One of the sectors experiencing the most profound alterations due to the coronavirus pandemic is commercial real estate.

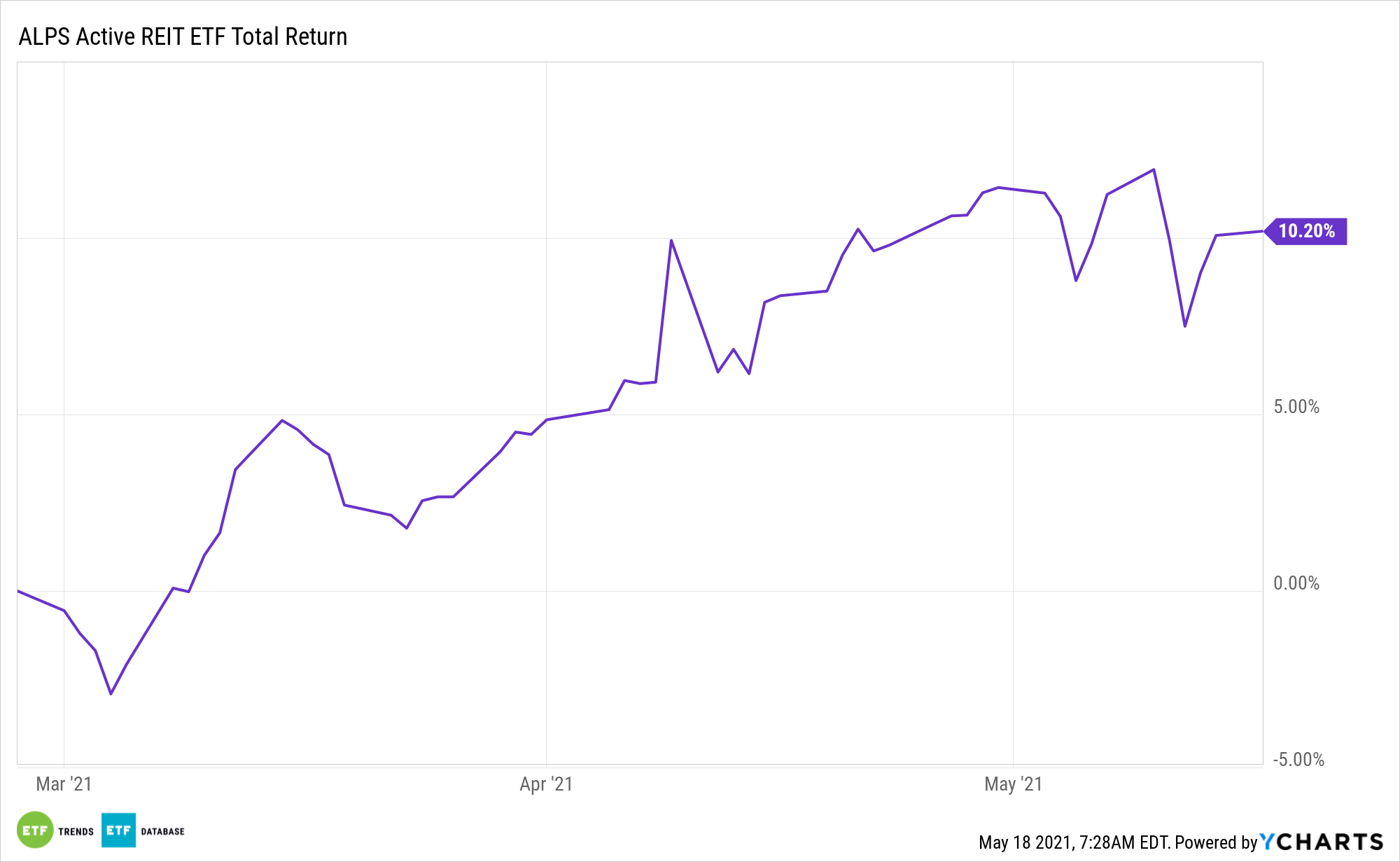

By now, many investors know about the punishment hotel and retail real estate investment trusts (REITs) endured during COVID-19 lockdowns, but there’s more to the story, and the changing face of the real estate sector today could be a sign active management is worth considering in this space. Enter the ALPS Active REIT ETF (NASDAQ: REIT).

Empty Offices Downtown

As an actively managed real estate exchange traded fund, REIT isn’t restrained by an index. That means the managers can make geographic and industry bets, additions, and subtractions that passive funds cannot compete with. The current state of Bay Area real estate is a prime example of why investors may want to get active with the ALPS fund.

“By the end of the first quarter of 2021, the amount of vacant sublease space in San Francisco had soared to 9.7 million square feet, up from about 3 million in late 2019, and accounted for 40% of all available commercial space in the city, according to commercial real estate firm Avison Young,” reports Ari Levy for CNBC.

Granted, San Francisco is just one region, but it’s real estate woes are twofold. First, many technology companies are realizing staff are just as productive working from home or on flex schedules as compared to the traditional five-day office work week.

Second, the city’s lease rates are among the highest in the country, and perhaps still too lofty for this point in the economic cycle. A traditional real estate index fund usually features heaping allocations to office REITs, making those products vulnerable to work-from-home trends and a lack of geographic qualifiers. REIT can avoid those pitfalls.

“While software and internet companies continued their stratospheric ascent in 2020, the plush offices they call home sat dormant, leaving San Francisco’s commercial real estate market with an unfamiliar supply glut. Much of the financial fallout was borne by the very tech companies that led a decade-plus bull market and expansion spree,” according to CNBC.

For now, it’d be hasty to write obituaries for the Bay Area real estate market, yet real estate investors may want to steer clear of the region for awhile.

Other REIT ETFs include the Schwab US REIT ETF (NYSEArca: SCHH) and the Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF (SRVR).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.