Political backlash, lack of clear regulatory guidance, and concern for adverse business outcomes has led many ETF issuers to limit disclosure of many stewardship-related topics compared to past years.

This is a concerning trend for the ETF industry, as stewardship remains a critical aspect of investing and often intersects with fiduciary duty, or the responsibility to act in the best interest of investors, according to Sage Advisory’s 2023 ETF Stewardship Survey.

With 16.1 million U.S. households invested in ETFs as of April 2023, it is imperative that current stewardship practices are evaluated. This helps identify the issuers that consistently act in the best interest of a given ETF and its shareholders.

Sage’s annual stewardship survey covers 76 questions spanning seven focus areas: Voting practices, engagement, stewardship professionals, disclosure, climate initiatives, diversity and inclusion, and sponsor-level governance. Firms choose to participate in the survey to help shed light on best practices throughout the industry and benchmark their practices against those of others, as well as to receive feedback from Sage on their practices and areas of strengths and weaknesses.

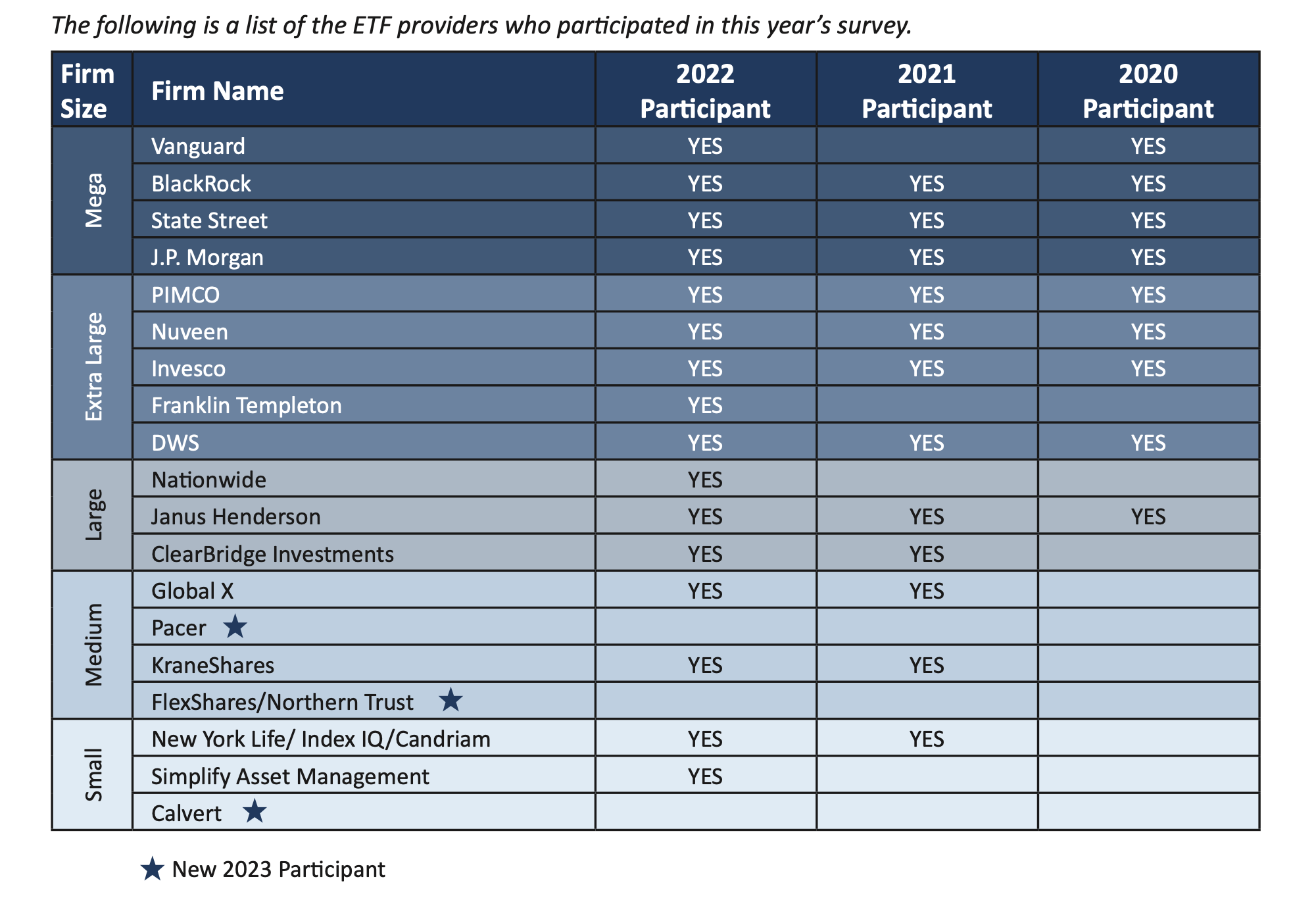

Participants in the 2023 Survey

19 major ETF providers were included in this year’s survey, including five of the top 10 largest ETF issuers in the U.S. The participants, who collectively oversee more than $28 trillion in assets, ranged in size from $333 million to $8.59 trillion.

81% of the 16 repeat participants received passing scores. 50% of repeat participants saw a notable improvement in scores while 31% saw a decline.

