Real estate investment trusts (REITs) have enviable history on their side when it comes to asset classes with reputations for damping inflation. That could prompt more investors to consider the ALPS Active REIT ETF (NASDAQ: REIT).

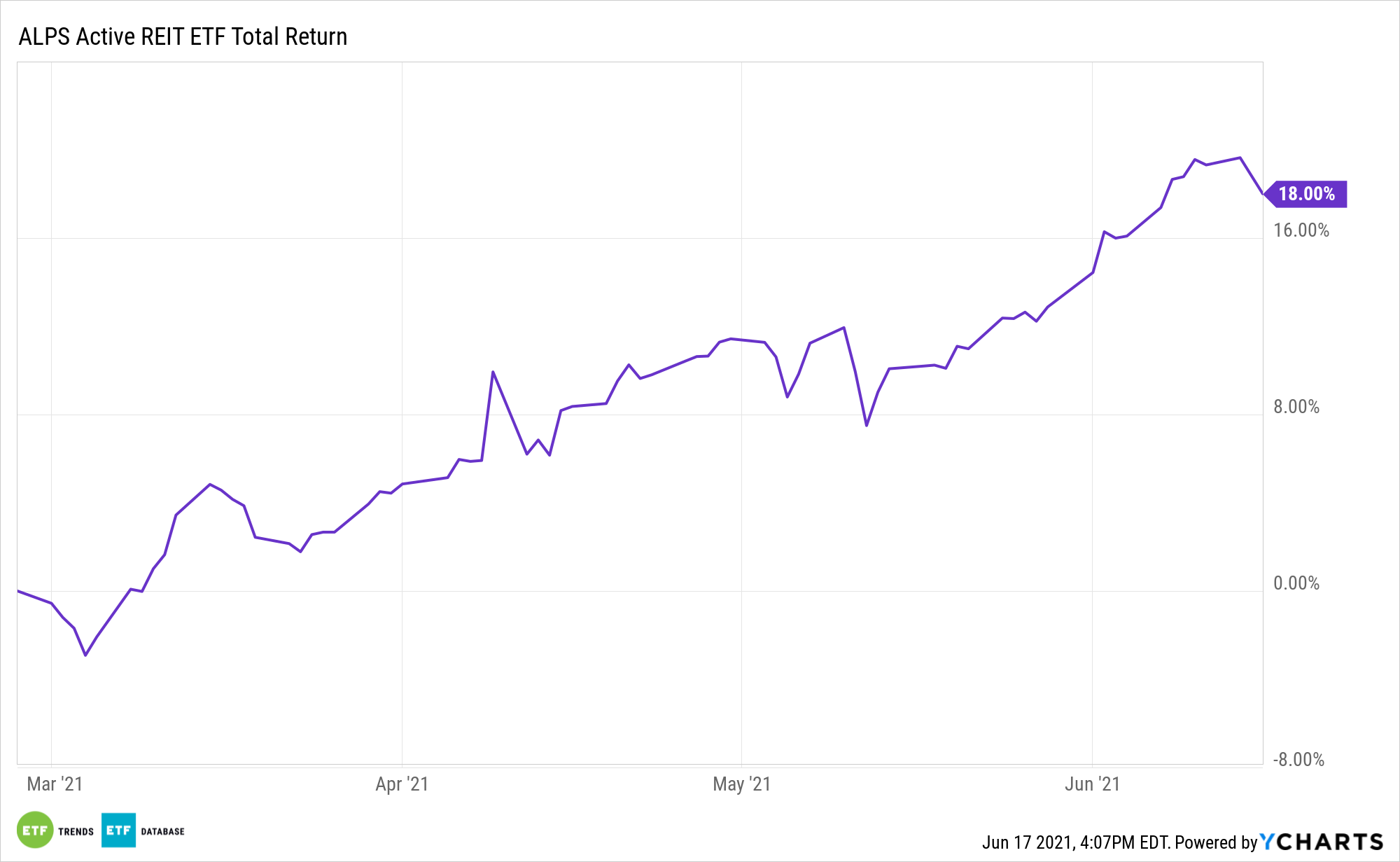

Another reason the actively managed REIT deserves near-term consideration is that with inflation heating up, real estate assets are living up to their billing as inflation fighters. In the current quarter, the real estate sector is topping the S&P 500 by a margin of better than 2-to-1. REIT is getting in on that act. It’s up almost 16% this quarter, beating both the broader real estate sector and the S&P 500.

“Shares of office owner Boston Properties Inc. and data-center landlord Equinix Inc. already climbed 20% and 19%, respectively, since the end of March,” reports Karen Langley for the Wall Street Journal.

REIT is a semi-transparent exchange traded fund, meaning its holdings aren’t disclosed on a daily basis, but at the end of the first quarter, Equinix (EQIX) was the fund’s second-largest holding.

Pricing Power Matters

One of the top reasons REIT is a relevant consideration as the Consumer Price Index (CPI) rises, which it did noticeably in April and May, is that real estate companies have pricing power, meaning they can raise lease rates with little threat of backlash from tenants, particularly at the commercial level.

Look at REIT pricing power this way. A consumer products company, say Coca-Cola or Kellogg, may raise prices to combat higher commodities costs. However, consumers have alternatives and can buy store brands or off-label equivalents. However, when a commercial landlord raises rent, which is often baked into lease agreements, tenants usually don’t just pack up and move. Rent escalators are common in commercial real estate, and that’s the case regardless of inflation data.

Paltry bond yields are also boosting the case for REIT.

“Lackluster bond yields have made the real-estate segment’s dividend payments more appealing. The yield on the benchmark 10-year U.S. Treasury note settled at 1.569%,” reports Langley.

The ALPS ETF has returned 18% since its March debut, making it one of the better-performing funds in the category over that span.

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.