Environmental, social, and governance funds cover a broad range of topics, the best-known being sustainability and climate. The social and governance aspects, though, are also crucial categories that shouldn’t be overlooked, as they ensure that companies are utilizing ethical work practices and promoting diversity and advancement all the way up through the executive level.

Investing in gender-focused funds has increased in the last year: Morningstar Direct found 52 funds that focused on gender equity and diversity, reported the Wall Street Journal. These funds have experienced a total of $4.9 billion of inflows this year as of the end of September, up from $2.9 billion the year before.

A gender-focused advisory firm, Parallelle Finance, reported that within equities, assets contained in funds focused on gender equity and diversity were up 8% in the second quarter over the first, and assets in bonds were up 20% in the same period.

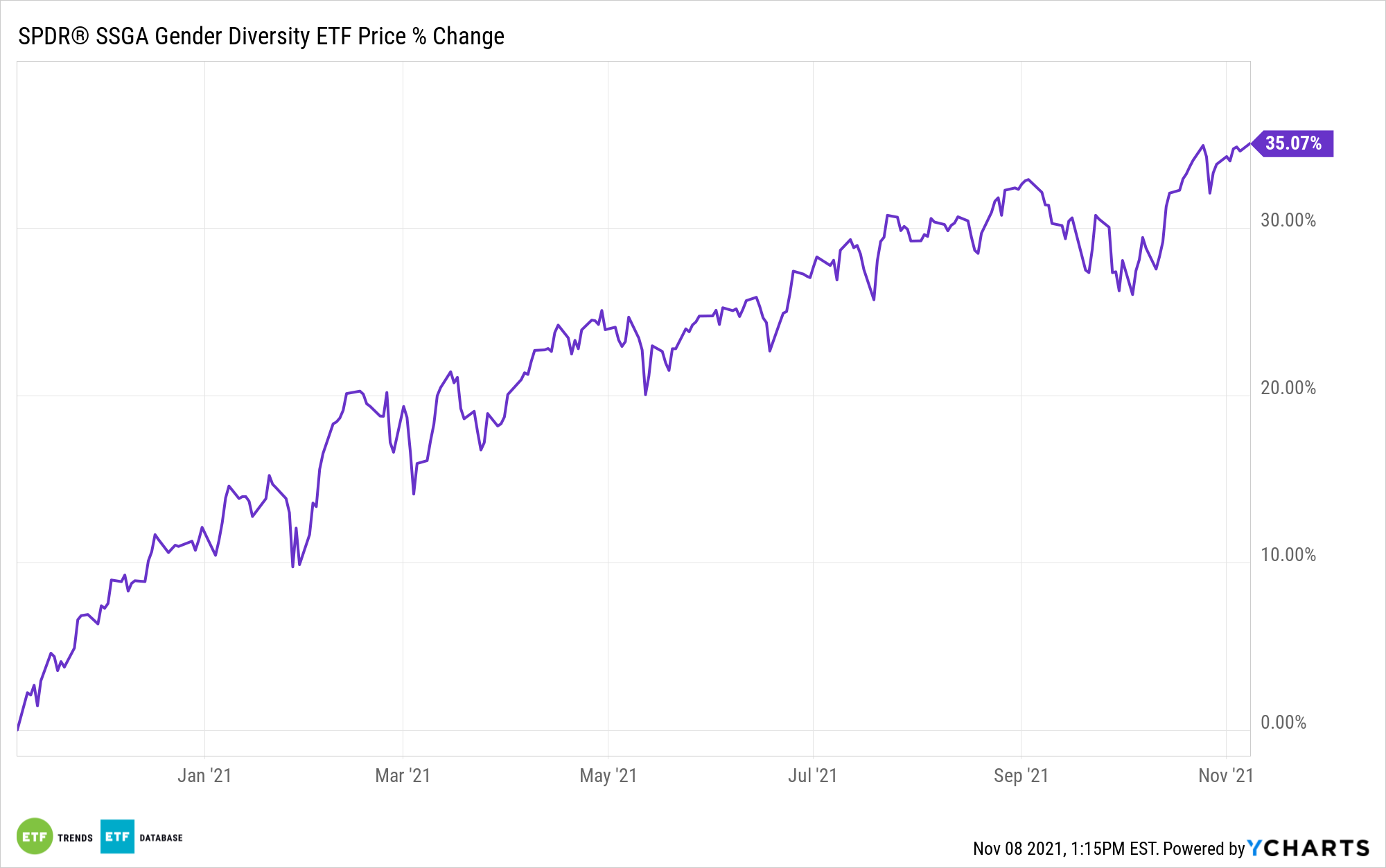

Of the gender equity funds that experienced growth, the SPDR SSGA Gender Diversity Index ETF (SHE) reported 20.21% growth this year so far. The fund offers data-driven exposure to companies with the highest diversity amongst leadership positions within their industries.

SHE follows the SSGA Gender Diversity Index, an index that tracks large-cap U.S. companies exhibiting gender diversity within their senior leadership.

The benchmark pulls from the top 1,000 U.S. stocks by market capitalization, utilizing three different gender diversity screens to narrow down its selection universe.

These metrics include the ratio of female executives and female board of director members to all executives and all board of director members, the ratio of female executives versus all executives, and the ratio of female executives (excluding those on the board of directors) compared to the number of executives in total (again, excluding board members).

For the purposes of the index, “executives” are defined as any position of vice president or higher in a company, or a position of managing director and above in a financial sector company.

According to their free-float market caps, the top-ranking 10% of companies within each sector are selected and weighted proportionally. Each stock has a maximum weight cap of 5%.

The top three sectors in SHE include information technology (32.11% of its portfolio), healthcare (12.57%), and consumer discretionary (12.24%).

Currently, the fund’s top three holdings include salesforce.com at 5.41% weight, UnitedHealth Group Incorporated at 4.77% weight, and Walt Disney Company at 4.72% weight.

SHE carries an expense ratio of 0.20%.

For more news, information, and strategy, visit the ESG Channel.