By Director, Global Research & Design for S&P Dow Jones Indices

While many investors appear to believe that winners persist over time, the most recent S&P Persistence Scorecard underscores the well-known disclaimer that “past performance is no guarantee of future results”: irrespective of asset class or style focus, few fund managers consistently outperformed their peers.

Some market participants believe that active managers with successful track records should have the skills to benefit from different market environments. However, volatility in the one-year period ending September 2019 did not help their persistence scores.

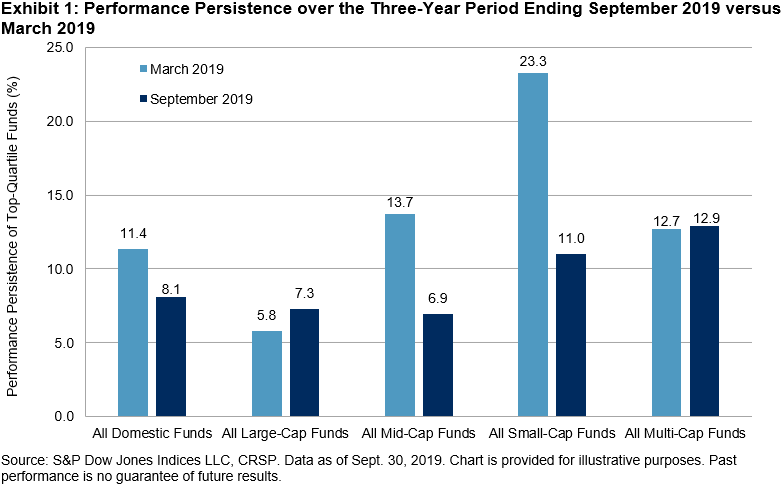

The market experienced ups and downs in the past year amid the uncertainty over Fed policy and trade tensions between the U.S. and China. The sell-off in the fourth quarter of 2018 was offset by the strong rally in the first six months of 2019, the best-performing first half of a year since 1997. For funds categorized as top performers in September 2017, 47% maintained their top-quartile performance in the subsequent year. However, there was a dramatic fall in persistence afterward—just 8% of domestic equity funds remained in the top quartile in the three-year period ending September 2019. Given that the random odds of a top-quartile manager in year one staying in the top quartile in the subsequent two years is 25% * 25% = 6.25%, it appears that top managers in the rising market prior to Q4 2018 navigated the subsequent market turmoil only marginally better than a random drawing.

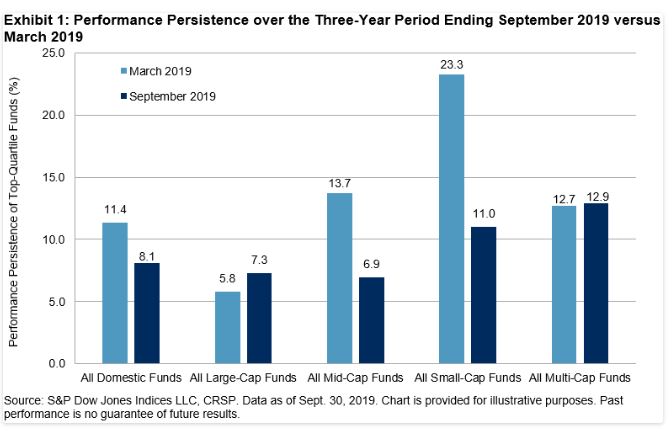

The S&P Persistence Scorecard also shows that a decline in persistence scores was prominent in small- and mid-cap funds when compared with results from March 2019.

Over a longer investment horizon, we observed even lower performance persistence. At the end of the five-year measurement period, only 0.88% of all domestic equity funds maintained their top-quartile status. No large-cap fund was able to consistently deliver top-quartile performance by the end of the fifth year.

Our latest persistence scorecard highlights the challenge for active managers to consistently beat their peers. If a market participant selects a manager based only on past performance, the chance that the manager would remain in the leading pack is not a far cry from a random drawing.

For more information on performance persistence in U.S. active funds, read our latest Persistence Scorecard.