By Andrew Poreda & Emma Harper

The consideration of ESG issues has become an essential component for investors to both manage risk and identify future investment opportunities. A recent Moody’s report highlighted that a quarter of credit ratings would be different if not for the integration of ESG factors, and nearly 30% of issuers are facing potential negative ratings from various ESG exposures.

For this year’s Sage ESG 50 list, we weighed the events of the past year, including the invasion of Ukraine and the politicization of ESG, and as a result our ESG evaluation frameworks have evolved. We’re excited to announce quite a few newcomers to the Sage ESG 50, a compilation of the most sustainable US dollar-denominated corporate debt issuers.

Key Takeaways

- There are 16 new issuers on this year’s list. These issuers all received Sage ESG Leaf Score® upgrades within the last year.

- The current geopolitical landscape has exposed the need for corporate business models to have thorough sovereign risk management, including for operations, revenue drivers, and supply chain management.

- Governance remains the critical component in corporate ESG assessment.

- Long-term climate focus is crucial, but more emphasis is needed on current environmental challenges, such as water management and biodiversity. Thirty-eight percent of the Sage ESG 50 companies have issued an impact bond.

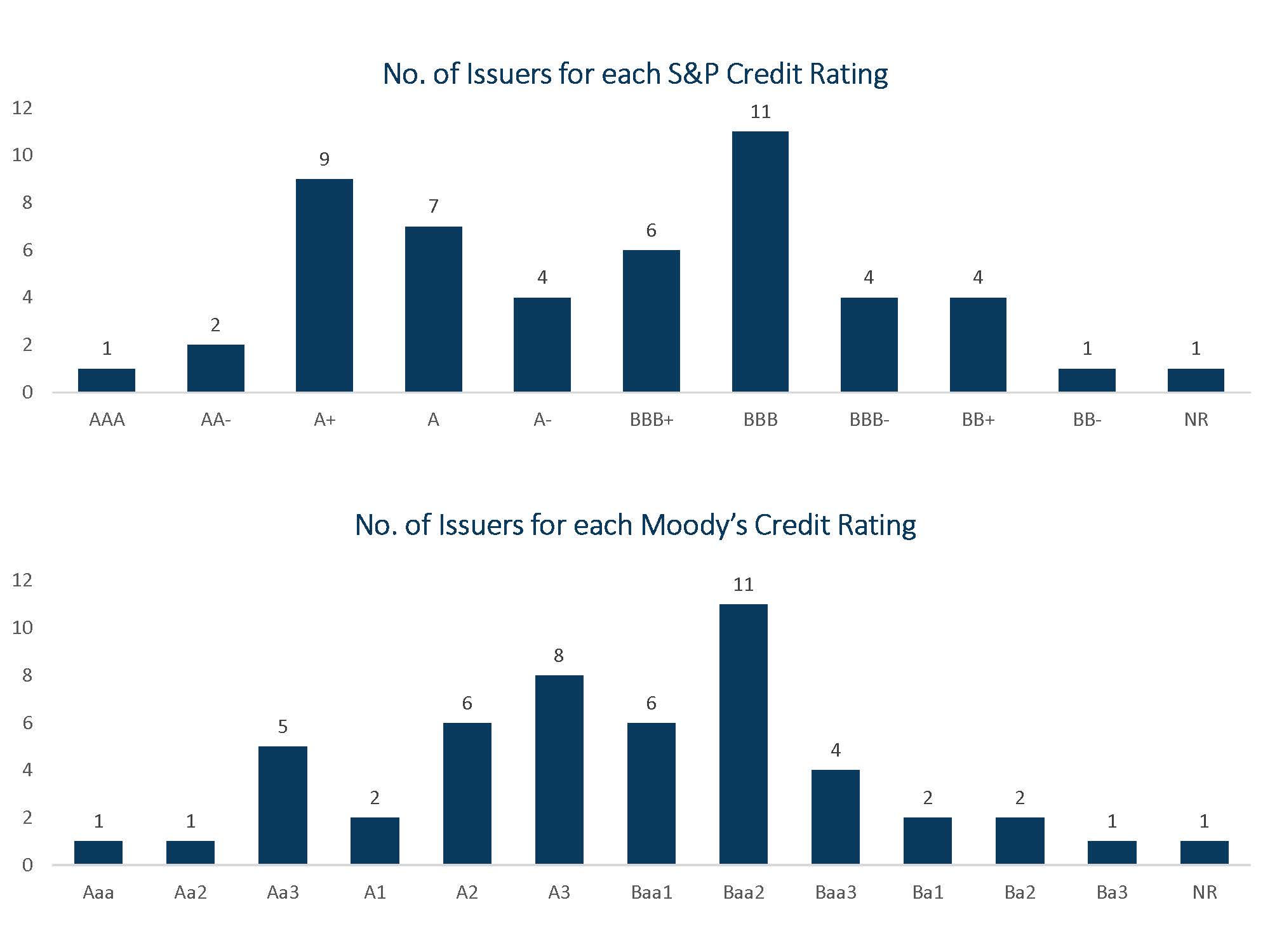

- The average credit rating for the Sage ESG 50 stood at BBB+ from S&P and Baa1 from Moody’s, while ESG ratings were strong, with averages of B- from ISS, 15 (low risk) from Sustainalytics, and AA from MSCI.

