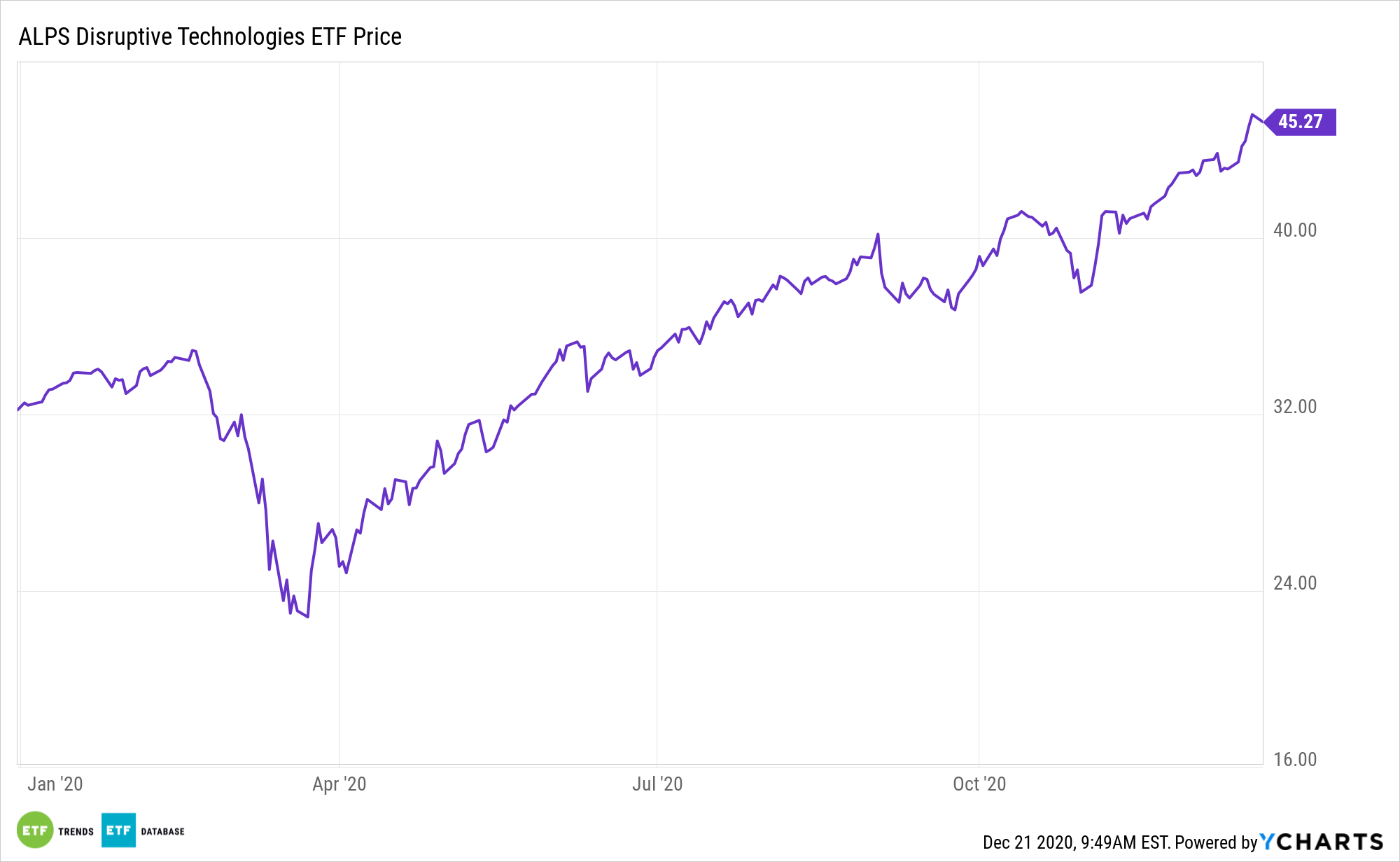

Energy storage and smart grid technologies are integral parts of the burgeoning electric vehicle (EV) landscape. The ALPS Disruptive Technologies ETF (CBOE: DTEC) provides a clean avenue for investors looking to access those concepts with the added benefit of exposure to an array of other fast-growing technologies.

DTEC tracks the Indxx Disruptive Technologies Index, which identifies companies using disruptive technologies across ten thematic areas, including Healthcare Innovation, Internet of Things, Clean Energy and Smart Grid, Cloud Computing, Data and Analytics, FinTech, Robotics, and Artificial Intelligence, Cybersecurity, 3D Printing, and Mobile Payments.

DTEC companies provide exposure to cutting-edge technologies in the energy space and are leaving traditional fossil fuels producers behind. This trend is going to be long-running, providing a lengthy runway for DTEC upside. Importantly, the energy storage/smart grid exposure found in DTEC is highly relevant in today’s EV environment.

“As huge quantities of electric vehicle (EV) chargers and energy storage are installed worldwide in the coming years, there is the possibility for both technologies to be deployed together,” according to IHS Markit research.

The DTEC ETF: At the Intersection of Energy and Electric Vehicles

With the incoming Biden Administration planning potentially massive spending on renewable energy, smart grid technologies are likely to be in focus, highlighting opportunities with DTEC.

“The case for energy storage has grown substantially in recent years, with investment being driven across the globe by profitable use cases,” according to IHS Markit. “Battery energy storage projects are accessing revenue streams by bidding into existing frequency response markets, providing other ancillary services, or increasingly trading wholesale energy as price volatility increases.”

Though it’s not a dedicated electric vehicle ETF, DTEC offers investors leverage to that theme via its clean energy and smart grid exposures. Some of the companies in the fund could be players in the fight to address high grid costs and low revenues faced by EV charging and storage providers. DTEC offers flexibility over time, which is crucial in the energy storage equation.

“To fully achieve this goal, the use case of the energy storage system must change over the lifetime of the project,” notes IHS Markit. “In the early years, the battery will provide much of the project’s revenues via ancillary services. Then, as EV adoption increases, project revenues will shift toward electricity sales to vehicles. The battery use case will shift to peak shaving in order to minimize grid charges. In this way, charge point developers can generate diversified revenues throughout the lifetime of the project while reducing risks.”

Other technology funds to consider include the Technology Select Sector SPDR ETF (NYSEArca: XLK) and the Fidelity MSCI Information Technology Index ETF (FTEC).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.