure of DTEC over the near-term is that many disruptive growth names are seeing estimates revised higher.

“The upside revision to estimates reflects higher earnings optimism and is further reinforced by a greater number of firms having more analyst upgrades relative to downgrades in the past four weeks – indicating depth of optimism, not just magnitude,” concludes State Street.

Other technology funds to consider include the Technology Select Sector SPDR ETF (NYSEArca: XLK) and the Fidelity MSCI Information Technology Index ETF (FTEC).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.