This year’s list is comprised of 50 top-performing companies across a broad spectrum of sectors and industries. These companies perform admirably against their peer group in sustainability practices, and they issue debt in the public market. Each company was evaluated using the Sage ESG Leaf Score® process, which scores a universe of more than 1,400 fixed income issuers through a sustainability lens with a focus on financial materiality and an emphasis on governance practices. The Sage ESG Leaf Score process assesses both the risk that each company faces from operating in their respective industries and individual performance of each company in comparison to their industry peer group on sustainability risk and opportunity management.

Each issuer was given a score of 1 to 5 leaves, where 1-leaf issuers are considered sustainability laggards and 5-leaf issuers are considered sustainability leaders. Each company on this year’s Sage ESG 50 list was awarded a 5-leaf rating and considered a sustainability leader in its industry. Approximately 68% of the companies that qualified for the Sage ESG 50 list also qualified in years past, demonstrating a continuation of sustainability outperformance.

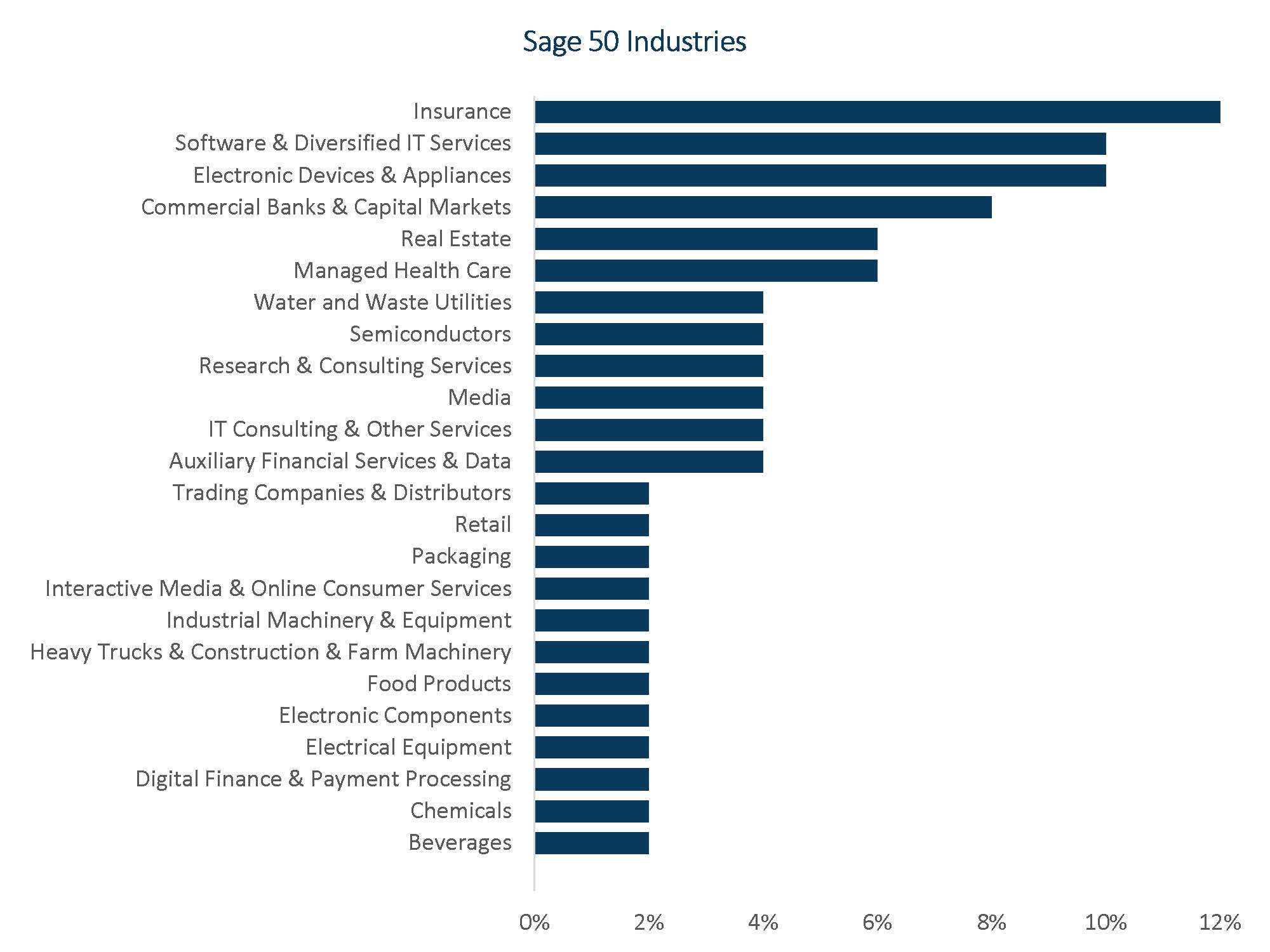

This year’s 50 companies come from 25 different sustainable industries. Our sustainable industry classification is based on industries that fit sustainable peer groups rather than strictly adhering to the Global Industry Classification Standard (GICS). This allows for better peer-to-peer comparison of the risks that face issuers.

Insurance (12%), Software & Diversified IT Services (10%), Electronic Devices & Appliances (10%), and Commercial Banks & Capital Markets (8%) were the most heavily represented industries. Notably, Insurance accounted for 12% of the Sage ESG 50 list, up from 8% in 2021. Although Insurance may not be the most obvious sustainable industry, we found that the leaders in this group have a very keen eye on their sustainability practices.

There are 16 newcomers this year from 11 different industries. These companies have the heaviest representation from Insurance (19%), Auxiliary Financial Services (13%), Managed Health Care (13%), and Software & Diversified IT Services (13%), and 81% are incorporated in the United States. All new corporate issuers were upgraded in the past year due to positive momentum in their sustainability performance.

