By Sara Rodriguez, Sage ESG Research Analyst

About Toyota Motor Corporation

Toyota Motor Corporation is a Japanese multinational automotive company that designs, manufacturers, and sells passenger and commercial vehicles. The company also has a financial services branch that offers financing to vehicle dealers and customers. Toyota is the second-largest car manufacturer in the world and ranked the 11th largest company by Forbes — and produces vehicles under five brands: Toyota, Hino, Lexus, Ranz, and Daihatsu. Toyota also partners with Subaru, Isuzu, and Mazda.

Environmental

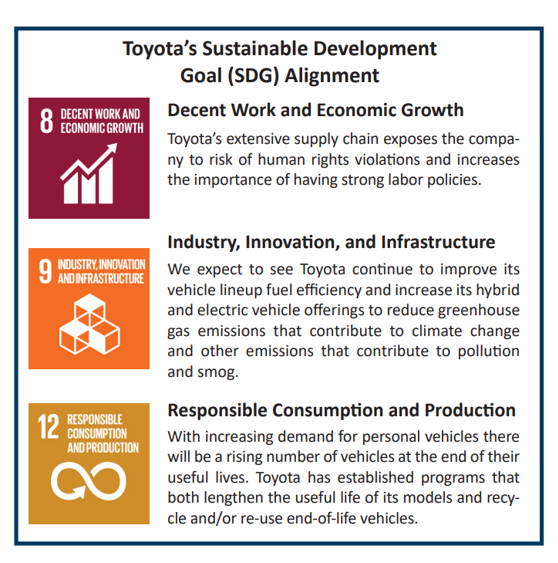

Motor vehicles are one of the largest contributors to greenhouse gas (GHG) emissions and, as a result, climate change, with the transportation sector accounting for a third of U.S. GHG emissions in 2018. Although most emissions come from vehicle usage rather than the process of manufacturing vehicles, government regulations place the burden on auto companies to improve fuel efficiency and reduce overall emissions. While climate change regulations present financial risk to automakers, they also offer opportunities; increased fuel efficiency requirements are likely to lead to more sales of electric vehicles and hybrid systems. Toyota pioneered the first popular hybrid vehicle with the 1997 release of the Prius, the world’s first mass-produced hybrid. Since then, Toyota has sold 15 million hybrids worldwide . In 2018, hybrids accounted for 58% of Toyota’s sales, contributing to Toyota reaching substantially better carbon dioxide (CO2) emissions from new vehicles than regulatory standards and the best levels in the industry (102.1g/km compared to U.S. regulation of 119g/km). In 2020, Toyota reduced global average CO2 emissions from new vehicles by 22% compared to 2010 levels by improving vehicle performance and expanding its lineup. Toyota’s goal is to increase that number to 30% by 2025, with the goal of 90% total reduction by 2050. The company aims to offer an electric version of all Toyota and Lexus models worldwide by 2025. (Toyota does not yet sell any all-electric vehicles to the U.S., but it does outside the U.S.)

In addition to greenhouse gases, cars emit smog-forming pollutants that contribute to poor air quality and trigger negative health effects. Recently, a London court ruled that air pollution significantly contributed to the death of a nine-year-old girl with asthma who had been exposed to excessive nitrogen dioxide (NO2) levels. NO2 is a toxic gas emitted by cars that use diesel fuel, and although European Union laws set regulatory levels for NO2 in the air, Britain has missed its targets for a decade due to a lack of enforcement. As Toyota expands into European markets, the smog rating of its cars will be financially material and an important aspect of risk management.

Compared to industry peers, Toyota excels in addressing emissions and fuel efficiency. In 2014 Toyota Motor Credit Corporation, the financial arm of Toyota Motor Corporation, introduced the auto industry’s first-ever asset-backed green bond and has since issued five total green bonds. The newest $750 million bond will go toward developing new Toyota and Lexus vehicles to possess a hybrid or alternative fuel powertrain, achieve a minimum of 40 highway and city miles per gallon, and receive an EPA Smog Rating of 7/10 or better. The bond program was reviewed by Sustainalytics, which found that Toyota leads its competitors in supporting its carbon transition through green bond investments.

In addition to curbing emissions caused by Toyota’s vehicles, the company seeks to reduce plant emissions to zero by 2050 by utilizing renewable energy and equipment optimization. In automaking, water is used in painting and other manufacturing processes. Toyota has implemented initiatives to reduce the amount of water used in manufacturing and has developed technology that allows the painting process to require no water. In 2019, Toyota reduced water usage by 5% per vehicle, with the goal of 3% further reduction by 2025, for an overall reduction of 34% from 2001 levels. To reduce the environmental impact of materials purchased from suppliers, Toyota has launched Green Purchasing Guidelines to prioritize the purchase of parts and equipment with a low environmental footprint. We would like to see Toyota continue to develop its supply chain environmental policies.