The participants were grouped by firm size: mega (over $2 trillion in AUM), extra large (between $800 billion and $2 trillion in AUM), large (between $50 and $800 billion in AUM), medium (between $10 billion and $50 billion in AUM), and small (less than $10 billion in AUM).

Image source: Sage Advisory

The ETF providers were split fairly evenly by size. Extra-large providers made up the largest portion of the group (28%), followed by mega and medium providers (21% each). Large and small providers had the lowest representation in the survey, each comprising 16% of the participant pool.

The ETF providers were almost evenly split between public and private entities. However, publicly held ETF providers scored better than their privately held peers in the extent and quality of their responses.

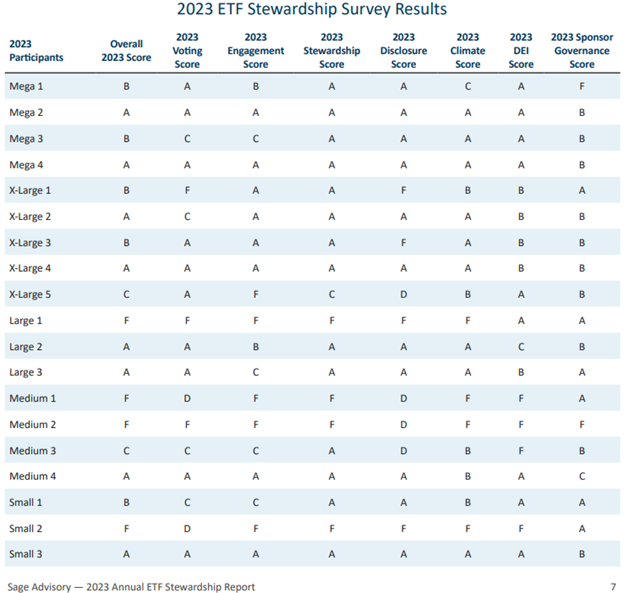

Overall, mega-sized providers received the highest scores, while the medium group had the lowest performance. This aligns with expectations, according to Sage, as mega providers have access to substantial resources.

Interestingly, the small group outperformed the medium-sized group. This can be partly attributed to small providers accessing resources from larger parent companies, according to Sage.

Diversity, Equity, & Inclusion (DEI)

DEI initiatives have gained prominence, but have been hindered in recent years by layoffs. The attrition rates for DEI roles exceed those of non-DEI roles, according to the survey. In a further setback, laws enacted by states including Florida and Texas prohibit state-funded universities from allocating funds to DEI initiatives.

Largely, participants in the survey performed well in the DEI section, with 79% receiving passing grades, an uptick from the previous year. Mega-sized providers performed the best, with an average score of 100%.