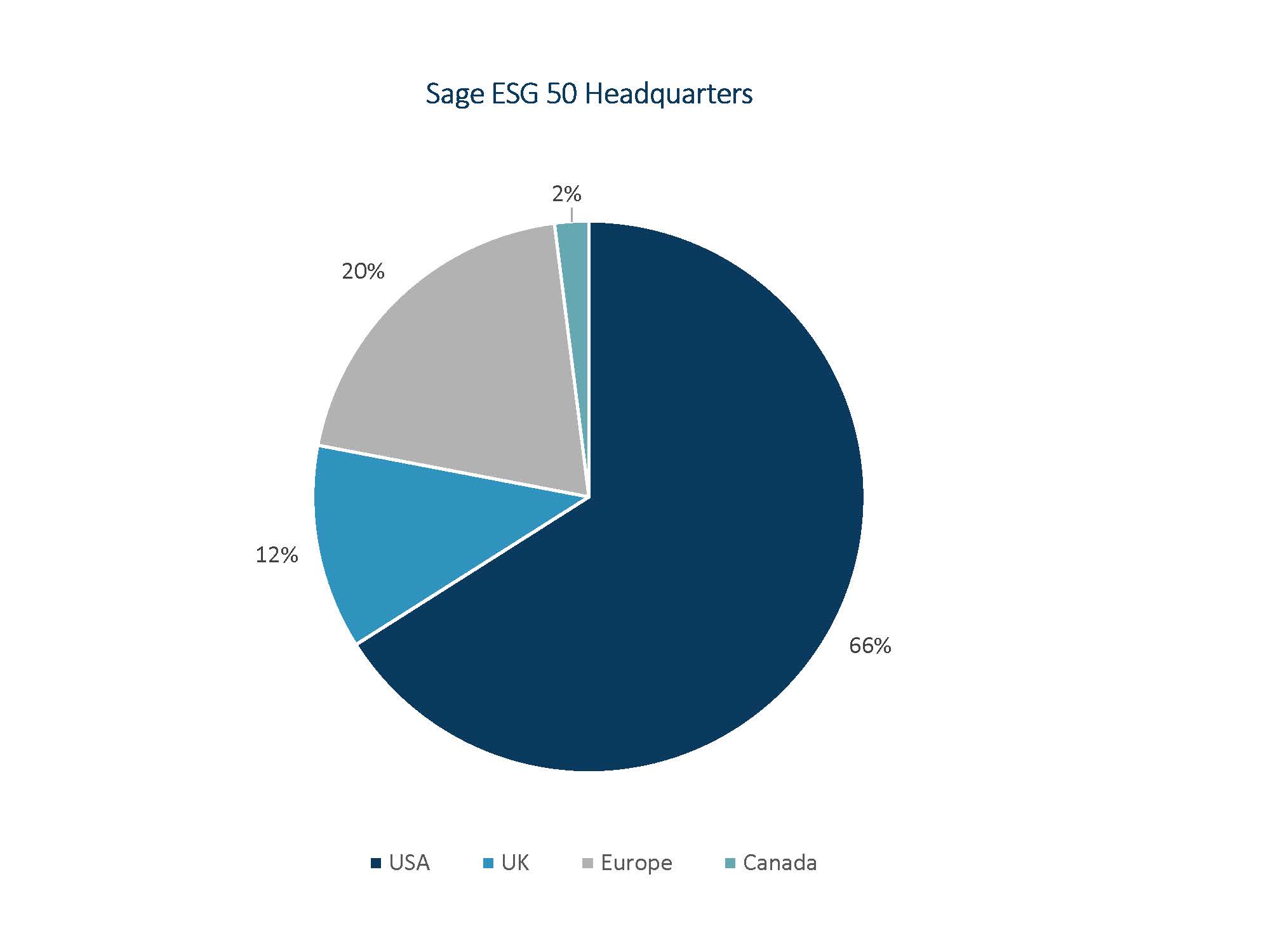

Most companies in the Sage ESG 50 are headquartered in the US, representing 66% of the list. Unsurprisingly, Europe (20%) is the second most heavily represented country, followed by the UK (12%) and Canada (2%). Although Europe has traditionally been a sustainability leader, the Sage list finds that US companies are capable of practices that match, if not exceed, the strength of their overseas counterparts.

Russia Withdrawal: Sacrificing Short-Term Profits for Long-Term Success

Russia’s invasion of Ukraine brought the notion of sovereign risk assessment to the forefront of ESG discussions. Operations, revenue sources, and supply chains are increasingly being scrutinized through a geopolitical lens.

Corporations have been forced to make difficult decisions in cutting ties to Russia. Many companies chose to exit Russia to prevent reputational damage, as customers, employees, and investors alike were clamoring for companies to exit. Others chose to exit fearing that their assets would be seized (e.g., which happened to Exxon when Russia chose to nationalize their assets in cases where they were joint investors). Both are important considerations, and we strongly believe that those corporations that chose to write-off short-term losses will be better off in the future from both an equity and credit perspective.

