Looking for an international ETF? U.S. advisors and investors of all kinds are looking abroad for equities opportunities right now with domestic uncertainty growing. Whether it’s rising rates or the still-lingering prospect of a recession, those challenges may make foreign equities more appealing by comparison. That may add to the case for an international dividend ETF like IDOG, the ALPS International Sector Dividend Dogs ETF. It’s showing strong tech chart action, too, sending a potent buy signal.

With both the U.S. and China seeing some notable headwinds rising, IDOG’s wide investing remit can play a strong role. Tracking the S-Network International Sector Dividend Dogs Index, IDOG holds stocks in developed nations ranging from Japan and Australia to France and Germany. Not only does it invest in developed nations, but by emphasizing dividends, it adds firms with slightly healthier outlooks. Robust, healthy dividends tend to indicate firms with broadly positive, stable outlooks.

Eyeing International ETF IDOG

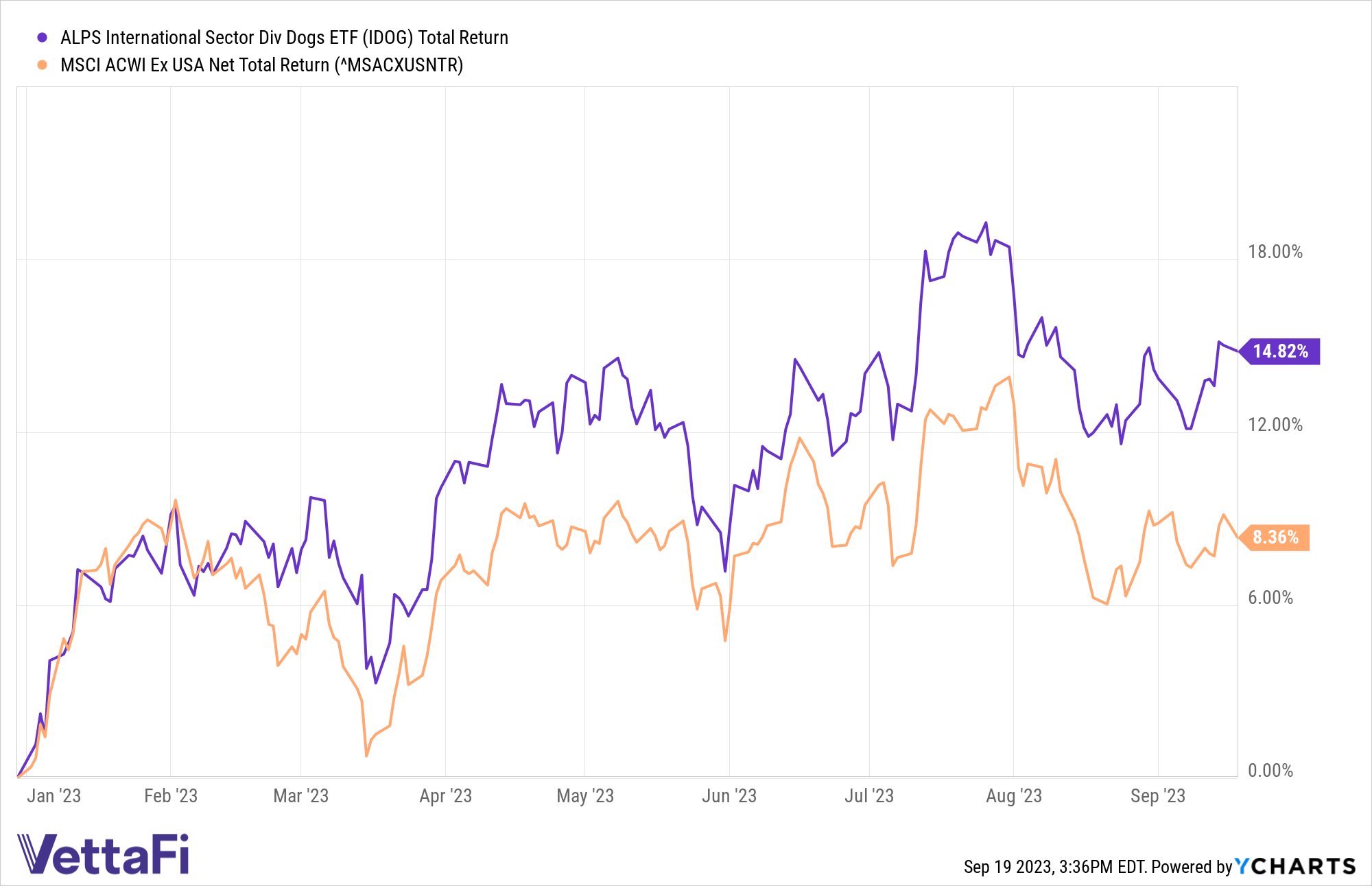

Not only does it emphasize dividends, IDOG’s index also equal weights the 10 GICS sectors in the world’s developed markets excluding the U.S. and Canada. That limits both a country’s risk to the overall index and a given sector’s threat to the index. Those and other factors have helped IDOG return 14.8% year to date, outperforming the MSCI ACWI EX USA Net Total Return ETF YTD. The international ETF also hit its 10-year mark this summer as it rose above $200 million this year.

IDOG is outperforming a notable international index YTD.

See more: “VettaFi Voices On: The Biggest Threat to the Global Economy“

All of these supporting factors have come together just as the strategy hit a key buy signal Tuesday. The international ETF saw its price rise above its 50-day simple moving average (SMA) of $28.28. IDOG’s price rose to $28.45 Tuesday per YCharts. That buy signal also brings the strategy even closer to seeing a “golden crossover” in which the 50-day SMA rises above the 200-day SMA. Taken together, the momentum behind IDOG and economic backdrop may see investors take a closer look.

IDOG has seen some exciting tech chart action per YCharts.

For more news, information, and analysis, visit the ETF Building Blocks Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for IDOG, for which it receives an index licensing fee. However, IDOG is not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of IDOG.