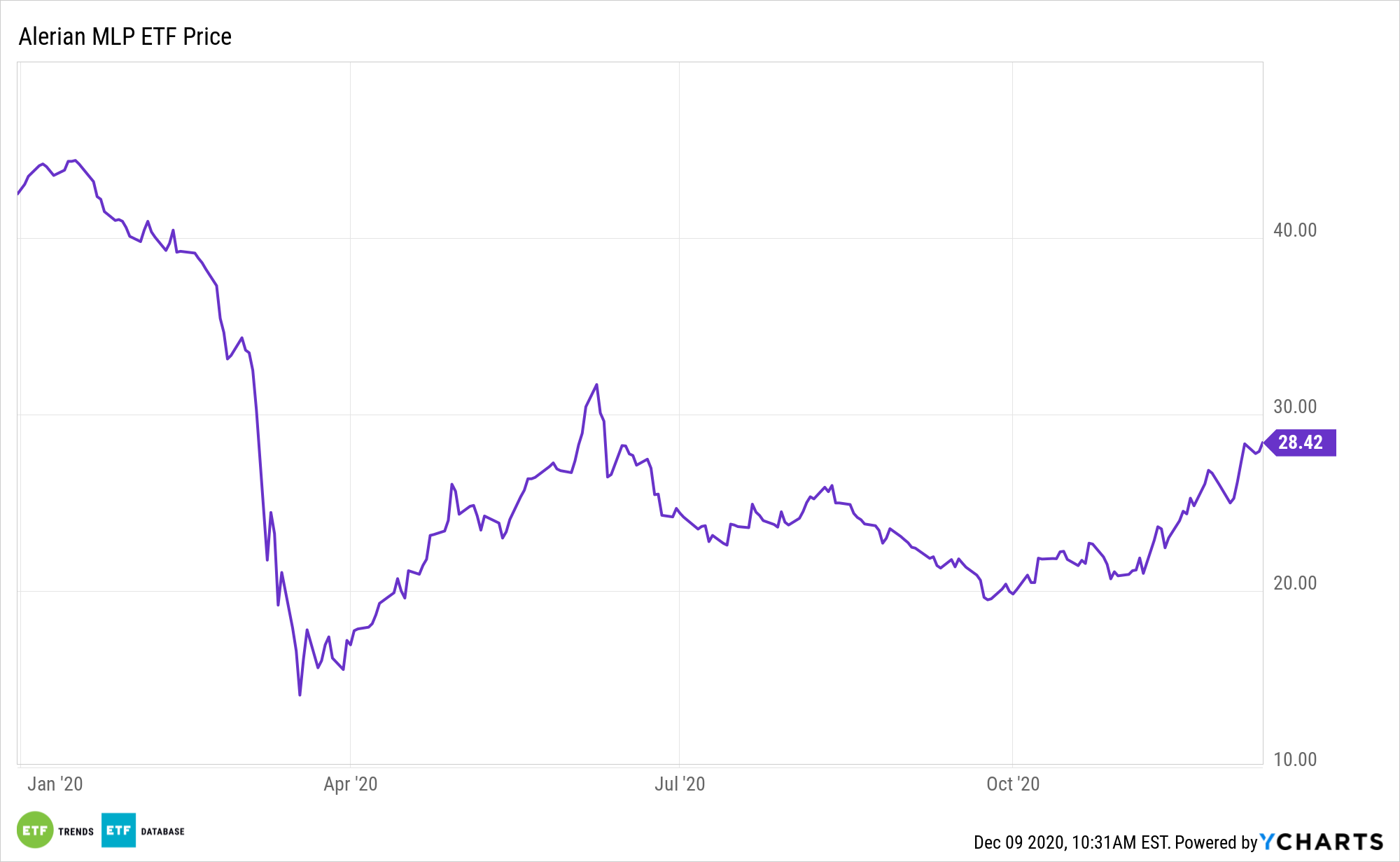

Buoyed by big gains by gathering and processing master limited partnerships (MLPs), the ALPS Alerian MLP ETF (NYSEArca: AMLP) surged 9% last week. There are indications that could be the start of something more substantive for midstream assets.

AMLP seeks investment results that correspond generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Index. The index is comprised of energy infrastructure MLPs that earn a majority of their cash flow from the transportation, storage, and processing of energy commodities.

Buoyed by factors such as coronavirus vaccine progress, rebounding oil prices, and a rotation into value stocks, AMLP is on a scintillating pace, surging 40% since late October.

Unlike oil producers and services companies, energy infrastructure companies provide real business-line diversification in the energy sector, as they deal with the transportation, storage, and processing of energy, which are far less reliant on commodity prices.

How Slowing Down the Permit Process Can Actually Benefit Oil

Interestingly, AMLP has some political tailwinds with the incoming Biden Administration.

“That slowdown might prove welcome for pipeline owners in the Permian Basin of Texas and New Mexico, the epicenter of U.S. drilling activity, where there is more pipeline capacity than supply to fill it. Plains All American Pipeline, which has a large presence in the Permian, noted in its earnings call in November that a change in administration could help make its pipelines on the ground more valuable by slowing down permits,” reports Jinjoo Lee for the Wall Street Journal.

MLPs primarily deal with the distribution and storage of energy products, so their business model is less reliant on the commodities market since MLPs profit off the quantity of oil and natural gas they are able to move around. Consequently, MLPs have historically shown a weaker correlation to energy prices over longer periods as MLPs act more like energy toll roads, profiting on the volume of oil moving through their pipelines.

The slowdown in new permit approvals can benefit AMLP components in another way. Investors are demanding that MLPs rein in spending and reduce debt, not spend frivolously on new projects while oil prices are still soft.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.