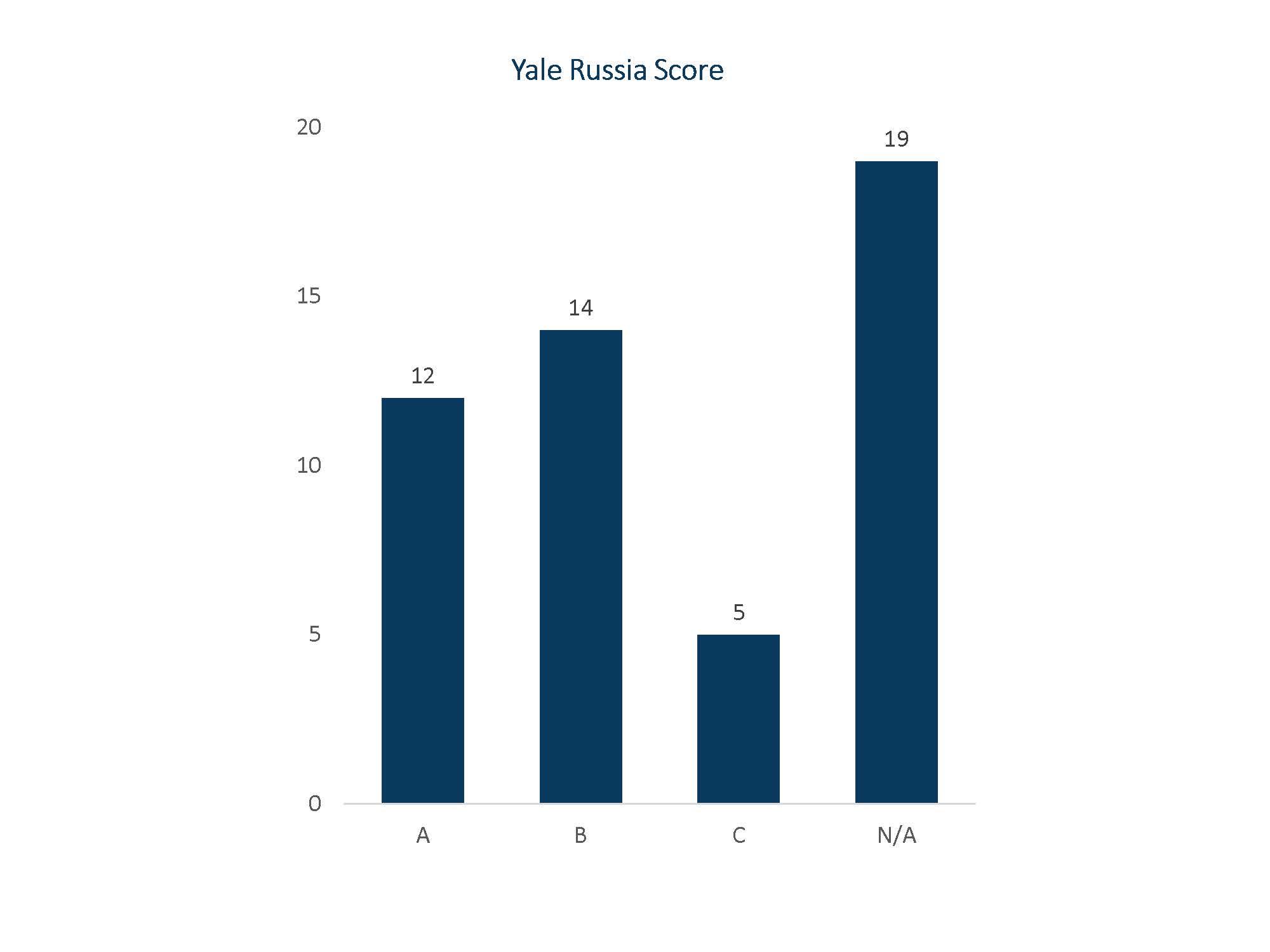

To highlight how varied the corporate responses were to the Russian invasion, we looked at the work from Yale School of Management (SOM) in assessing various responses. Yale SOM assessed corporate responses, providing scores ranging from an A (complete withdrawal from Russia) to F (business as usual). For illustrative purposes, we have provided the scores of the Sage ESG 50 constituents. We note that there were companies on last year’s Sage ESG 50 list that had D and F scores, which factored into determining this year’s list. While not every company we included in our list was scored by Yale, we felt certain that those that did score below a C did not meet the criteria necessary for inclusion. As an overall distribution, 26% of the Sage ESG 50 scored an A, 26% of the Sage ESG 50 scored a B, 10% scored a C, and 38% were not represented.

While the Russia-Ukraine War was a wakeup call for better evaluation of sovereign risks for corporations and investors, it is only a start to making progress on better integrating geopolitics into the investment process. We anticipate 2023 will be a pivotal year for companies assessing decisions that impact their global presence.

Good Governance Remains the Most Important ESG Factor

Sage has previously asserted that the “G” is the most critical aspect of the ESG assessment. Moody’s recent ESG report also revealed that governance is the most influential ESG consideration. It found that where the credit impact of ESG was highly negative, more than 90% of issuers had relative governance weaknesses. This helps reaffirm our focus on this critical assessment area for all asset classes.

Sage’s governance analysis continues to evolve. For the Sage ESG 50, we considered emerging topics like executive compensation tied to ESG-related performance and themes such as board diversity. However, at the heart of our assessment is “The 5 Cs of Good Governance” (compensation, composition, competency, clarity, and consistency).

