Active REIT ETFs are a strong choice for 2024 as they can potentially offer uncorrelated returns to portfolios.

REIT ETFs allow investors to gain exposure to the real estate market via a tax- and cost-efficient, highly liquid vehicle. REIT exposure can help advisors build diversified portfolios and improve risk/return fundamentals for clients.

1. ALPS Active REIT ETF (REIT)

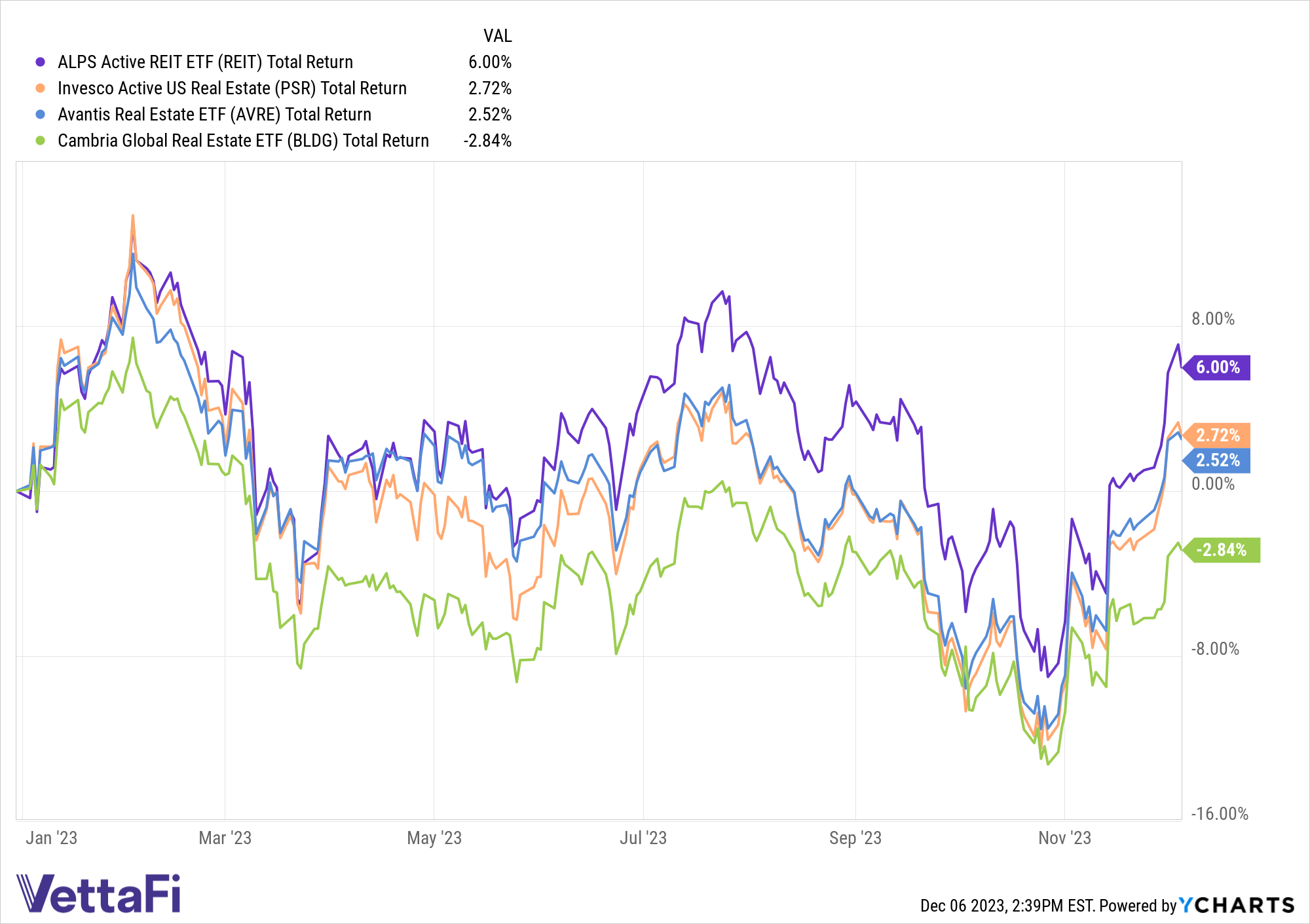

REIT is leading the active REIT ETFs segment by year-to-date returns. The fund is up 6.0% year to date as of December 5.

REIT comprises common equity securities of U.S. REITs but may also include common equity of U.S. real estate operating companies that are not structured as REITs, preferred equity of U.S. REITs, and real estate operating companies, as well as cash and cash equivalents.

The fund’s proprietary methodology gives it an advantage over other funds. In selecting its constituents, REIT considers the intrinsic value of the underlying properties held by REITs as well as the corresponding intrinsic value of the REITs in which the fund seeks to invest.

2. Invesco Active U.S. Real Estate Fund (PSR)

PSR takes second place among the active real estate ETFs, up 2.7% year to date.

The fund offers exposure to REITs within the U.S. equity market. It structures and selects its investments primarily from a universe of securities that are included within the FTSE NAREIT All Equity REITs Index, which has just fewer than 50 holdings diversified primarily across mid- and large-cap equities.

The fund’s selection methodology uses quantitative and statistical metrics to identify attractively priced securities and manage risk

3. Avantis Real Estate ETF (AVRE)

AVRE is slightly lagging PSR, having climbed 2.5% year to date. The ETF invests in global real estate stocks that are expected to have higher returns or better risk characteristics, similar to BLDG.

The fund holds real estate companies across a variety of property sectors, including REITs and REIT-like entities, located in countries included in its benchmark index, the S&P Global REIT Index.

4. Cambria Global Real Estate ETF (BLDG)

BLDG, which has declined 2.8%, is the only fund posting negative returns year to date.

The fund provides global exposure to a basket of real estate securities, including REITs and real estate management and development firms. It allocates 40% of its assets in equities listed outside of the U.S. and targets a total of 50-100 securities with equal weightings.

For more news, information, and analysis, visit the ETF Building Blocks Channel.