As the global population grows, so does number of cars on the road, which creates waste when they’ve reached the end of their useful lives. Toyota’s Global 100 Dismantlers Project was created to establish systems for appropriate treatment of end-of-life vehicles through battery collection and car recycling. Toyota aims to have 15 vehicle recycling facilities by 2025. Toyota is also working to minimize waste by prolonging the useful life of its vehicles. Toyota has a strong reputation for producing quality, reliable vehicles. Consumer Reports lists Toyota’s overall reliability as superb, and Toyota and Lexus often take the top spots in Consumer Reports Annual Auto Reliability Survey. An Iseecars.com study found that Toyota full-size SUV models are the longest-lasting vehicles and most likely to reach over 200,000 miles.

Social

Driving is an activity with inherent risk. The World Health Organization estimates that 1.35 million people die in car accidents each year. Accidents are worse in emerging nations where transportation infrastructure has not kept up with the increase in the number of cars on the road; without countermeasures, traffic fatalities are predicted to become the seventh-leading cause of death worldwide by 2030. Demand for personal vehicles will continue to increase as developing countries experience higher standards of living, and product safety will be paramount to automaker’s reputations and brand values. Toyota has put forth a goal of Zero Casualties from Traffic Accidents and adopted an Integrated Safety Management Concept to work toward eliminating traffic fatalities by providing driver support at each stage of driving: from parking to normal operation, the accident itself, and the post-crash. Toyota and Lexus models regularly earn top safety ratings by the National Highway Traffic Safety Administration (NHTSA) and the Insurance Institute for Highway Safety. In addition to traditional safety features, Toyota actively invests in the development of autonomous vehicles, including a $500 million investment in Uber and autonomous ridesharing. If fully developed, autonomous driving can offer increased safety to passengers, lower accident rates, and provide mobility for the elderly and physically disabled.

Accidents caused by defective vehicles can have significant financial repercussions for auto manufacturers. Toyota experienced significant damage to its reputation and brand value in 2009 when unintended acceleration caused a major accident that killed four people riding in a dealer-loaned Lexus in San Diego. Toyota subsequently began recalling millions of vehicles, citing problems of pedal entrapment from unsecured floor mats and “sticky gas pedals.” Toyota’s failure to quickly respond resulted in a $1.2 billion settlement with the Justice Department and $50 million in fines from the NHTSA. The scandal generated an extraordinary amount of news coverage, and the Toyota recall story ranked among the top 10 news stories across all media in January and February 2010. Litigation costs, warranty costs, and increased marketing to counter the negative publicity of the event were estimated to cost Toyota over $5 billion (annual sales are about $275 billion). As a result of bad press, Toyota’s 2010 sales fell 16% from the previous year and its stock price fell 10% overall, while competitors like Ford benefitted and experienced stock price growth of 80% over the same period. Future recalls and quality issues are certain to prove costly for Toyota and may continue to negatively impact its consumer reputation.

Another social issue that can be financially material for automakers is human rights. Automobiles consist of about 30,000 parts, making their supply chain extensive and at high risk for human rights abuses. Toyota addresses human rights concerns in its Corporate Sustainability Report (CSR) and cites Migrant Workers and Responsible Sourcing of Cobalt as its priorities for 2020; however, Toyota does not have a clean labor record. A 2008 report published by the Institute for Global Labour and Human Rights accused Toyota of a catalog of human rights abuses, including stripping foreign workers of their passports and forcing them to work grueling hours without days off for less than half of the legal minimum wage. Toyota was also accused of involvement in the suppression of freedom of association at its plant in the Philippines. Toyota’s CSR lists a host of external nongovernmental organizations the company partners with to promote fair working conditions, however; due to the high-risk present in its supply chain and its past offenses, we would like to see the company further develop its labor and human rights policies.

Lastly, we would mention that Toyota has been accused of discriminatory practices. In 2016, Toyota Motor Credit Corporation, the financial arm of Toyota Motor Corporation, agreed to pay 21.9 million in restitution to thousands of African American, Asian, and Pacific Islander customers for charging them higher interest rates on auto loans than their white counterparts with comparable creditworthiness. Toyota has since taken measures to change its pricing and compensation system to reduce incentives to mark up interest rates.