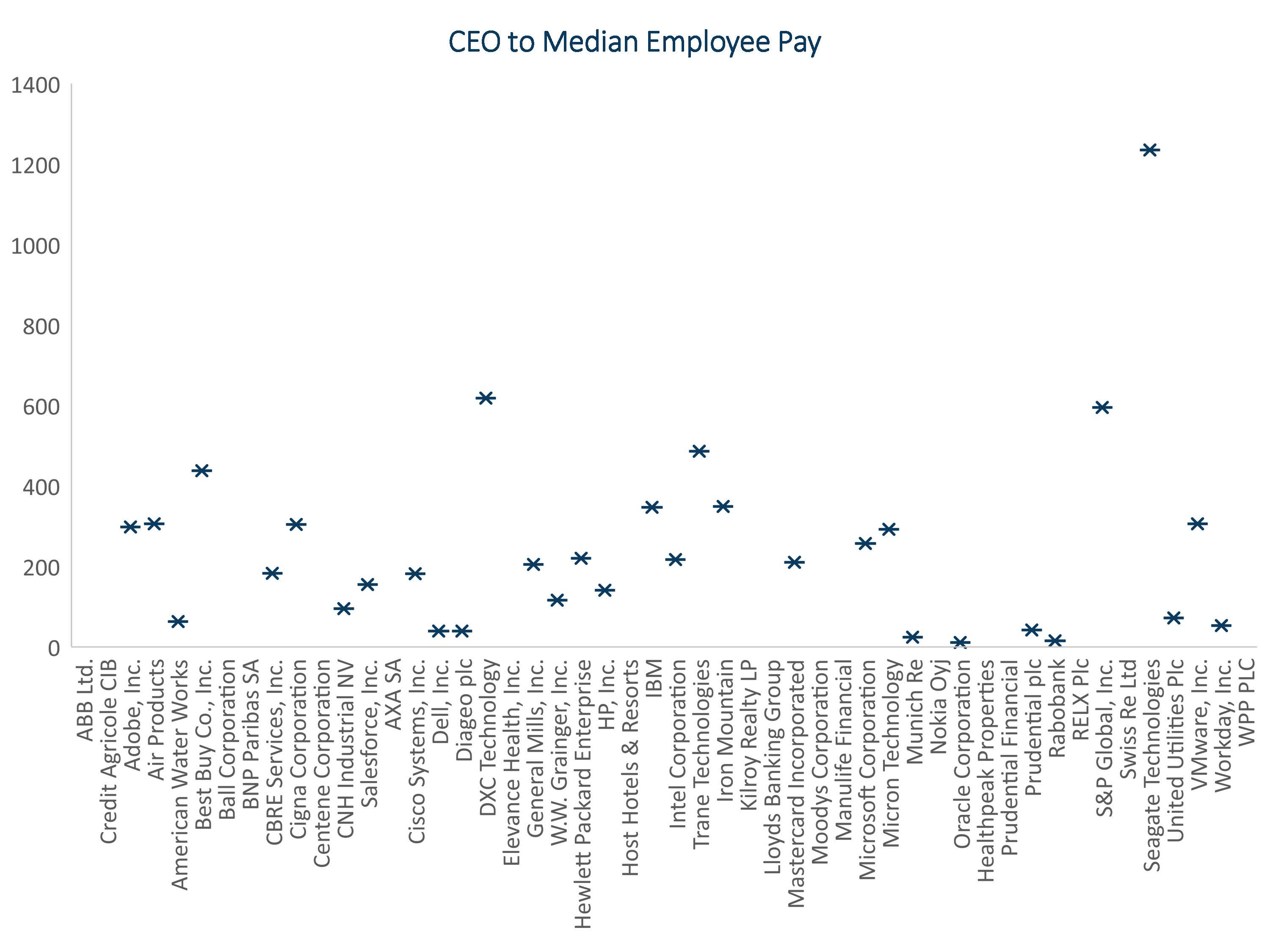

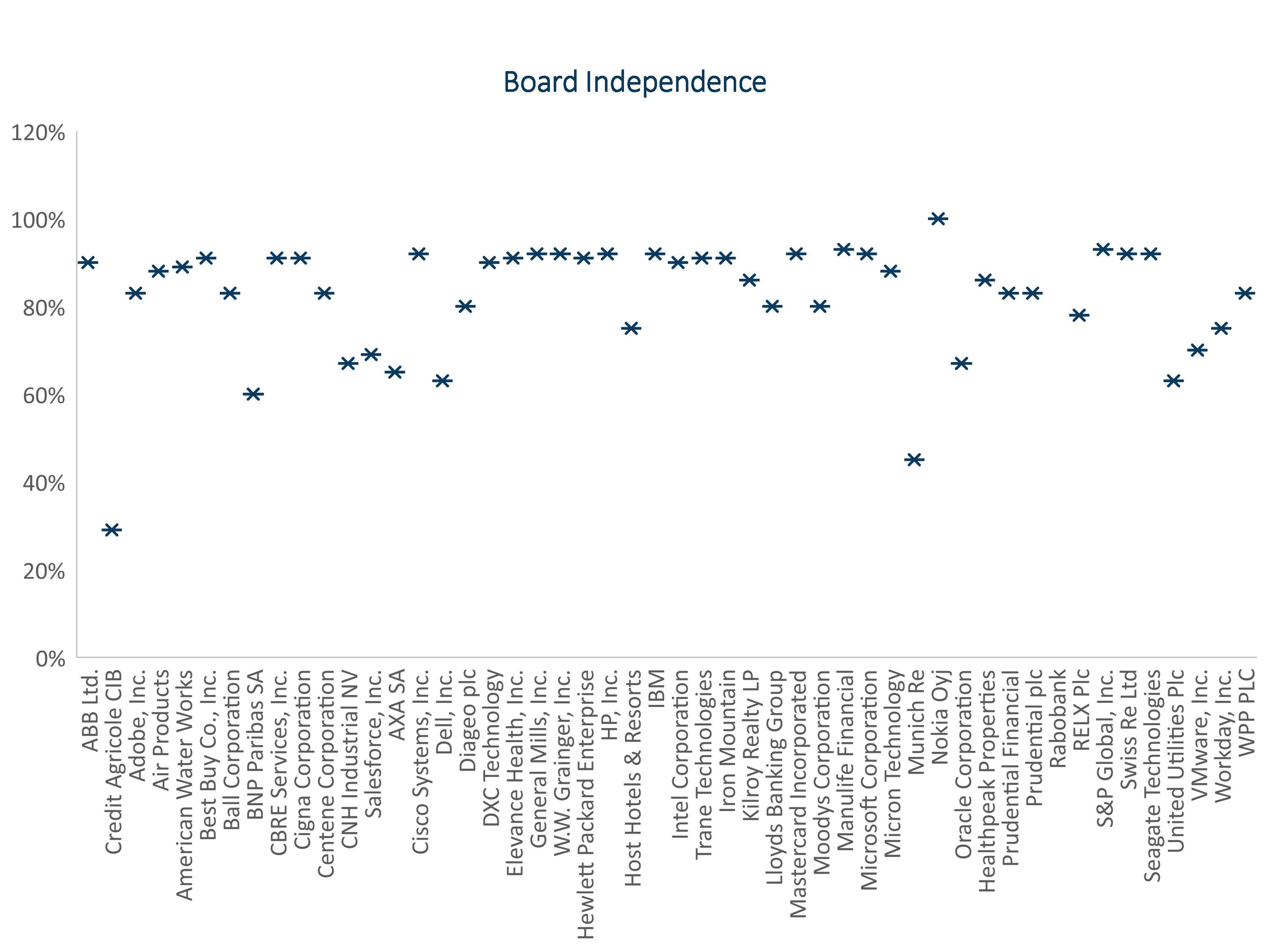

Every company in the Sage ESG 50 was evaluated on a set of governance factors, including, but not limited to, diversity in management and board, independence of the board, CEO duality, and CEO compensation in comparison to the median employee. For the entire peer group, approximately half the group (48%) had an independent board chair, while the other half (52%) had a non-independent board chair. In our view, best practice lies with the group whose CEO is independent and is not the board chair. Some industries more frequently have this practice, including those that are more prevalent on the Sage ESG 50 list.

Other governance metrics, such as CEO-to-median employee pay ratio and overall board independence seem to be more consistent with much of the peer group. Certainly, there are outliers within each group; the average CEO-to-median employee ratio was 247:1, and the median was 208:1; while the max was rather high at 1,235:1, and the minimum was 11:1. Although there are certain operating practices, such as outsourcing, that can create a vast disparity between CEO pay and employee pay, we would like to see those at the higher end reach a more normal range.

Board independence is another metric with a high level of consensus, with an average of 82% and median of 88% of board members considered independent. Here, too, there were outliers, with the max at 100% and the minimum at 29%. Our view is that boards with greater independence have the ability to drive strategy with less bias and potential conflict of interest.