Conversely, medium-sized providers lagged the group tremendously, receiving an average score of 39%. Some medium-sized providers had very little to no DEI programs in place, according to Sage, impacting the group’s average score.

KPIs that lagged included policies intended to increase equity at the senior leadership and investment team levels, lack of mentorship programs, and lack of pay parity policies, according to Sage.

Sponsor-Level Governance

Governance is the foundation of a company’s operations. Responsible governance is critical for ensuring transparency, risk management, and accountability, according to Sage.

Interestingly, the vast majority (89%) of ETF providers received passing governance scores despite scores decreasing compared to the previous year. Of the repeat participants, 25% saw a decline in their governance scores. This was attributed to reduced disclosure and explanations of policies compared to the previous year, according to Sage.

In contrast to other sections, mega-sized providers scored lower than extra-large, large, and small providers. Mega-sized providers scored on par with medium providers, as the average scores for both categories were negatively affected by a small number of laggards in the groups, according to Sage.

Proxy-Voting

Image source: Sage Advisory

Of all the fiduciary duties a financial advisor has, proxy voting is arguably one of the most important. ETF providers continue to improve in this arena, with 74% earning a passing rating this year. Of the providers that also reported last year, 81% improved their rating from 2022 according to the survey.

Despite improvements, the provider proxy voting process grew more opaque this year. What’s more, 95% of providers reported using proxy voting advisors to some degree, with ISS and Glass Lewis dominating the landscape. Pass-through proxy voting also continues to grow.

“Providers are likely looking to give voting decision to client in response to political backlash that has been so prevalent recently,” Sage Advisory told VettaFi.

Of note, 79% of ETF providers also reported that some element of ESG influenced their votes. Environment, social, and governance factors are both an avenue of opportunity and carry carrying potential risk for companies.

“We are seeing providers gravitating toward thematic-based funds,” Sage Advisory explained to VettaFi. Themes employed by ETF providers include “climate, biodiversity, carbon capture/reduction, and energy transition.”

Engagement Practices

Engagement is a fundamental driver of positive change alongside proxy voting by ETF providers. There are a number of ways for providers to engage with the companies they hold positions in, and to varying degrees. The outsized role that engagement has on longer-term impacts means the transparency of the engagement process is tantamount according to Sage Advisory.

Increasing opacity across the stewardship spectrum was a main theme this year. Though more providers scored a passing grade for engagement, their processes have grown increasingly less transparent. That said, more providers were awarded passing scores for engagement this year (74%) than previously.

Of those providers that also reported in previous years, 56% experienced score declines this year. These declines were driven largely by a lack of transparency. Large companies fared best in terms of engagement scores, but of note, small companies outperformed medium ones.

Sage Advisory explained in a communication that many medium-sized providers lacked engagement practices entirely. Specific areas that smaller providers outperformed their medium peers “included post-engagement time frames… examples of measurable changes because of engagements, and identified escalation practices.”

Stewardship Teams and Disclosures

Despite challenges in other arenas, ETF providers across the board recognize the importance of stewardship teams. Unsurprisingly, mega providers scored the best, receiving a perfect score for building out stewardship teams. Of companies that had teams, however, few team members held CFA ESG or SASB FSA certificates. It’s notable given the degree to which ESG influences stewardship decisions, as self-reported by providers.

The impact of looming regulatory changes to disclosure rules by the SEC featured prominently in how voting records were reported to Sage Advisory. The impending changes seek to make voting records easier for investors to access and understand. As a direct result of preparing for this process, many ETF providers shared their voting records with Sage Advisory through new dashboards that streamline the data.

“Previously disaggregated voting records made understanding how providers vote on certain issues very difficult,” Sage Advisory explained to VettaFi. “Voting dashboards are a step in the right direction,” but they still need a greater degree of transparency. In their current, early forms, it’s difficult for investors to clearly see how providers voted on individual issues.

Overall, the industry continues to gain traction in the right direction. More ETF providers across the size spectrum are engaging across a range of issues, but the generalized shift to more opaque processes was a major trend this year.

For more news, information, and analysis, visit the Responsible Investing Channel.