In one of the more impressive redemption stories in recent memory, the energy sector is the best-performing group in the S&P 500 to start 2021, and that ebullience isn’t confined to large cap oil names.

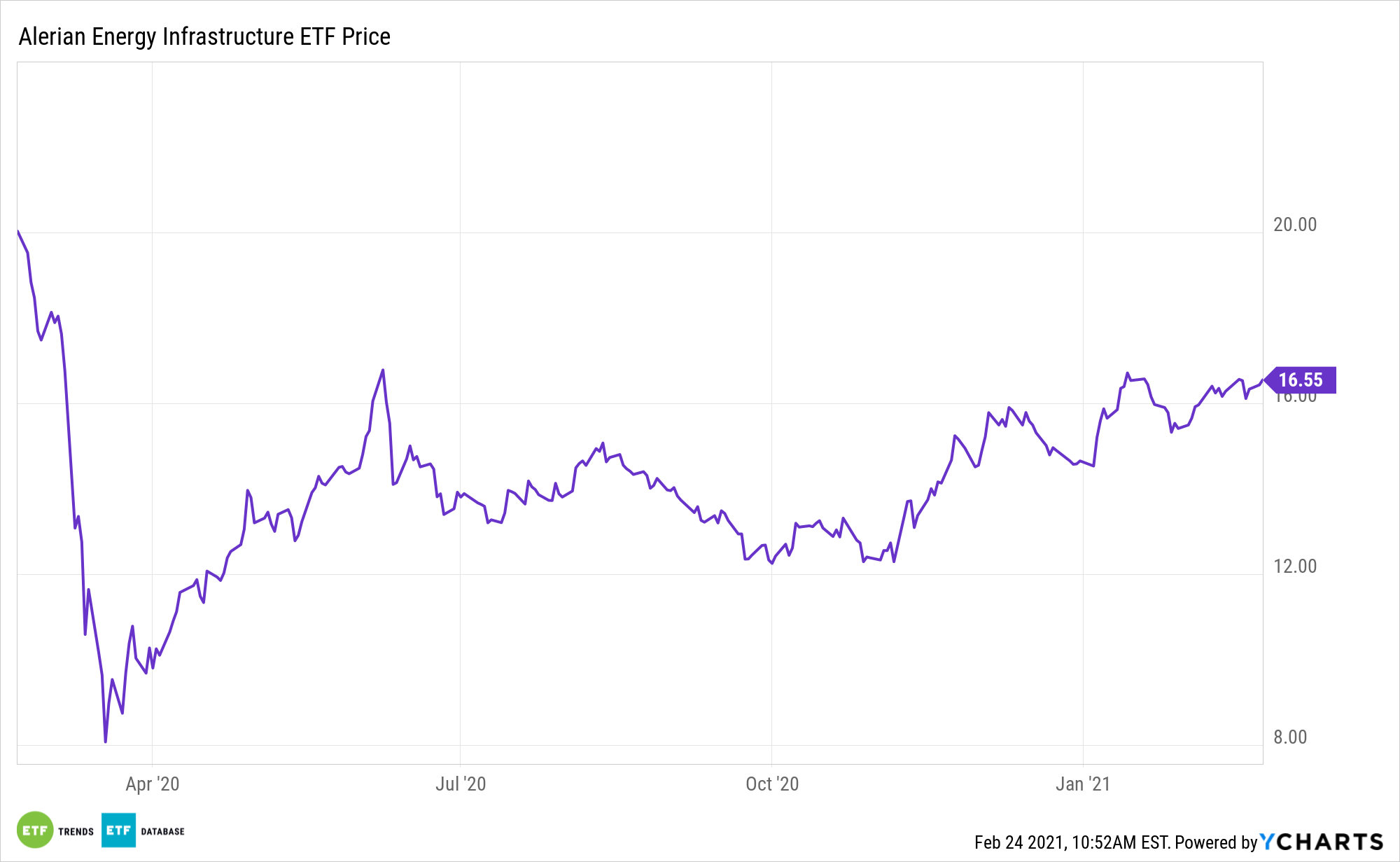

As highlighted by the Alerian Energy Infrastructure ETF (ENFR), midstream assets are participating in the energy rally.

The ALPS ETF tracks the Alerian Midstream Energy Select Index (CME: AMEI). ENFR acts as a type of hybrid energy infrastructure ETF, which helps investors capture some of the high yields from MLPs while limiting the tax hit from solely owning MLPs. Part of the good news for the sector is that some well-known investors are revisiting energy equities.

“Energy stocks, often viewed as a classic cyclical play, have risen more than 24% this year following a brutal 2020 where the pandemic-triggered demand loss wreaked havoc in the industry. The space has garnered interest from some of the world’s biggest investors including Warren Buffett and David Tepper as they snapped up energy shares to bet on an economic comeback,” reports Yun Li for CNBC.

Building a Case for ENFR

The energy sector can be sensitive to sudden changes to economic factors like demand, making a factor-based strategy that incorporates value or quality optimal in certain cases.

With an energy rally underway thanks to strong oil prices and a keen interest in renewable sources, ETF investors can get a sold income-based strategy with ENFR.

“One sector where high hedge fund ownership worked well as a factor in 2020 and has continued to lead in early 2021 is energy,” Lori Calvasina, head of U.S. equity strategy at RBC, said in a note. “The most popular Energy stocks in hedge funds have outperformed in early 2021, continuing a trend seen in 2020.”

Energy’s recent resurgence is widely attributable to success on the coronavirus vaccine front. The faster a vaccine comes to market, the more rapidly demand will increase as industry ramps up and Americans unleash pent-up travel demand. Increasing travel would likely boost oil prices too.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.