By ALPS Funds

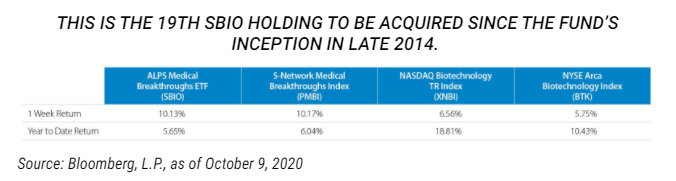

SBIO ON AN ALL-TIME HIGH, TRUMPING JULY’S PEAK

- While broader equity markets rallied last week, the ALPS Medical Breakthroughs ETF (SBIO) rallied over 10% to surpass its previous all-time high. Biotech stocks continue to gain momentum after President Trump touted Regeneron Pharmaceuticals (REGN; not in SBIO) monoclonal antibody to treat COVID-19, boosting SBIO and many of its immunotherapy names.

- Vir Biotechnology Inc. (VIR, 3.46% weight*) gained nearly 23% last week after announcing its COVID-19 antibody immunotherapy will be entering Phase 3 trials, using a similar approach to Regeneron.

- Immunogen Inc (IMGN, 0.56% weight*) rallied nearly 25% last week after the FDA granted breakthrough drug therapy for its antibody immunotherapy to treat a rare form of blood cancer.

- Apellis Pharmaceuticals (APLS, 1.83% weight*) climbed nearly 18% last week after announcing positive Phase 2 data for its immunotherapy inhibitor to treat a rare kidney disease.

- Springworks Therapeutics (SWTX, 1.63% weight*) rose nearly 18% last week after announcing a partnership with Pfizer (PFE; not in SBIO) to study its immunotherapy inhibitor to treat myeloma, a blood cancer.

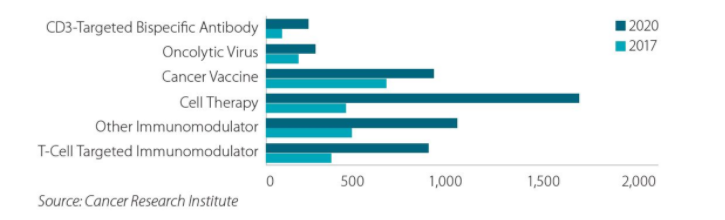

- The volume of immunotherapies to treat or cure cancer (Immuno-Oncology) in preclinical and clinical trials continues to grow.

- There has been a 22 percent increase of I/O drugs in development from 2019 to 2020, a greater year-over-year increase than seen from 2018 to 2019, and a 233% increase since 2017.

BIOTECH M&A CONTINUES TO BE IN PLAY

- Eidos Therapeutics (EIDX; 1.90% weight*), a clinical stage biopharmaceutical company, skyrocketed over 40% this week after announcing that majority shareholder, Bridgebio Pharma (BBIO; not in SBIO), has agreed to acquire the remaining shares of the company (~36%) in a stock or cash deal.

Performance data quoted represent past performance. Past performance is no guarantee of future results so that shares, when redeemed may be worth more or less than their original cost. The investment return and principal value will fluctuate. Current performance may be higher or lower than the performance quoted. For the most current month end performance data please call 844.234.5852. Performance includes reinvested distributions and capital gains.

Past performance is not indicative of future results. For standardized performance of the fund please click here.

* Weights in ACES as of 10/9/2020

Originally published by ALPS Funds

Important Disclosure & Definitions

An investor should consider the investment objectives, risks, charges and expenses carefully before investing. To obtain a prospectus which contain this and other information call 866.675.2639 or visit www.alpsfunds.com. Read the prospectus carefully before investing.

ALPS Medical Breakthroughs ETF Shares are not individually redeemable. Investors buy and sell shares of the ALPS Medical Breakthroughs ETF on a secondary market. Only market makers or “authorized participants” may trade directly with the Fund, typically in blocks of 50,000 shares. There are risks involved with investing in ETFs including the loss of money. Additional information regarding the risks of this investment is available in the prospectus. The Fund is subject to the additional risks associated with concentrating its investments in companies in the market sector.

Diversification does not eliminate the risk of experiencing investment losses. An investor cannot invest directly in an index.

S-Network Medical Breakthroughs Total Return Index is designed to capture research and development opportunities in the pharmaceutical industry. PMBI consists of small-cap and mid-cap pharmaceutical and biotechnology stocks listed on U.S. stock exchanges that have one or more drugs in either Phase II or Phase III U.S. FDA clinical trials.

NASDAQ Biotechnology Total Return Index is a modified market capitalization-weighted index designed to measure the performance of the all NASDAQ stocks in the biotechnology sector.

NYSE Arca Biotechnology Index is an equal-dollar weighted index designed to measure the performance of a cross section of companies in the biotechnology industry that are primarily involved in the use of biological processes to develop products or provide services.

The indexes are reported on a total return basis, which assumes reinvestment of any dividends and distributions realized during a given time period. The indexes are not actively managed and do not reflect any deductions for fees, expenses or taxes. One cannot invest directly in an index. Index performance does not reflect fund performance. This fund may not be suitable for all investors. There are risks involved with investing in ETFs including the loss of money.

The Fund is considered non-diversified and as a result may experience great volatility than a diversified fund. The Fund’s investments are concentrated in the pharmaceuticals and biotechnology industries, and underperformance in these areas will result in underperformance in the Fund. Investments in small and micro capitalization companies are more volatile than companies with larger market capitalizations.

The Fund employs a “passive management”- or indexing- investment approached and seeks to track the investment results of an index composed of global companies that enter traditional markets with new digital forms of production and distribution, and are likely to disrupt an existing market or value network. Unlike many investment companies, the Fund is not “actively” managed. Therefore, it would not necessarily sell a security because the security’s issuer was in financial trouble unless that security is removed from the Poliwogg Medical Breakthroughs Index. Similarly, the Fund does not buy a security because the security is deemed attractive unless that security is added to the Medical Breakthroughs Index.

Companies in the pharmaceuticals and biotechnology industry may be subject to extensive litigation based on product liability and similar claims. Legislation introduced or considered by certain governments on such industries or on the healthcare sector cannot be predicted. Companies in the pharmaceuticals industry are subject to competitive forces that may make it difficult to raise prices and, in fact, may result in price discounting. The profitability of some companies in the pharmaceuticals industry may be dependent on a relatively limited number of products. In addition, their products can become obsolete due to industry innovation, changes in technologies or other market developments. Many new products in the pharmaceuticals industry are subject to government approvals, regulation and reimbursement rates. The process of obtaining government approvals may be long and costly. Many companies in the pharmaceuticals industry are heavily dependent on patents and intellectual property rights. The loss or impairment of these rights may adversely affect the profitability of these companies. The development of new drugs generally has a high failure rate, and such failures may negatively impact the stock price of the company developing the failed drug. Biotechnology companies may have persistent losses during a new product’s transitionfrom development to production. In order to fund operations, biotechnology companies may require financing from the capital markets, which may notalways be available on satisfactory terms or at all.

ALPS Portfolio Solutions Distributor, Inc. is the distributor for the ALPS Medical Breakthroughs ETF.