Amid fears that inflation will remain persistent and that the Federal Reserve could raise interest rates as many as three times in 2022, growth and technology stocks took a beating on Thursday and have been weak in recent sessions.

That price action shouldn’t be ignored, but some market observers believe that 10-year Treasury yields need to experience dramatic increases from current levels to truly bring value stocks back into fashion. Perhaps that’s a sign investors shouldn’t be hasty in bailing on exchange traded funds like the ALPS Disruptive Technologies ETF (CBOE: DTEC).

“Throughout the post-war era, when bond yields were below 3%, growth stocks provided investors with consistently higher returns and much lower volatility than value stocks,” said Leuthold Group’s Jim Paulsen in a note to clients on Thursday. “Even though bond yields appear poised to rise in the coming years, the 10-year yield would need to double before the sweet spot for growth stocks is lost and growth finally loses its mojo.”

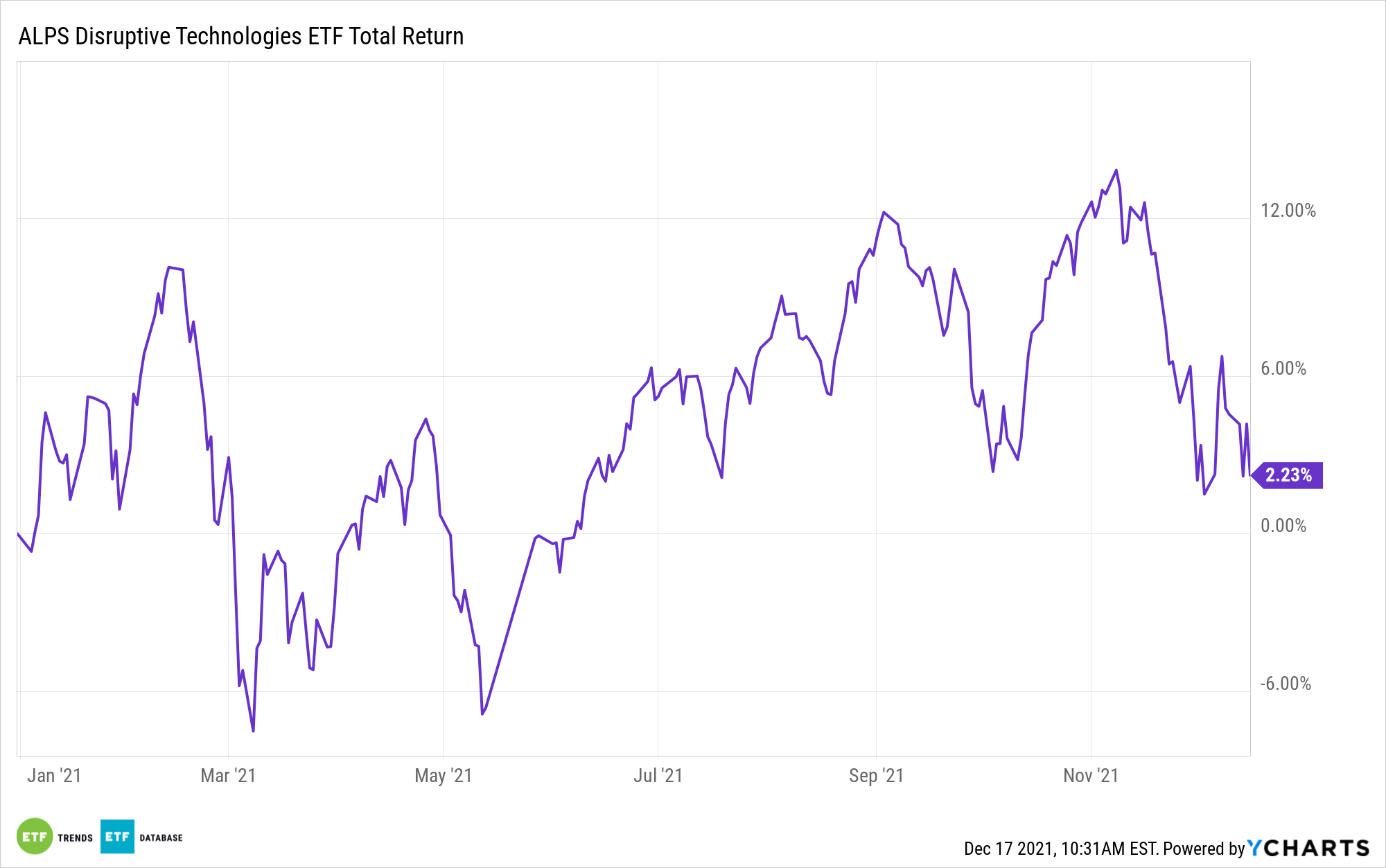

DTEC is off 2.44% over the past week, indicating that the fund, along with other disruptive growth strategies, is being hindered by speculation about what the Federal Reserve has in store in 2022. That doesn’t mean a flight to value stocks is on.

“Value investing — buying cheaper, economically-sensitive shares — has been an underperforming strategy for well over a decade with the U.S. gauge in a downtrend against its growth peer since 2007. It hit an all-time relative low last month,” reports Cormac Mullen for Bloomberg.

Over the near term, debate over Fed policy in 2022 could continue weighing on growth stocks. However, DTEC has some ways to potentially surprise investors in the new year. Notably, it’s possible that if the Fed believes rate hikes will weigh on economic growth, the central bank could scale back its tightening plans.

Speaking of economic growth, assuming it moderates as many experts believe it will, investors could flock to growth stocks, perhaps providing some support to DTEC along the way. DTEC has exposure to 10 themes, which are equally weighted, as are the fund’s components.

Other technology funds to consider include the Technology Select Sector SPDR ETF (NYSEArca: XLK) and the Fidelity MSCI Information Technology Index ETF (FTEC).

For more news, information, and strategy, visit the ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.