Thought to ponder…

“Most of us don’t think about the motivating force behind our decisions as we approach the unknowable. We don’t realize when we’re choosing faith or fear. Before making any significant decision or taking any important action, you have to ask yourself, ‘Am I doing this based on faith or fear? Am I doing this based on confidence or worry?’ Remember this: success follows faith and failure follows fear. Make sure you choose faith over fear.” – Darrin Donnelly, “Think Like a Warrior”

The View from 30,000 feet

Last week was central bank week, with major news from US and Japanese policy makers. In the US, Powell surprised markets by looking through recent inflationary pressures and expressing confidence that disinflationary trends would persist. Adding to the dovish tilt, aggregated forecasts by Fed leadership indicated that expectations for higher growth, lower unemployment and higher inflation could co-exist with an expectation for rate cuts. Importantly, the Fed also inched up their long-term expectations for neutral rate for Fed Funds, opening the door for a substantive “higher for longer” debate. Another dovish surprise coming out of the US was clarity on the plan for QT. Although less unexpected because it has been leaked the week before, the Bank of Japan disembarked from their negative rate policy for the first time since 2016. The financial markets provided clear feedback on what market participants thought of each policy move. In the US, the Fed meeting reinvigorated a rally in both risk assets and Treasuries taking the S&P500 to fresh highs and ending a two- week selloff in Treasuries that left the yields flirting with levels where the markets began to struggle last summer. In Japan, the JPY told the true story when it weakened off the back of the BoJ announcement, suggesting markets interpreted the rate hike and policy adjustments as more lip service than action. Overall, the markets took central bank actions last week as confirmation that inflation is still heading in the right direction and policy will be on a path to normalization this year, which, if it ends up being true, is supportive of risk asset prices.

- Key take aways from the Summary of Economic Projections, press conference and market reaction to Fed decision

- The path of the Fed in 2024 will likely come down to three variables: Housing, Wages and Energy

- Flies in the ointment for the Fed – Housing signaling pent up demand and Wages tied to participation and immigration

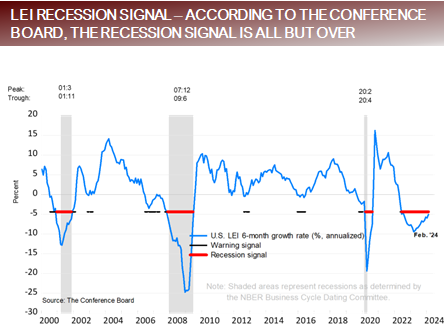

- Conference Board Leading Economic Index turns positive for the first time in two years

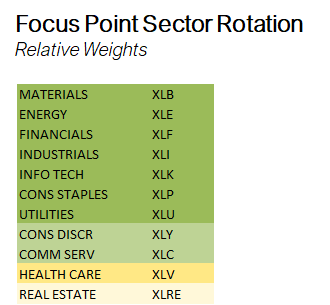

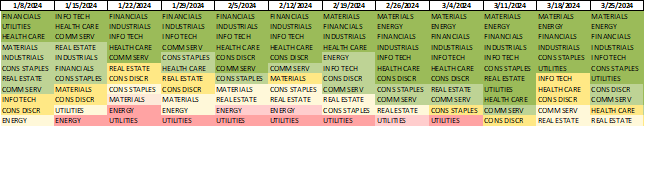

- Focus Point Sector Rotation Update: FOMC and Nvidia GTC AI Conference boost positive trends

Key takeaways from the Summary of Economic Projections and Press Conference

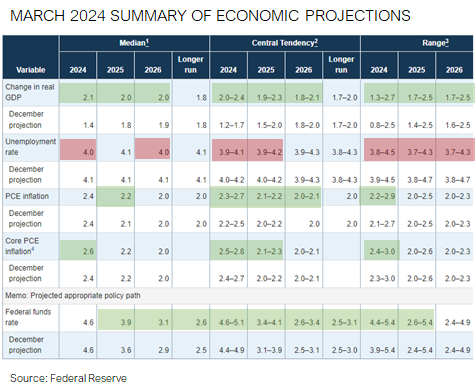

- Summary of changes

- GDP forecast increased

- Unemployment forecast decreased

- PCE forecast increased

- Fed Funds Rate forecast increased

- Long-run Neutral Fed Funds Rate forecast increased

- Rate cuts for 2024 remained the same, with the increase in long- term rates coming in 2025 and 2026

- The theme for last previous (January 31st) press conference was “confidence”. The word confidence appeared 31 times in the transcript of that press conference, continually being referenced as something the Fed needed more of before they would feel comfortable committing to rate cuts. Fast forward to March 20th, and the world “confidence” appeared 20 times in the press conference, and there was a shift in tone to confidence that disinflationary trends would stay in place, despite disappointingly higher inflationary readings so far in 2024, which the Fed dismissed as “seasonal” and “bumps in the road”.