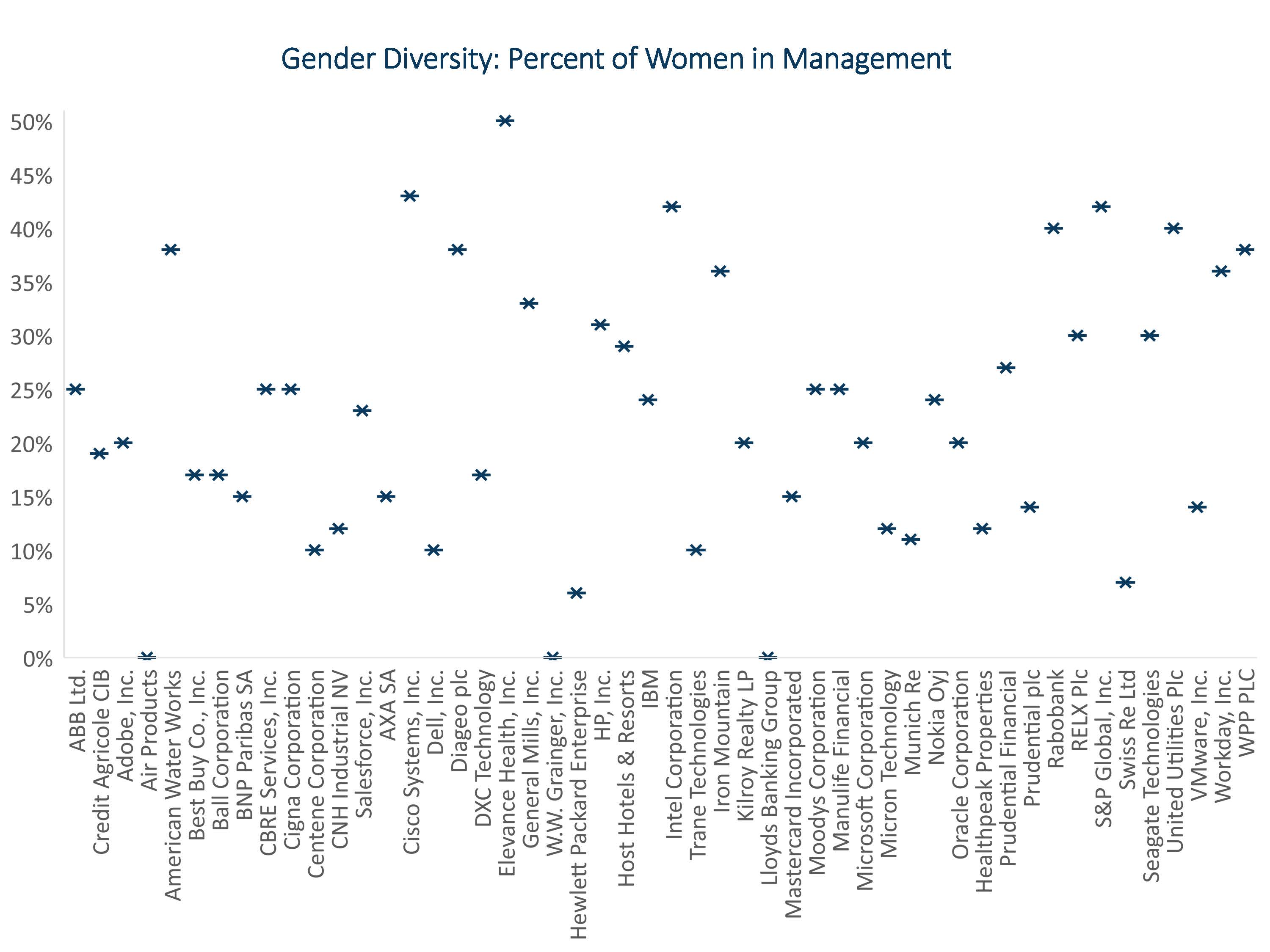

Gender diversity, measured here by percentage of women in management, tells us somewhat of a different story, with much less consistency in terms of overall percentage. The average hovered just around 23% and the median was right at 22%. Encouragingly, the max percentage of women in management from our list was right at 50%, but our minimum was a concern at 0%. Although this statistic is not where we would like it to be, we understand that it is something that is still being worked on by many of the best-ranked sustainability companies, and we look forward to improvement.

ESG Ratings vs. Credit Ratings

Sage ESG 50 companies scored well from an ESG ratings perspective from all scoring systems we surveyed. The average scores were B- from ISS, 15 from Sustainalytics, and AA from MSCI. These scores provide a level of consensus on the Sage ESG 50 companies and their superior level of sustainable performance.

From a credit rating perspective, the Sage ESG 50 received an average rating of BBB+ from S&P and Baa1 from Moody’s. Changes in credit ratings over the last year for the Sage ESG 50 trended favorably, with two issuers receiving upgrades, including one that ascended from high yield to investment grade, and two issuers receiving minor downgrades. Interestingly, this year’s list included four issuers with a credit rating below the investment grade threshold from both Moody’s and S&P. All four issuers were on our list in the previous year, and two have been on the list for the past two years. Each of these companies remains ahead of the curve in terms of their sustainability practices regardless of their credit rating profile.

‘E’ Considerations Beyond Climate and Net Zero by 2050

With the excitement that surrounded 2021’s COP26 and a push toward Net Zero by 2050, corporations rushed to showcase their climate intentions. Unfortunately, the Russia-Ukraine war and the associated energy crunch provided a few key lessons for investors assessing climate change. While pledging an ambitious long-range goal is welcomed, it needs to reach benchmarks along the way. Sage was excited to join the Net Zero movement, but we have started to focus our climate assessment more on short-term progress and developments that have a meaningful impact (e.g., innovative products and solutions that help others reduce emissions).

