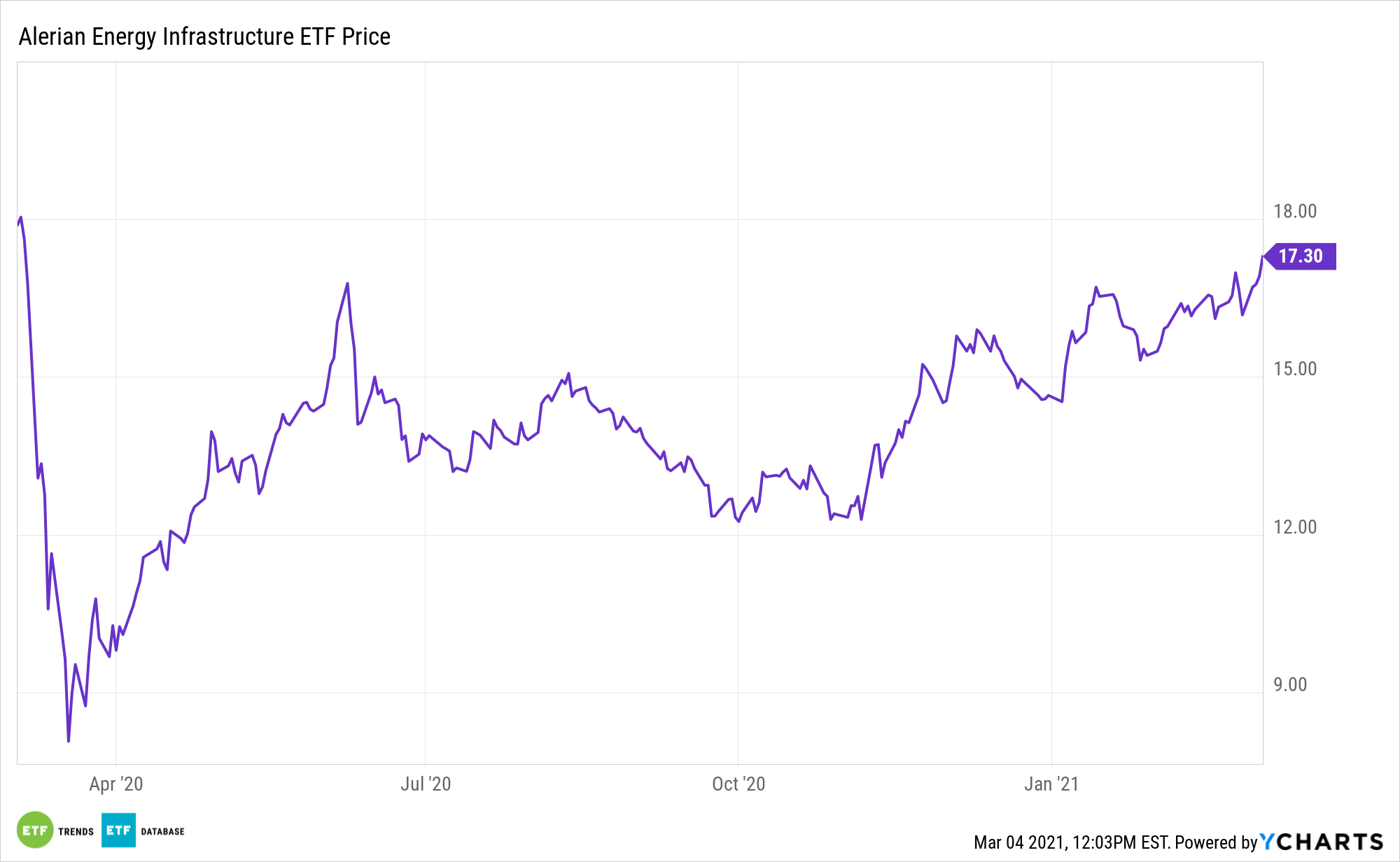

The energy sector was one of the epicenters of negative dividend action last year, but the outlook is improving for midstream assets like the Alerian Energy Infrastructure ETF (ENFR).

The ALPS ETF tracks the Alerian Midstream Energy Select Index (CME: AMEI). ENFR acts as a type of hybrid energy infrastructure ETF, which helps investors capture some of the high yields from MLPs while limiting the tax hit from solely owning MLPs. Part of the good news for the sector is that some well-known investors are revisiting energy equities.

In the fourth quarter, midstream dividends were broadly maintained with limited negative action.

“As has largely been the case since 2Q20, midstream dividends for 4Q20 were largely maintained, though there were a few examples of growth. In conjunction with annual investor days or earnings releases, some companies have also guided to dividend growth in 2021, serving as another positive sign of the improving dividend outlook. Even as midstream equities have moved higher over the last few months, midstream yields remain well above other income-oriented sectors,” writes Alerian analyst Michael Laitkep.

ENFR Has Some Payout Promise

Additionally, the midstream space is usually more defensive and less volatile than other energy segments due to steady, reliable cash flows.

Dividend growth is meaningful, but against a challenging backdrop in the oil patch, it’s also telling that many large cap midstream names were able to hold dividends steady in the first half of 2020.

“With most midstream companies holding dividends steady sequentially, year-over-year dividend changes reflect cuts that occurred in 2020 on one hand and annual growth for names that traditionally increase dividends for the fourth or first quarter on the other,” according to Alerian.

Dividend-paying stocks can also help insulate investors from broad market pullbacks. Dividend growth is also meaningful today because payout growers typically weather rising rates. That’s something to consider with Treasury yields climbing.

“After proactive cuts in 2020 biased to the smaller players in the space, midstream payouts have proven resilient in recent quarters. Even as yields have come off their highs in conjunction with improved performance, midstream’s income proposition remains attractive in the current market environment and is complemented by tailwinds from buybacks and an improving macro environment for energy,” concludes Alerian.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.