Key takeaways from market reaction to FOMC Meeting

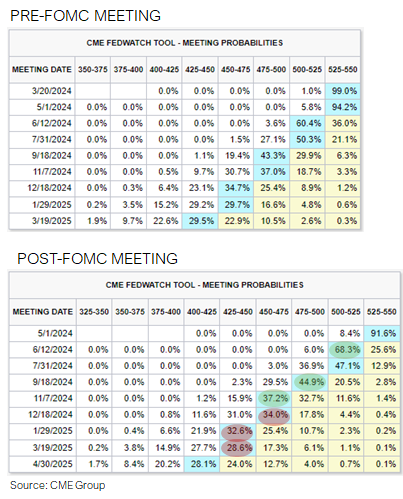

- Expectations for interest rates cuts changed marginally after the FOMC meeting.

-

- There was a slight increase in probability of a cut in June

- There as a very small increase in the probability of a cut in September

- Market probabilities shifted forward the expectation of a third cut in 2024 from December to November

- Market probabilities for further cuts in 2025 decreased

- In a usual turn of events, the markets seem to have listened to Powell, with market probabilities matching the SEP.

- Yields on the 10-year and 2-year both finished lower on the week, with the 10-year dropping about 7 bps and the 2-year dropping about 10 bps from before the FOMC announcement and the press conference to the end of the week.

- Equities reacted positively with the S&P500 posting the best week one week gain of 2024.

The path of the Fed in 2024 will likely come down to three variables: Housing, Wages and Energy

- The Fed clearly has a bias towards cutting rates in From an outside observes perspective, they desperately want to cut, likely because they know that rates are restrictive and the longer they are kept as high as they are, the greater the chance there is a major market disruption. However, the most recent inflationary data is not helping their case to cut, so they are trying will the data into existence. There are like three major determinants of how inflation will play out in 2024. Looking at each and a couple key indicators within each highlights the challenges.

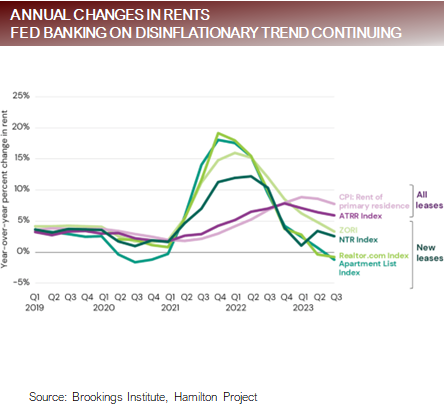

- Housing

- Housing accounts for about 36% of inflation in CPI and about 17% in

- As of the most recent data release, Owner Equivalent Rent, the largest single contributor to CPI, was up 6.0% YoY and accounted for over half of the increase in CPI.

- Owners Equivalent Rent is in a clear down trend, but even if it continues to fall at its current trajectory, it will not reach pre- pandemic trends until late 2024 / early 2025.

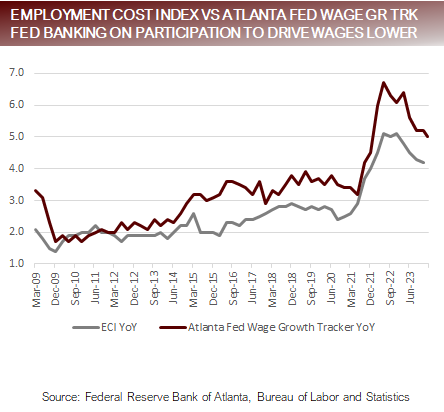

- Wages

- Both the Employment Cost Index (4.2% YoY) and the Atlanta Fed Wage Growth Tracker (5.0% YoY), two key measures are in clear downtrends, but are still elevated above pre-pandemic levels by at least 100 At the current trajectory it would take three to six months more to reach pre-pandemic levels.

- Energy

- Energy may be the biggest challenge. WTI Oil and the AAA average gallon of gas are both up 13% in 2024, but Wholesale Gasoline futures are up over 30% YTD, signaling there may be higher prices as we head into the busy driving season.

- Housing

Trends in Housing and Wages are providing Fed with confidence disinflation will continue

Flies in the ointment for the Fed: Housing (pent-up demand) and Wages (participation and immigration)

- Although the Fed and markets desperately want to believe the disinflationary trends will continue in Housing and Wages, there are serious challenges.