The challenge of fighting climate change myopia involves not overlooking current environmental challenges that society and corporations face. As an example, investors often overlook biodiversity and water scarcity as standalone issues even though they are inexorably tied to climate change. The big water scarcity story in 2022 was the drought in the Southwestern United States, but other areas like the Midwest are also exposed to water challenges. According to a recent report from the Water Council, the Ogallala Aquifer in the Great Plains, spanning from the Rocky Mountains to the Mississippi River, will run out of water within the next three decades. General Mills, a perennial Sage ESG 50 participant, was identified as one of the leading companies managing water risks.

Sage will continue to take a holistic approach when evaluating environmental risks, and our Sage ESG 50 companies have demonstrated outstanding intentionality toward managing them relative to their peers; the Sage ESG 50 all have climate scores that are above average.

Looking Into 2023 & Beyond

As the year unfolds, Sage will be closely scrutinizing how companies manage sovereign risks and current environmental challenges. Human capital management will be a large theme to follow, especially in the US as we will are likely to see the SEC’s Proposed Rule on Human Capital disclosure. We also anticipate that increased ESG-related disclosures and processes will continue to become more vital to operating a successful business.

Sources:

- Jeffrey Sonnenfeld and Yale Research Team. Yale CELI List of Companies Leaving and Staying in Russia. Yale School of Management. January 13, 2023.

- ESG ratings provider methodologies: Sustainalytics,MSCI,ISS

- ESG Considerations Have Significant Credit Impact on Large Number of Debt Issuers. Moody’s Investor Services. November 23, 2022.

- Foster, Lauren. The Water Shortage Is Worse Than You Think. What It Means for Food Companies. Barron’s. November 21, 2022.

- Smith, Bob and Andy Poreda. The 5 C’s of “G” in ESG. Sage Advisory Podcasts. December 11, 2020.

Disclosures

This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.