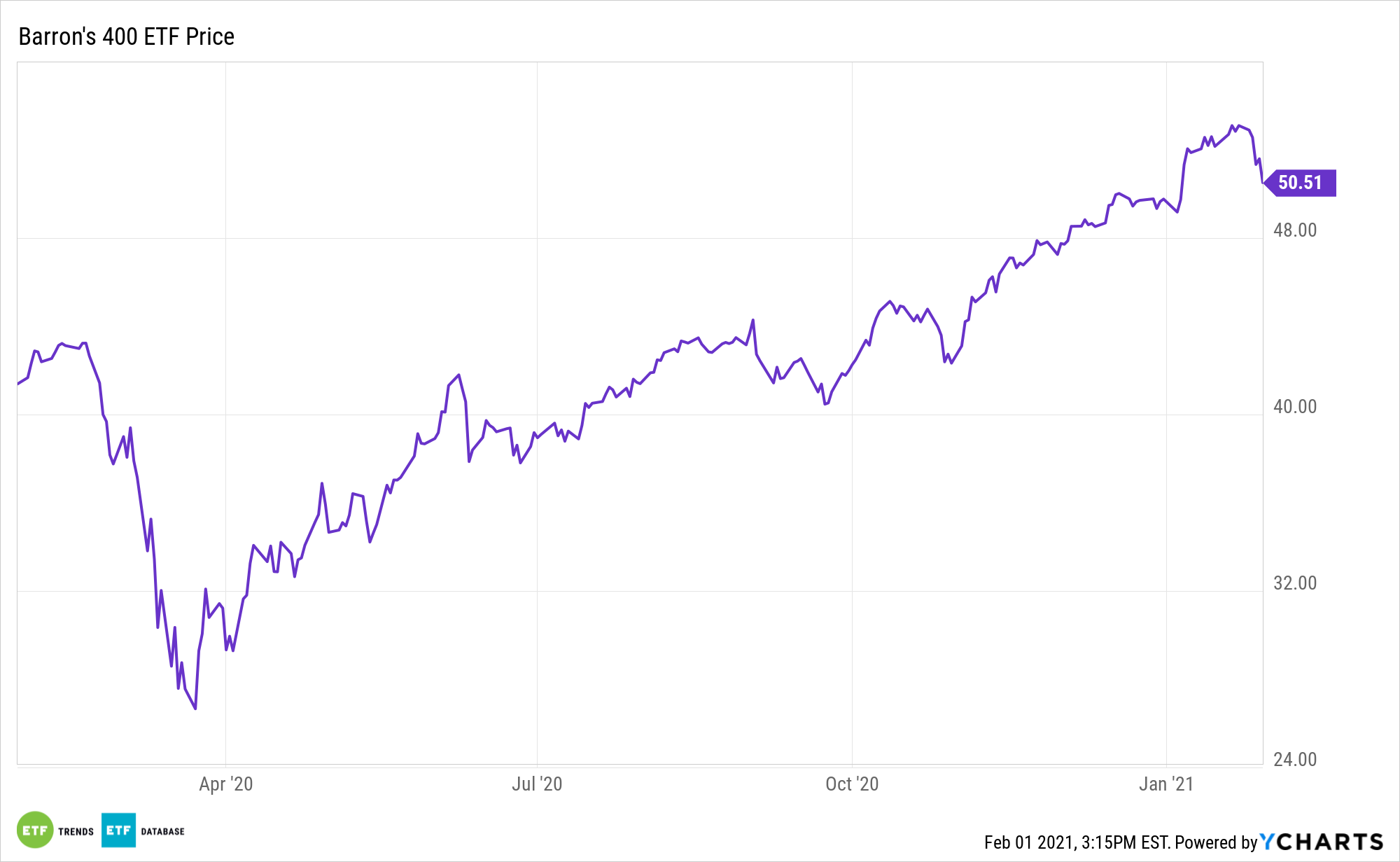

Last week’s broader market pullback could give investors an opportunity to get involved with smaller stocks, including mid caps and the Barron’s 400 ETF (NYSEArca: BFOR).

BFOR tracks the Barron’s 400 Index (B400), which takes 400 stocks from the broader MarketGrader U.S. Coverage Universe by using a methodology that selects components based on the strength of their fundamentals in growth, valuation, profitability, and cash flow, and then screens components for certain criteria regarding concentration, market capitalization, and liquidity.

BFOR has utility as a portfolio diversification tool for investors that are heavily exposed to large cap stocks.

“An important implication is that the S&P 400 and 600 index returns are less reliant on a handful of names, and may therefore be an effective tool for diversifying US equity exposure,” according to S&P Dow Jones Indices.

Why the BFOR ETF Can Shine in 2021

Mid cap companies are slightly more diversified than their small cap peers, which allows many to generate more consistent revenue and cash flow, along with more stable stock prices. Many are not so big that their size slows down growth.

“Looking at very long term time periods, small and mid-size indexes have demonstrated superior performance when compared to large-cap only. 25 years of data show an outperformance of 186 basis points per year (S&P 400) and 99 basis points per year (S&P 600) compared to the S&P 500,” notes S&P Dow Jones.

BFOR could also be a winner if the U.S. economy starts to shake off the effects of the coronavirus pandemic.

“The S&P 400 and 600 have historically had a higher correlation to a number of economic indicators (GDP growth, investment and consumption growth). As the re-opening becomes more broad-based, if consistent with such higher correlations, these indexes may provide a higher beta, leading to outperformance versus the S&P 500,” adds S&P Dow Jones.

Alternatives to BFOR in the mid cap growth space include the iShares Russell Midcap Growth ETF (NYSEARCA: IWP), First Trust Mid Cap Growth AlphaDEX Fund (NasdaqGM: FNY), and the iShares Morningstar Mid Growth ETF (NYSEArca: JKH).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.