Of all the drivers of the S&P 500’s growth so far this year, internet-focused firms have perhaps contributed the most. The key market index has grown 18% year-to-date as of Tuesday, with big internet tech names like Microsoft (MSFT) and Amazon (AMZN) contributing significantly. The global internet ETF OGIG has benefitted this year, including U.S. and global internet-focused companies. OGIG’s returns have spiked, while also sending a key buy signal per its tech charts.

What’s helped push those internet firms forward this year? The U.S. economy has proven resilient despite some of the fastest rate hikes in decades. Meanwhile, a much-discussed recession has so far failed to materialize. That may have allowed those big tech companies to rebound from a 2022 selloff in amid a broader story of economic resilience. Firms like MSFT have also benefitted from artificial intelligence’s breakout year as a source of economic growth.

See more: “VettaFi’s Artificial Intelligence Symposium Recap”

Digging Into Global Internet ETF OGIG

Those factors have helped push OGIG forward. The ALPS O’Shares Global Internet Giants ETF (OGIG) has returned 5.7% over the last week according to the ETFDatabase. That’s on top of a robust 36% return YTD, as well. The strategy charges a 48 basis point (bps) fee, having recently hit its five-year ETF milestone.

It tracks the O’Shares Global Internet Giants Index, which picks and weights global internet and internet tech stocks by growth and quality. It considers factors like monthly cash burn rate and revenue growth rate, building its universe from U.S., European, Pacific Basin, and EM firms. Sitting above $140 million in current ETF AUM, it holds foreign internet tech firms like MercadoLibre, Inc (MELI), an e-commerce name in South America.

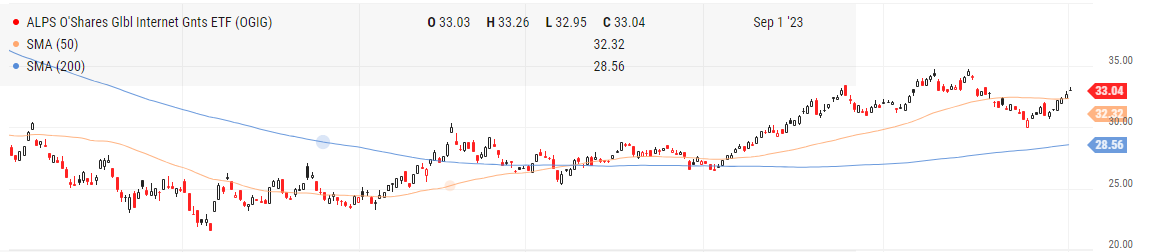

Notably, the global internet ETF recently saw its price rise above its 50-day Simple Moving Average (SMA). Its $33.04 price as of Tuesday midday compares well to its $32.32 50-day SMA. Considering the above factors together, investors may want to keep an eye on the global internet ETF in the weeks ahead.

The global internet ETF OGIG has shown a key buy signal based on its tech chart, per YCharts.

For more news, information, and analysis, visit the ETF Building Blocks Channel.