Small-cap ETFs began their rally last week on the cooler-than-expected October CPI report.

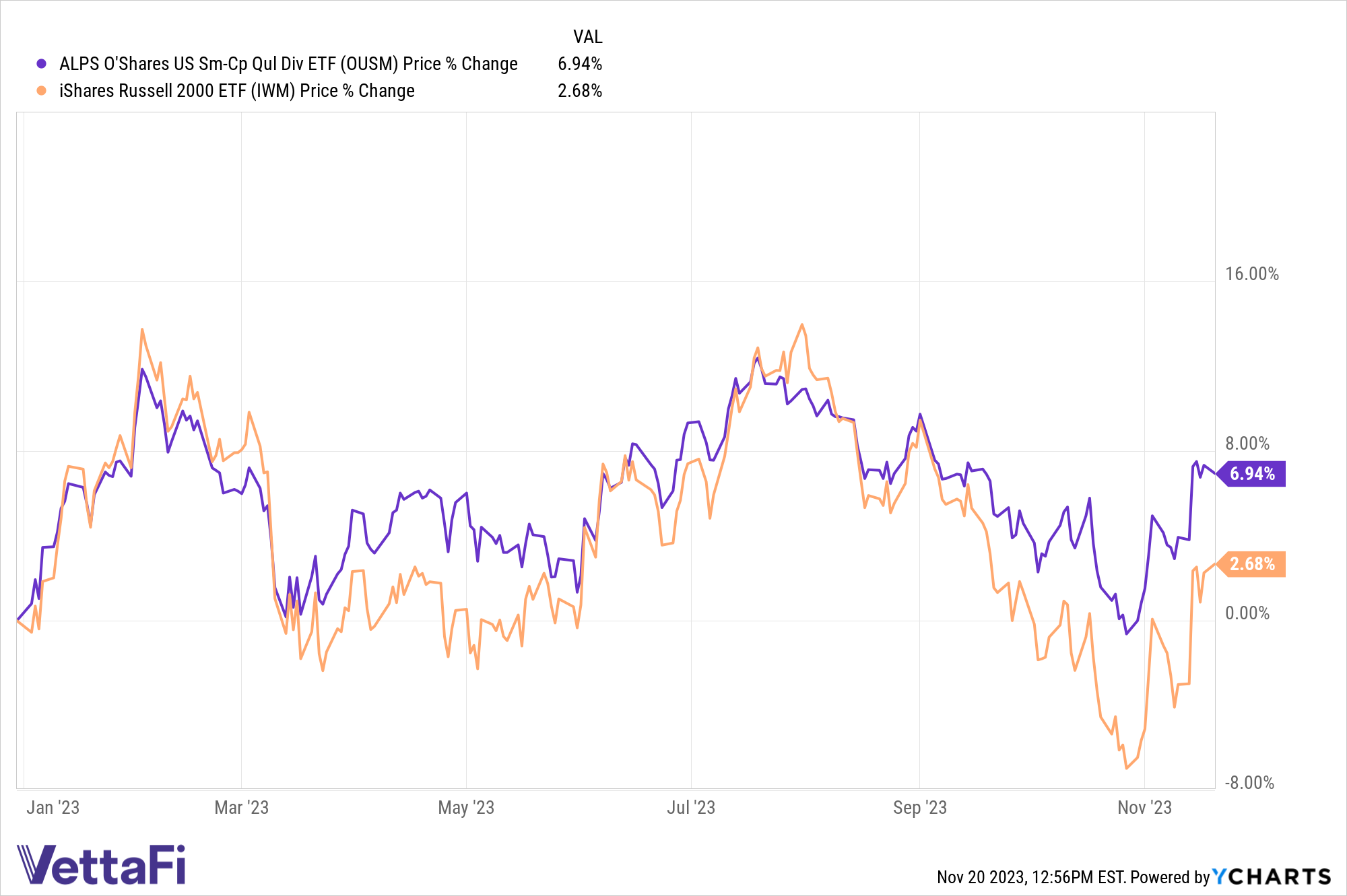

The small-cap benchmark Russell 2000 Index entered positive territory for the year last week, clawing back its recent losses. Despite the benchmark’s recent advances, SS&C ALPS Advisors’ small-cap ETF offering is handily outpacing the index year to date, highlighting the strength of a quality strategy.

The current environment could be an attractive entry point for a small-cap ETF. While small caps have seen compelling returns in recent weeks, the asset class is still available at a discount. Small caps are currently cheap from both a historical perspective and in comparison to large-cap stocks.

The ALPS O’Shares US Small-Cap Quality Dividend ETF (OUSM) is up 6.9% year to date as of November 20. In comparison, the style-pure iShares Russell 2000 ETF (IWM), which tracks the Russell 2000, is up just 2.7% during the same period. OUSM is up 4.2% over one year while IWM has declined 2.6%.

OUSM takes a more conservative approach than the benchmark. The fund is designed to provide cost-efficient access to a portfolio of small-cap, high-quality, low-volatility, dividend-paying companies in the U.S.

The fund aims to provide strong performance with less risk than a market cap-weighted approach. Quality dividend growth strategies are designed to reduce risk and exposure to stress events by avoiding lower-quality stocks.

“Advisors are seeking to add small-cap exposure heading into 2024. However, are hesitant because many of the companies are unprofitable. A higher quality approach like OUSM might make sense to those more risk-aware advisors,” Todd Rosenbluth, head of research at VettaFi, said.

OUSM has seen $15 million in net flows over the past four-week period. The fund has $377 million in assets under management and charges a 40 basis point expense ratio.

For more news, information, and analysis, visit the ETF Building Blocks Channel.