- Housing

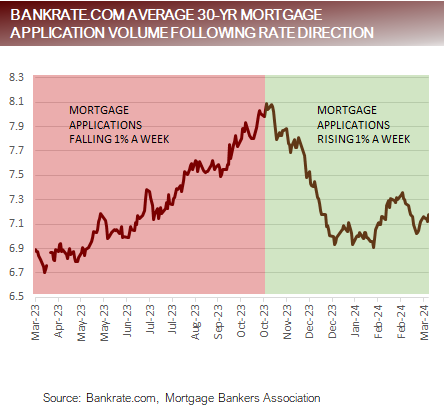

- The average 30-year mortgage peaked in October at 09% and has since fallen to 7.18%.

- Dividing the last 52 weeks into two periods, those before the peak in mortgage rates (30 weeks) at those after the peak in mortgage rates (22 weeks). The average number of mortgage applications in the first period, while rates were rising, fell by an average of about 1% per week. Since rates began to fall, the second period, the average number of mortgage applications has increased about 1% a

- Since mortgage applications an early indicator of housing demand, the message is that as mortgage rates fall, demand for mortgages/existing home sales will increase. Unless supply increases substantially, prices may stand to increase from the uptick in

- Wages

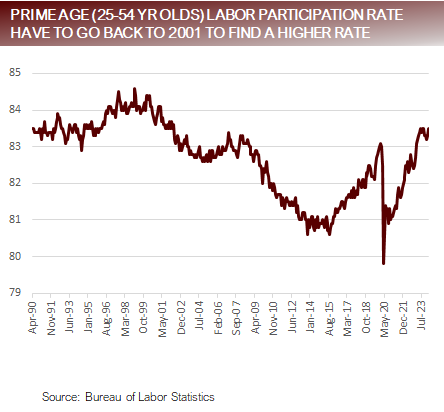

- The Powell highlighted in the press conference that the reason that wage pressures remain in a downtrend is because even if demand for labor is high, which can be measured by JOLTS, as long as supply for labor is increasing, which can be measured by Labor Participation, the increased supply of workers will offset demand This is what occurred in 2023, because participation increased and immigrate surprised on the upside. It’s unclear if these trends will continue in 2024

- Prime age labor participation is now above pre-pandemic levels and has stalled out at 5%. Only one time in history has prime age labor participation been higher, between 1997 and 2001.

Fed putting faith in housing and wage trends continuing but drivers looking played out

Conference Boarding Leading Economic Index turns positive for the first time in two years

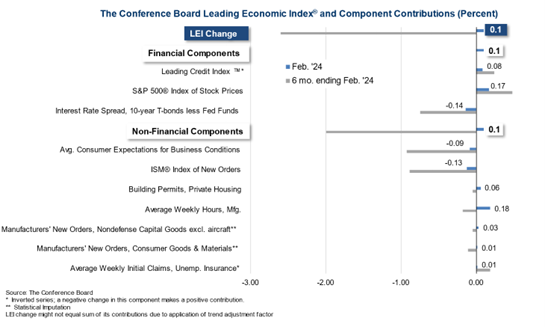

- The Conference Board Leading Economic Index turned positive for the first time since February 2022.

- The Conference Board Leading Economic Index is a composite of ten different measurements of economic activity, split into two groups, Financial Components and Non-Financial Components.

- Only three out of the ten continued to have a negative

- Looking deeper into the three that continue to produce negative

-

-

- The Treasury Curve is inverted and has been a key quantitative component triggering recession calls since November 2022. Because of the Fed’s intervention in the Treasury market, there have been questions raised as to the reliability of using the yield curve as a recession forecasting tool.

- The other two negative contributors are both survey related, also known as soft data, as opposed to hard data, which is measuring actual output. There has been considerable debate on the reliability of soft data during the current cycle.

-

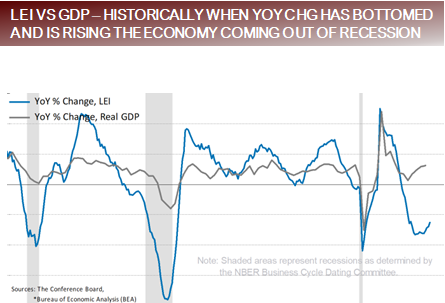

LEI indicating that recession risk may have past for the short term

Focus Point Sector Rotation Update: FOMC and Nvidia GTC AI Conference boost trends

- The Focus Point Sector Rotation Model is a combined trend following and mean reversion model that utilizes seven factors to analyze daily price data on sectors to determine the strength of upward trends.

- Last week’s post-FOMC meeting rally and Nvidia’s GTC AI conference combined to reverse weakening trends mega cap leadership names.

- Strongest up trends are in Materials, Energy and Industrials, which together combine to make up less than 15% of the S&P500. Microsoft, Apple and Nvidia together represent a larger share of the S&P500 than these three sectors.

