Oil prices are high relative to last year’s levels, but profligate spending in the energy patch appears to be a thing of the past.

That could be a good thing for investors.

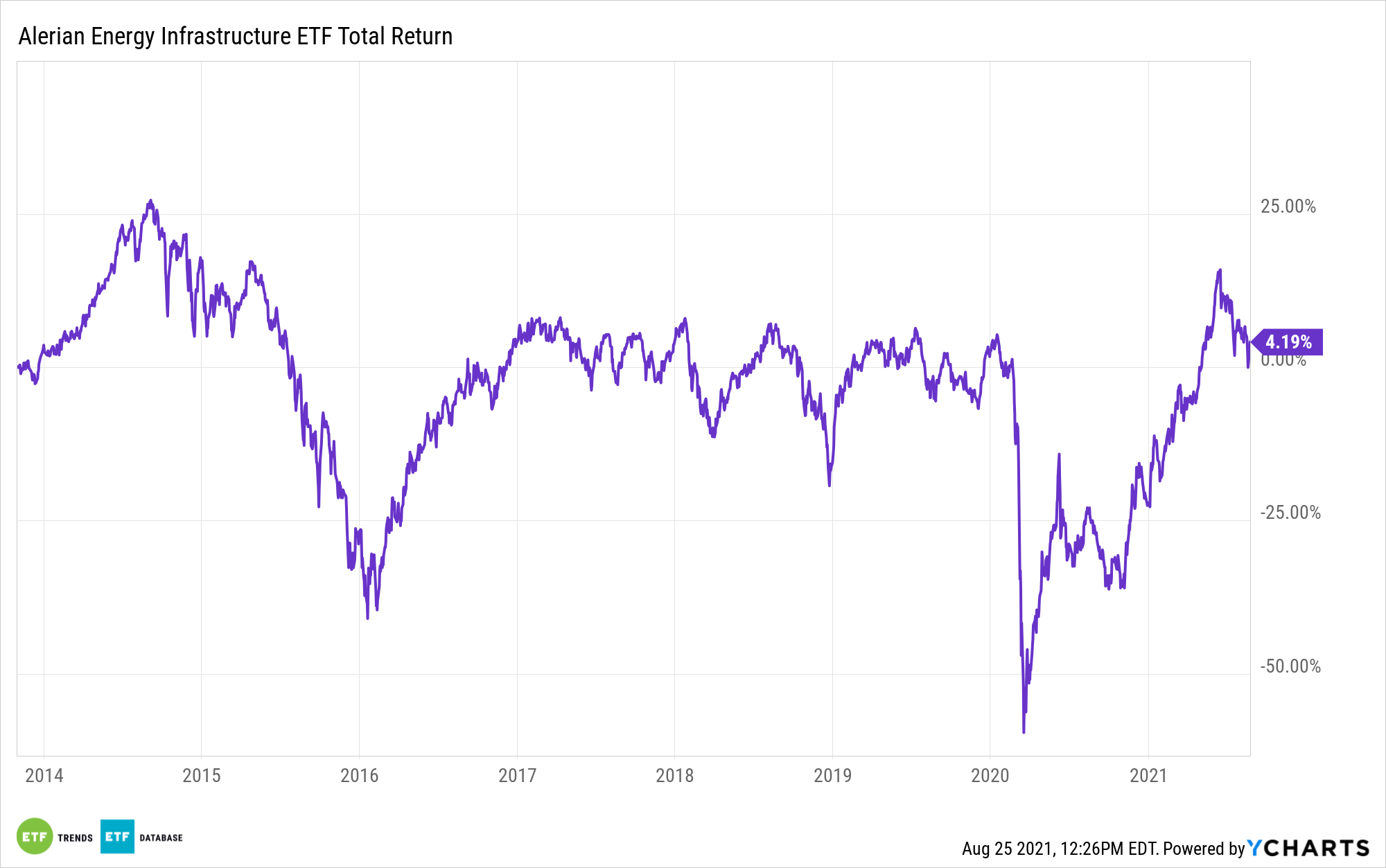

Global energy giants are tightening their belts, a strategy that could prove impactful for exchange traded funds, including the Alerian Energy Infrastructure ETF (ENFR). ENFR, which follows the Alerian Midstream Energy Select Index (CME: AMEI), is home to C-corps and master limited partnerships (MLPs) that operate pipelines and process, store and transport energy commodities, including oil and natural gas.

Indeed, those are capital-intensive endeavors, and while oil and gas prices are higher than they were a year ago, that doesn’t mean ENFR components are getting carried away with spending. RBC Capital Markets expects oil industry spending to inch higher this year, but remain well below 2019 levels.

“Companies continue to hold the line on spending and activity with many staying steadfast on maintenance plans through the remainder of 2021,” according to the Canadian bank.

The ENFR Thesis

ENFR member firms usually aren’t highly tethered to oil majors’ spending plans because companies in the ALPS fund provide essential services for the industry – a positive trait against the backdrop of modest spending plans.

“The 2021 investment budget for the 190 oil and gas companies RBC analysts track totals $348.0 billion. This is up 4% from $334.7 billion in 2020, when the industry slashed spending as lockdowns and other coronavirus-induced restrictions hit fuel demand and prices. However, the 2021 capex forecast is 25% lower than the $461.7 billion spent in 2019,” reports Jaime Llinares Taboada for Dow Jones.

Midstream operators, including ENFR holdings, have been monitoring spending for some time, working to firm up their balance sheets. That’s paying off in the form of steadier earnings and more visibility when it comes to buybacks and dividend growth.

“Reinvestment frameworks, boosted shareholder return/debt reduction plans and service cost pressures provide guardrails to 2022 spending increases which we expect results in most companies targeting maintenance/modest growth rates next year,” RBC said.

Up 33.78% year-to-date, ENFR is proving it can deliver for investors, even if energy companies trim capital expenditures. The fund yields 5.64%.

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.