Key Takeaways

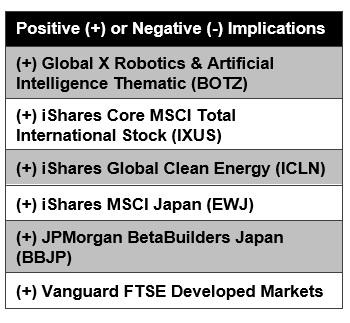

- Though iShares Core MSCI Total International ETF (IXUS) has underperformed iShares Core S&P 500 ETF (IVV ) in the last three years, CFRA thinks investors should continue to maintain a diversified equity portfolio.

- Broadly diversified international ETFs, including IXUS and Vanguard FTSE Developed Markets (VEA), are less concentrated than IVV.

- Many ETFs focused on long-term themes, including Global X Robotics & Artificial Intelligence (BOTZ) and iShares Global Clean Energy (ICLN), have less than half their assets invested in U.S. domiciled companies as significant innovation is happening in international markets.

Fundamental Context

U.S. investors have been drifting away from international equities. According to BlackRock’s advisor portfolio analysis, the average international equity allocation for U.S. financial advisors’ equity sleeve at the end of June 2020 was only 25%, down from 30% in 2018. This is significantly lower than the share of economic impact of those international economies and much lower than 42% in the MSCI All Country World Index. While some investors might have made a call on U.S. outperformance, this is likely also for some an unconscious decision stemming in part from the relative strong performance of U.S. equities. For example, iShares Core S&P 500 ETF rose 14% on an annualized basis in the three-year period ended December 4, 2020, nearly triple the 5.2% gain for the iShares Core MSCI Total International Stock ETF, which invests in developed and emerging markets.

A heavily weighted U.S. portfolio is concentrated and is missing out on some global trends. The five largest companies inside IVV represented 22% of assets, the highest level on a calendar year basis than any time in the ETF’s 20-year history — making IVV less diversified than many international alternatives. The top-five holdings were just 7% and 6% of recent assets for IXUS and Vanguard FTSE Developed Markets ETF, respectively. Both ETFs have stakes in Nestle and Samsung Electronics, but IXUS also owns emerging market stocks such as Alibaba (BABA ) and Taiwan Semiconductor (TSM). While we think many of the top positions in IVV remain attractively valued, there’s greater risk when the assets are not spread out.

In addition, while Apple (AAPL ) and Microsoft (MSFT) are innovative and generate much of their revenues from international markets, many of the companies poised to benefit from next-generation industry trends are based outside of the U.S.

For example, iShares Global Clean Energy ETF (ICLN) focuses on companies that produce energy from wind, solar, and other renewable sources; the ETF’s assets nearly doubled in size year-to-date through December 4. ICLN has just one-third of its assets in U.S. domiciled companies, with Canada, China, Denmark, New Zealand, and Spain each representing more than 6% of assets. Meanwhile, Global X Robotics & Artificial Intelligence Thematic ETF (BOTZ), which includes companies involved with industrialized robotics, autonomous vehicles, and other long-term trends, has 45% of assets in Japanese companies, much higher than its 35% stake in the U.S. Companies in Switzerland and the U.K. are also well represented.

These global ETFs seek out companies regardless of their domicile, providing less obvious diversification benefits than dedicated international funds.

Investors can also enhance exposure to individual countries using ETFs. For example, iShares MSCI Japan (EWJ ) and JPMorgan Betabuilders Japan (BBJP) offer diversified exposure to Japan, which recently represented 24% of VEA assets. While BBJP has a lower expense ratio, EWJ’s average daily trading volume is higher, providing enhanced liquidity. Both ETFs own Nintendo, Sony, Toyota, and other multinationals based in Japan.

Conclusion

While U.S. equities have been the driver of investor returns in recent years, this has not and will not always be the case. We think there are strong global and international equity funds to consider based on our forward-looking ratings process that combines holdings analysis with fund attributes.

Originally published by CFRA

All of the views expressed in this research report accurately reflect the research analyst’s personal views regarding any and all of the subject securities or issuers. No part of the analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this research report. For more information and disclosures, please refer to CFRA’s Legal Notice at https://www.cfraresearch.com/legal/.

Copyright © 2020 CFRA. All rights reserved. All trademarks mentioned herein belong to their respective owners.