When something like ESG skyrockets in popularity, it can be difficult to avoid becoming a target for scrutiny. In this case, it’s the Securities and Exchange Commission (SEC) taking aim.

The SEC has taken a more proactive approach when it comes to compliance requirements for ESG.

“As investor demand for socially responsible investing continues to rise, the U.S. Securities and Exchange Commission (SEC) has increased its focus on compliance practices of investment advisors and funds,” a National Law Review article said. “After the change in the presidential administration, it was anticipated that the SEC would again take up environmental, social, and corporate governance (ESG) reporting. While Commissioner Gary Gensler was not confirmed until this week, the Commission has already been positioning itself to act on this issue over the past several months.”

The SEC has already taken steps to add a layer of quality assurance to ESG finances, with the introduction of a new task force.

“Last month, the Commission launched a new Climate and ESG Task Force likely to drive new initiatives,” the article added. “The Commission also announced the appointment of the first senior policy advisor for climate and ESG matters, Satyam Khanna. There are several topics that may be considered by Mr. Khanna and the Task Force for policy and rule changes, including environmental disclosure rules, diversity disclosures at the board and workforce levels, and political spending disclosures. In the meantime, the Task Force will focus on increasing enforcement of the existing legal framework applicable to ESG investments.”

A Clean Power Option

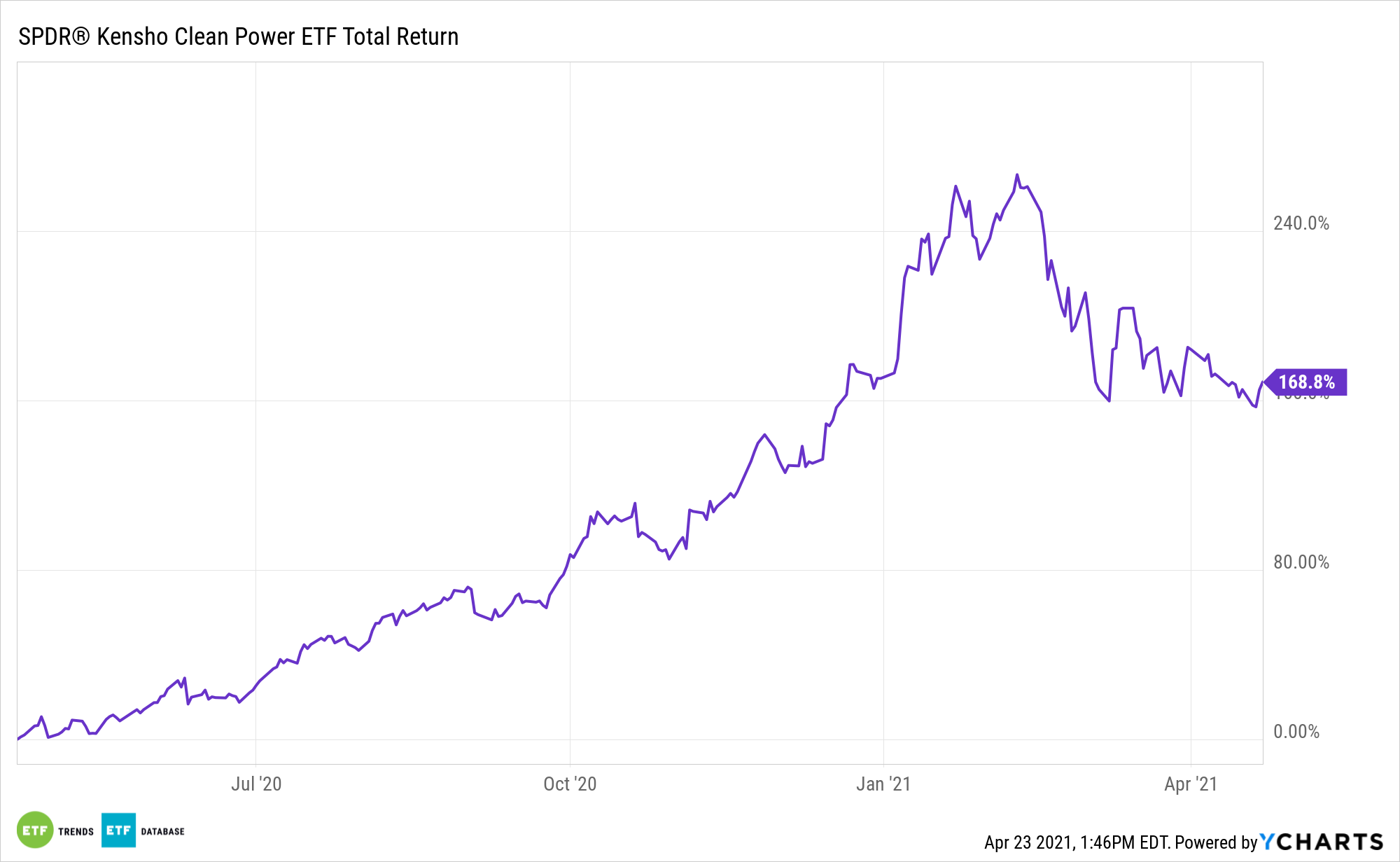

ESG can be sliced and diced into various funds that focus on specific niches. One way to play the renewable energy sector is with funds like the SPDR S&P Kensho Clean Power ETF (CNRG).

U.S. president Joe Biden’s recent infrastructure plan is already conducive to clean energy initiatives that protect the environment.

“Overall, the Biden administration is expected to encourage ESG investing as part of its approach to addressing climate change,” the article said. “The administration has ordered a review of the prior administration’s rules on the issue.”

Key features of CNRG:

- Seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P Kensho Clean Power Index.

- Seeks to track an index utilizing artificial intelligence and a quantitative weighting methodology to capture companies whose products and services are driving innovation behind the clean energy sector, which includes the areas of solar, wind, geothermal, and hydroelectric power.

- Provides ETF investors an effective way to pursue long-term growth potential by investing in a portfolio of companies involved in the transition to lower emission-generating power supply.

For more news and information, visit the ESG Channel.