Yes, REITs have had a rough go of it for a while now — but now could be the time to get back in. With inflation continuing to cool, the Fed may have only a few remaining hikes planned. Meanwhile, the U.S. economy, particularly housing, hasn’t suffered nearly as much as they may have this year. With the S&P 500 perhaps overreliant on megacap tech names to help it rise overall, REITs can also offer some meaningful diversification. Those factors could make the case for a REIT dividend ETF.

While, yes, based on the S&P United States REIT index, REITs are down over the last year, they’ve rebounded YTD. The index has negative returns over the last full year, coming in a -2.6%, but it’s also returned 5.4% YTD.

The trends impacting REITs have been split up between a disastrous commercial real estate landscape and a steadier residential sector. Even despite many Americans not returning to downtown offices, the situation may not be as bad as it seems. Valuations remain high, while the market for office real estate itself remains liquid. Residential news, meanwhile, may be seeing an upturn.

Finding the Right REIT Dividend ETF

A REIT dividend ETF could be an option in such an environment, adding current income while the housing market transitions. The ALPS REIT Dividend Dogs ETF (RDOG) offers a 6.1% annual dividend yield with a $2.27 annual dividend rate. By both metrics, the REIT dividend ETF outperforms its ETF Database Category and Factset Segment Averages.

See more: “The Active Real Estate ETF Nearing a Key Buy Signal”

