Master limited partnerships (MLPs) are a favored asset class of some income-hungry investors, but given energy price gyrations, dividend stability isn’t guaranteed.

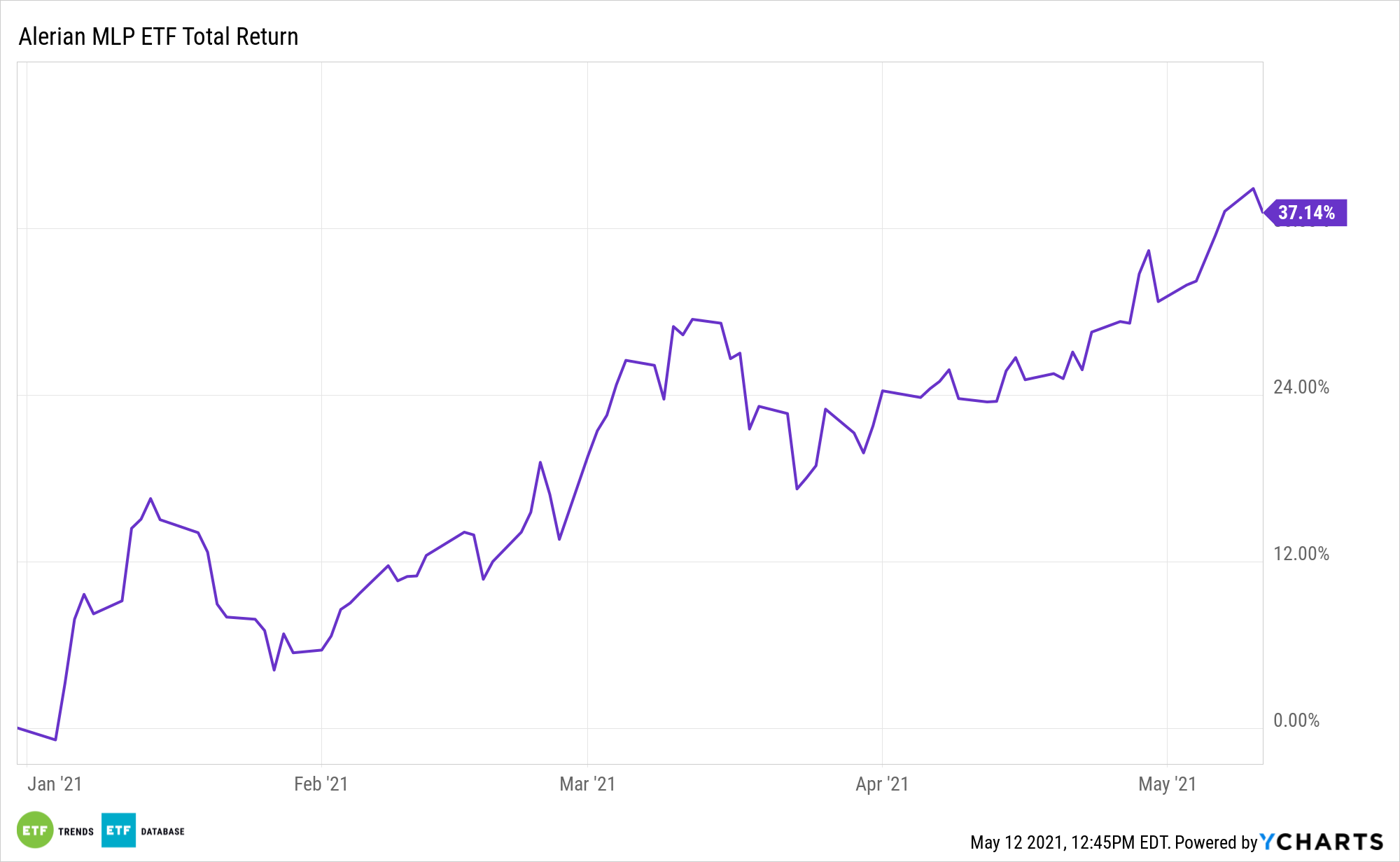

Fortunately, payouts in the midstream space, accessible via the ALPS Alerian MLP ETF (NYSEArca: AMLP), are showing stability following a turbulent start to 2020, when energy commodities plunged due to the onset of the coronavirus pandemic. Some midstream names boosted payouts in the first quarter of 2021.

“As has been largely the case following the dividend cuts for 1Q20, midstream companies broadly held their payouts steady in 1Q21, with a handful of names increasing their dividends sequentially,” writes Alerian analyst Mauricio Samaniego.

AMLP seeks investment results that correspond generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Index. The index is comprised of energy infrastructure MLPs that earn a majority of their cash flow from the transportation, storage, and processing of energy commodities.

The Prognosis for Energy Dividends

Regardless of sector, dividend growth is not guaranteed, but at the very least, data indicate AMLP components should largely be able to maintain current payouts over the course of this year.

“With midstream earnings season largely in the books, strong results from many companies and some eye-popping quarterly beats complement an improving macro outlook to provide added comfort around the reliability of midstream income,” notes Samaniego. “Several management teams discussed expectations for the macro energy environment to continue to strengthen into 2H21 and 2022.”

On the sustainability front, while MLPs are famous for their high yields relative to other asset classes, current yields in the group are actually below historical norms. That could be another sign today’s payouts among AMLP components aren’t straining those holdings.

“Midstream yields have falledn below their five-year averages as a solid earnings season, steady dividends, and an improving outlook have all supported the outperformance of the space relative to broader energy in recent months. Since the end of February through April 30, AMNA and AMZI are up 14.5% and 15.0% on a total-return basis, respectively, compared to a 3.5% total return for the Energy Select Sector Index (IXE) over the same period. As of April 30, AMNA was yielding 6.4% or 20 basis points below its five-year average, while the AMZI was yielding 8.2% or 50 basis points below its five-year average,” adds Samaniego.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.