Putting it all together

- The markets are in euphoria. Fed Funds Futures Probabilities indicate that they have completely bought into the Fed’s soft- landing / no-landing framework, and risk assets are providing the perfunctory rally for good

- The only problem with this story is that, as much as we all want to believe this will go according to plan, there are some flies in the ointment that may not be playing along. Housing, wages and energy have the potential to be a problem. The Fed is currently waving off signs of inflationary pressures in these areas as part of a bumpy road.

- As long as the labor markets remain strong, and supports consumer spending, which in turn buttresses corporate earnings, whether or not the Fed sticks the soft-landing may not be the driving factor of equity upside because the markets can gravitate higher based on earnings fundamentals, rather than

- As we round the corner into Q2 at the end of this week, corporate earnings for Q1 will start to come into Right now, there is no indication that there will be anything to upset the apple cart in corporate earnings land, which means the path of least resistance remains higher.

- The risk for April is if corporate earnings or guidance comes in unexpectedly light and inflationary numbers continue to surprise on the upside, the markets may face a rude awaking of a double whammy of policy and earnings both

For more news, information, and analysis, visit Vettafi | ETF Trends.

DISCLOSURES AND IMPORTANT RISK INFORMATION

Performance data quoted represents past performance, which is not a guarantee of future results. No representation is made that a client will, or is likely to, achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Focus Point LMI LLC

For more information, please visit www.focuspointlmi.com or contact us at [email protected] Copyright 2024, Focus Point LMI LLC. All rights reserved.

The text, images and other materials contained or displayed on any Focus Point LMI LLC Inc. product, service, report, e-mail or web site are proprietary to Focus Point LMI LLC Inc. and constitute valuable intellectual property and copyright. No material from any part of any Focus Point LMI LLC Inc. website may be downloaded, transmitted, broadcast, transferred, assigned, reproduced or in any other way used or otherwise disseminated in any form to any person or entity, without the explicit written consent of Focus Point LMI LLC Inc. All unauthorized reproduction or other use of material from Focus Point LMI LLC Inc. shall be deemed willful infringement(s) of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Focus Point LMI LLC Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Focus Point LMI LLC Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

All unauthorized use of material shall be deemed willful infringement of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights. While Focus Point LMI LLC will use its reasonable best efforts to provide accurate and informative Information Services to Subscriber, Focus Point LMI LLC but cannot guarantee the accuracy, relevance and/or completeness of the Information Services, or other information used in connection therewith. Focus Point LMI LLC, its affiliates, shareholders, directors, officers, and employees shall have no liability, contingent or otherwise, for any claims or damages arising in connection with (i) the use by Subscriber of the Information Services and/or (ii) any errors, omissions or inaccuracies in the Information Services. The Information Services are provided for the benefit of the Subscriber. It is not to be used or otherwise relied on by any other person. Some of the data contained in this publication may have been obtained from The Federal Reserve, Bloomberg Barclays Indices; Bloomberg Finance L.P.; CBRE Inc.; IHS Markit; MSCI Inc. Neither MSCI Inc. nor any other party involved in or related to compiling, computing or creating the MSCI Inc. data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice.

This communication reflects our analysts’ current opinions and may be updated as views or information change. Past results do not guarantee future performance. Business and market conditions, laws, regulations, and other factors affecting performance all change over time, which could change the status of the information in this publication. Using any graph, chart, formula, model, or other device to assist in making investment decisions presents many difficulties and their effectiveness has significant limitations, including that prior patterns may not repeat themselves and market participants using such devices can impact the market in a way that changes their effectiveness. Focus Point LMI LLC believes no individual graph, chart, formula, model, or other device should be used as the sole basis for any investment decision. Focus Point LMI LLC or its affiliated companies or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. Neither Focus Point LMI LLC nor the author is rendering investment, tax, or legal advice, nor offering individualized advice tailored to any specific portfolio or to any individual’s particular suitability or needs. Investors should seek professional investment, tax, legal, and accounting advice prior to making investment decisions. Focus Point LMI LLC’s publications do not constitute an offer to sell any security, nor a solicitation of an offer to buy any security. They are designed to provide information, data and analysis believed to be accurate, but they are not guaranteed and are provided “as is” without warranty of any kind, either express or implied.

FOCUS POINT LMI LLC DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE.

Focus Point LMI LLC, its affiliates, officers, or employees, and any third-party data provider shall not have any liability for any loss sustained by anyone who has relied on the information contained in any Focus Point LMI LLC publication, and they shall not be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information or opinions contained Focus Point LMI LLC publications even if advised of the possibility of such damages.