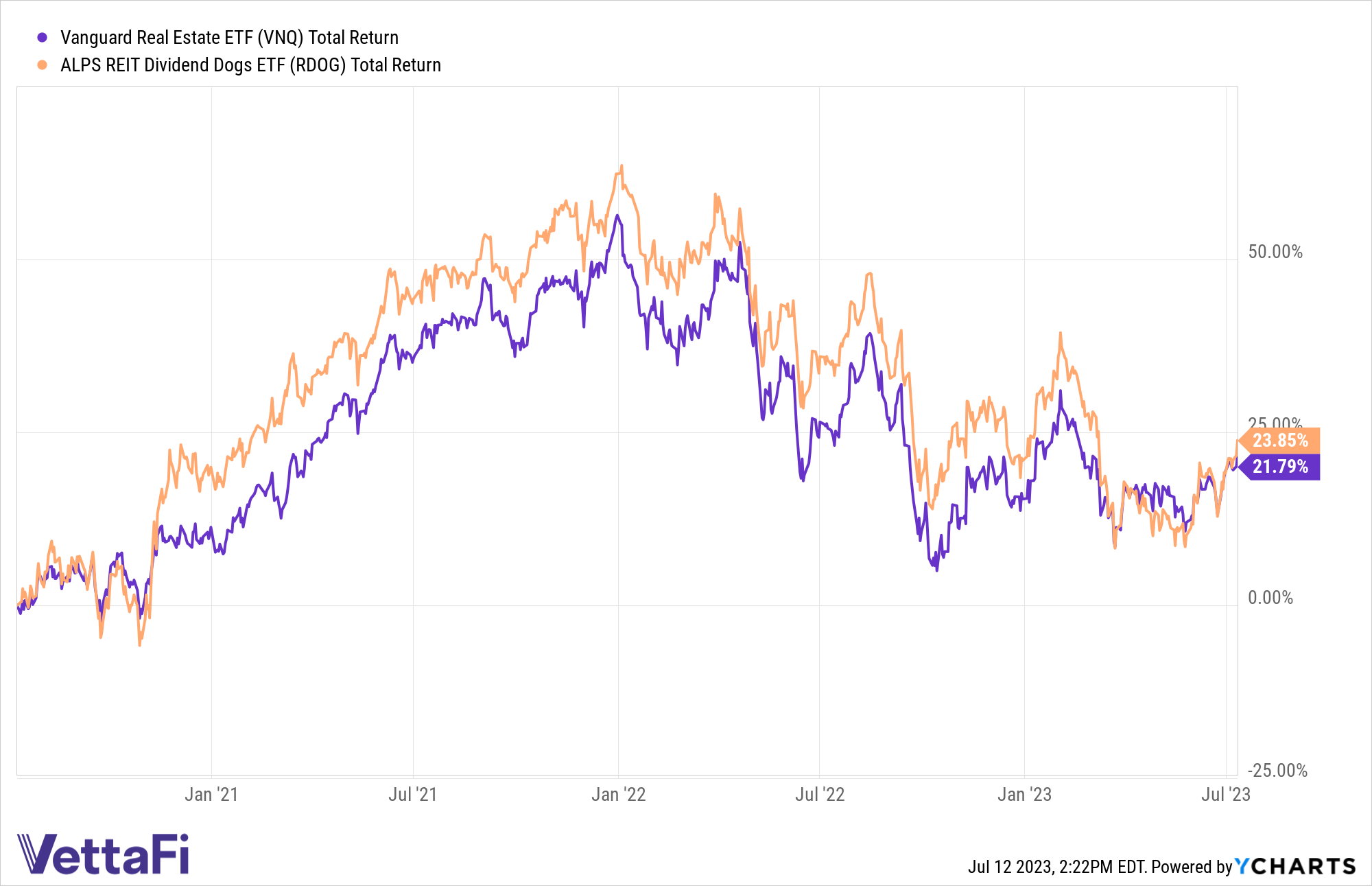

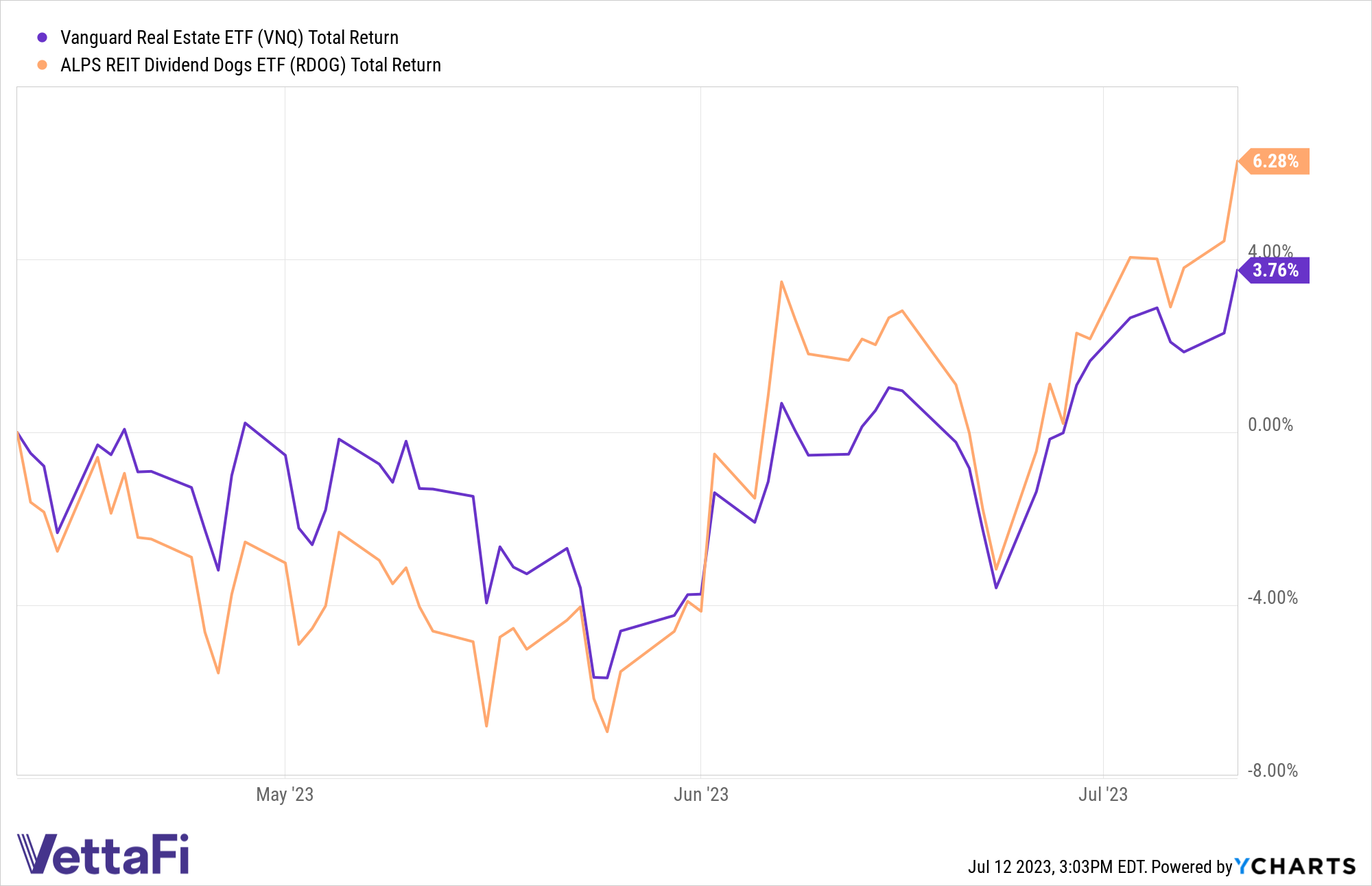

RDOG invests by tracking the S-Network REIT Dividend Dogs Index and picking the five highest-yielding REITs within nine equally-weighted REIT segments. RDOG charges 35 basis points (bps) to do so, returning 6.65% over the last three months. The ETF has also outperformed the Vanguard Real Estate ETF (VNQ) over the last three years and the last three months.

RDOG has outperformed VNQ over the last three years per YCharts.

RDOG has outperformed VNQ over the last three months, too.

For those investors looking to add some REIT diversification to their portfolios, RDOG can be an option. If the real estate landscape benefits from a rate hike slowdown or even reversal, RDOG could be positioned to benefit its investors with potent dividends.

For more news, information, and analysis, visit the ETF Building Blocks Channel.