Governance

Toyota shows strength in its transparency, and its Corporate Sustainability Report (CSR) is prepared in accordance with multiple sustainability reporting agencies, including the Global Reporting Initiative, Sustainable Accounting Standards Board, and the Task Force on Climate-Related Financial Disclosures; the CSR data is also verified by a third party. Starting in 2021, Toyota’s CSR will be updated whenever necessary to ensure timely disclosure, rather than annually. In 2019 Toyota created a Sustainability Management Department and added the role of Chief Sustainability Officer to its executive management team in 2020. Toyota’s CSR offers thorough information on its executive compensation policies, however; the composition of Toyota’s board of directors is an area of weakness for the company. There is a lack of independence among board members, and the chair of the board is not independent. In general, when compared to the U.S., Japanese companies have a smaller percentage of outside directors due to a history of corporate governance emphasizing incumbency and promotion from within. However, since the release of the Japanese Corporate Governance Code in 2015, companies have felt pressure to make meaningful board composition changes. We hope to see Toyota strengthen its board composition and adopt executive renumeration policies that are tied to sustainability performance.

Like other automakers, Toyota has lobbied aggressively to weaken Obama-era fuel economy standards. In 2017, the Environmental Protection Agency announced plans to work with Toyota to overhaul internal management practices at the agency. Inviting a company regulated by the agency to alter internal practices has been previously unprecedented and raises concerns over how Toyota could wield influence over EPA functions. Toyota is a member of the Alliance of Automobile Manufacturers, the most powerful automotive industry lobbying association, which has strongly opposed climate change motivated regulation since 2016, contradicting the company’s public stance on emissions.

Risk & Outlook

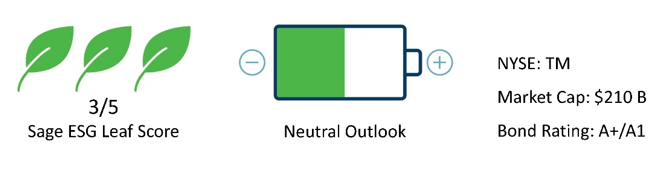

Sage believes Toyota to be well adapted to manage sustainability challenges, despite the high environmental and social risks in the automotive industry. We expect the auto industry to see an increase in regulatory risk surrounding vehicle emissions and fuel efficiency; however, we believe Toyota will continue to innovate to meet and exceed emission standards and the company is well positioned to benefit from future fuel efficiency regulations. We hope to see Toyota continue to improve its social performance and expand on its recently introduced human capital policies. In addition to regulation, the auto industry faces disruption caused by new areas of technology such as automated driving, electrification, and shared mobility, and these areas will be important to monitor. Toyota’s strong management of ESG issues makes the company a leader amongst its peers; however, due to risk present in the automotive industry we rank Toyota a 3/5 for its Sage ESG Leaf Score.

Sage ESG Leaf Score Methodology

No two companies are alike. This is exceptionally apparent from an ESG perspective, where the challenge lies not only in assessing the differences between companies, but also in the differences across industries. Although a company may be a leader among its peer group, the industry in which it operates may expose it to risks that cannot be mitigated through company management. By combining an ESG macro industry risk analysis with a company-level sustainability evaluation, the Sage Leaf Score bridges this gap, enabling investors to quickly assess companies across industries. Our Sage Leaf Score, which is based on a 1 to 5 scale (with 5 leaves representing ESG leaders), makes it easy for investors to compare a company in, for example, the energy industry to a company in the technology industry, and to understand that all 5-leaf companies are leaders based on their individual company management and the level of industry risk that they face.

For more information on Sage’s Leaf Score, click here.

Originally published by Sage Advisory

Sources:

- ISS ESG Corporate Rating Report on Toyota Motor Corporation.

- Environmental Report 2020 Toyota Motor Corporation.

- Sustainability Data Book 2020 Toyota Motor Corporation.

- Lambert, Lisa. “Toyota Motor Credit settles with U.S. over racial bias in auto loans” February 2, 2016.

- “Automobiles” Sustainability Accounting Standards Board. September, 2014.

- Kaufman, Alexander. “Scott Pruitt’s Plan to Outsource Part Of EPA Overhaul to Automaker Raises Concerns” December 12, 2017.

- “How the US auto industry accelerated lobbying under President Trump” November, 2017.

- Charles Kernaghan, Barbara Briggs, Xiaomin Zhang, et al. “The Toyota You Don’t Know” Institute for Global Labour and Human Rights. 2008.

- Road Safety World Health Organization.

- Toyota Motor Credit Corporation Green Bond Framework Second-Party Opinion January 21, 2020.

- Toshihiko Hiura and Junya Ishikawa. “Corporate Governance in Japan: Board Membership and Beyond” Bain & Company. February 23, 2016.

- Taylor, Lin. ”Landmark ruling links death of UK schoolgirl to pollution” December 16, 2020.

Disclosures

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. The information included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. This report is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results. Sustainable investing limits the types and number of investment opportunities available, this may result in the Fund investing in securities or industry sectors that underperform the market as a whole or underperform other strategies screened for sustainable investing standards. No part of this Material may be produced in any form, or referred to in any other publication, without our express written permission. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.