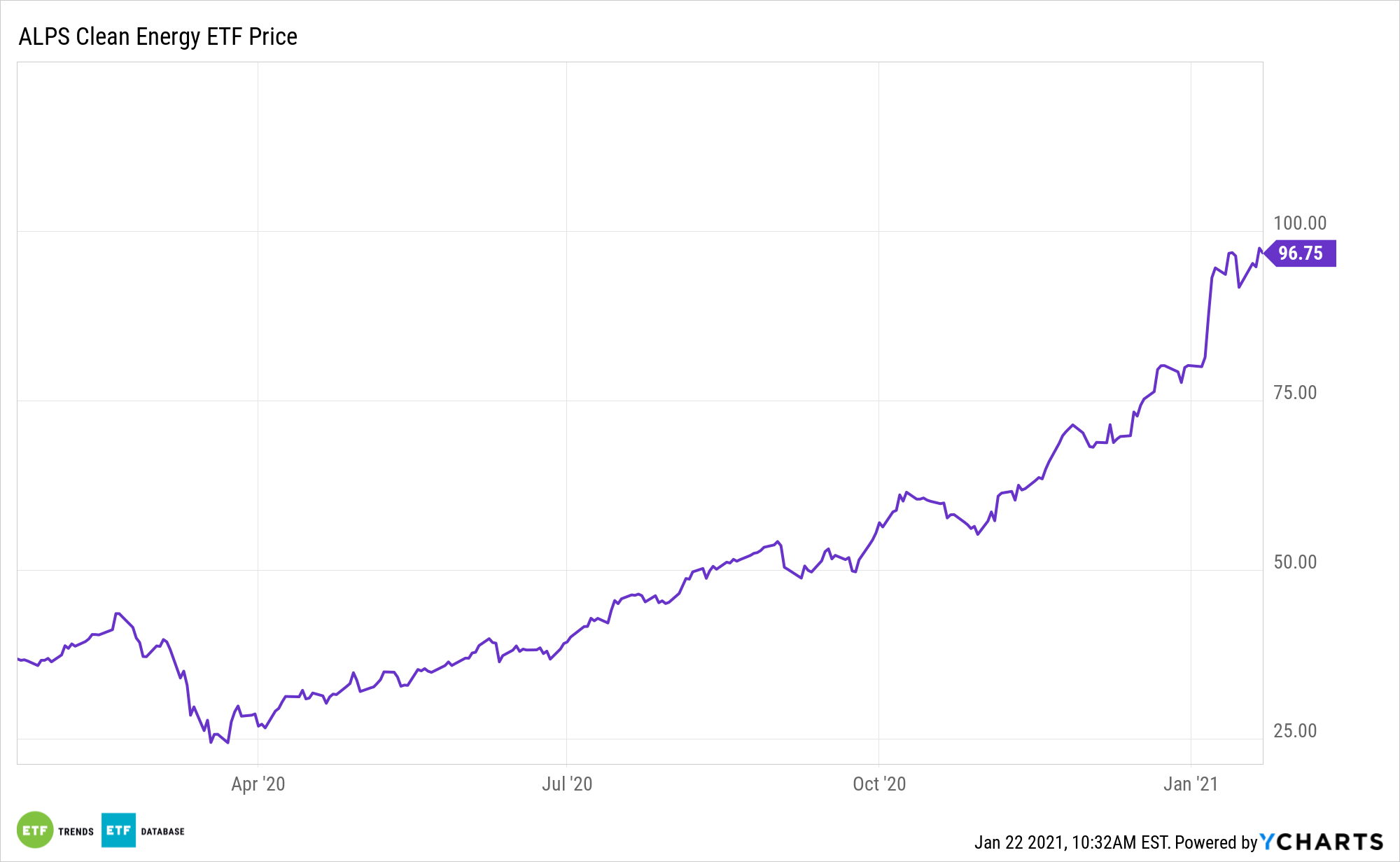

Already up 21.60% to start 2021, the ALPS Clean Energy ETF (ACES) is on a torrid pace. Some market observers argue that there’s even more than meets the eye in the renewable energy realm.

ACES follows the CIBC Atlas Clean Energy Index. That benchmark is comprised of U.S.- and Canada-based companies that primarily operate in the clean energy sector. Constituents are companies focused on renewables and other clean technologies that enable the evolution of a more sustainable energy sector.

“Global investment in wind and solar power, biofuels, biomass and waste, small hydropower—the main technologies behind clean electricity—has expanded by nearly an order of magnitude since BloombergNEF first started tracking this data,” reports Nathaniel Bullard for Bloomberg. “In annual dollars terms, clean-energy investment surged from $33 billion nearly two decades ago to more than $300 billion last year.”

ACES’ Renewable Energy: The Ultimate Long-Term Theme

While the political climate in the nation’s capital remains hostile, it’s also ripe for more renewable energy investment.

“A new BNEF analysis including the electrification of heat and transport as well as nascent investment in energy storage, hydrogen, and carbon capture and storage shows that overall investment grew to $501 billion—nearly 70% higher than older, narrower estimates,” according to Bloomberg.

Some industries known for their heavy carbon footprints are looking to change their ways and adopt alternative sources, but that move requires capital.

What makes ACES appealing for long-term investors is these capital investments take time, often multiple decades. That means there could be a generational trend of rising renewable energy spending ahead.

“In the 15 years from 2005 to 2019, annual installations of wind and solar increased more than 13 times over,” reports Bloomberg. “That’s a compound annual growth rate north of 20%.

“To put it another way: annual installed capacity of wind and solar will double again in less than four years if it keeps up this pace.”

Other alternative energy ETFs include the First Trust Global Wind Energy ETF (FAN) and the SPDR Kensho Clean Power ETF (CNRG).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.