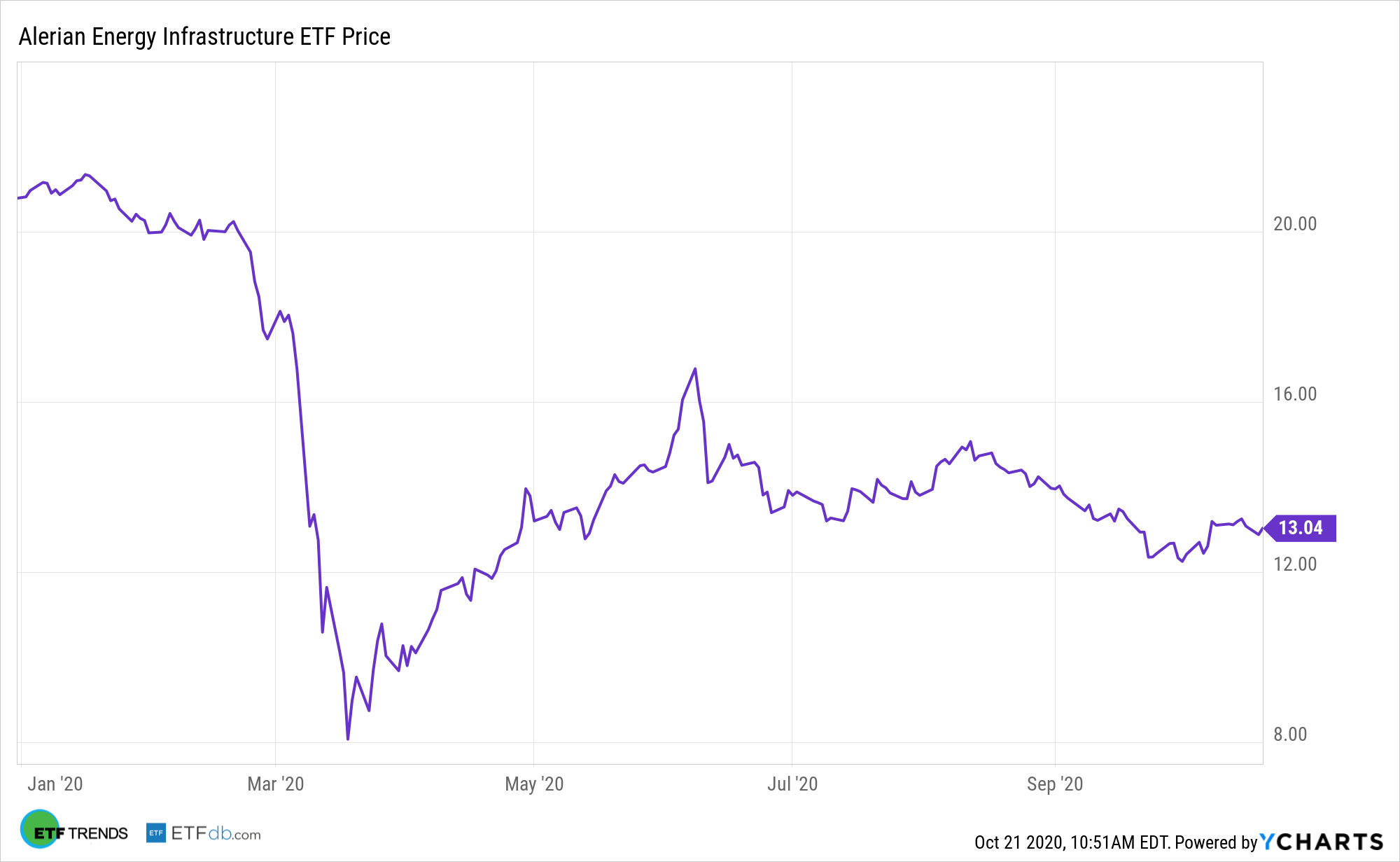

With midstream energy companies readying to step into the third-quarter earnings confessional, the Alerian Energy Infrastructure ETF (ENFR) is an exchange traded fund for income investors to consider.

ENFR tracks the Alerian Midstream Energy Select Index (CME: AMEI). ENFR acts as a type of hybrid energy infrastructure ETF, which could help investors capture some of the high yields from MLPs while limiting the tax hit from solely owning MLPs.

“Market observers will be closely watching the outlook for demand and growth spending heading into 2021 as North American operators of natural gas pipelines, processing facilities and liquefaction terminals release third-quarter financial results,” reports S&P Global Market Intelligence.

The midstream space is usually more defensive and less volatile than other energy segments due to steady, reliable cash flows. However, that defensive posture could be tested during earnings season.

The Coronavirus and Energy Infrastructure

Although ENFR is mostly steady over the past month, another wave of coronavirus cases could weigh on energy assets.

“Rising coronavirus infection rates in the US have added uncertainty over the depth and resilience of a rebound in volumes. And while prices in Europe and Asia have recently been incentivizing a pickup in activity at LNG terminals, how that picture looks after the peak winter heating season remains in flux,” according to S&P Global.

One thing analysts and investors are looking, particularly amid expectations most midstream operators won’t be profitable for third quarter, are more spending cuts.

“Even though industry analysts predict that the Nov. 3 US elections will overshadow midstream results, they are still looking for management teams to announce more budget cuts and pivot toward buying back stock once Kinder Morgan, which is often viewed as a barometer for the sector, releases its results,” notes S&P Global.

Free cash flow is the cash a company has left over after accounting for capital spending and it’s a vital evaluation metric in capital-intensive industries, such as energy. Fortunately, the outlook on this front is bright for midstream names.

ENFR currently yields almost 9%.

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.