Silver and silver ETFs surged on Monday. Investors are scrambling into the industrial metal to spike it above recent highs after it became the latest target for Reddit retail traders.

Silver prices rallied on the first day of February to peg their highest intraday level since 2013, as a buying riot attributed to a post on Reddit implied that a short squeeze on the precious and industrial metal is in play.

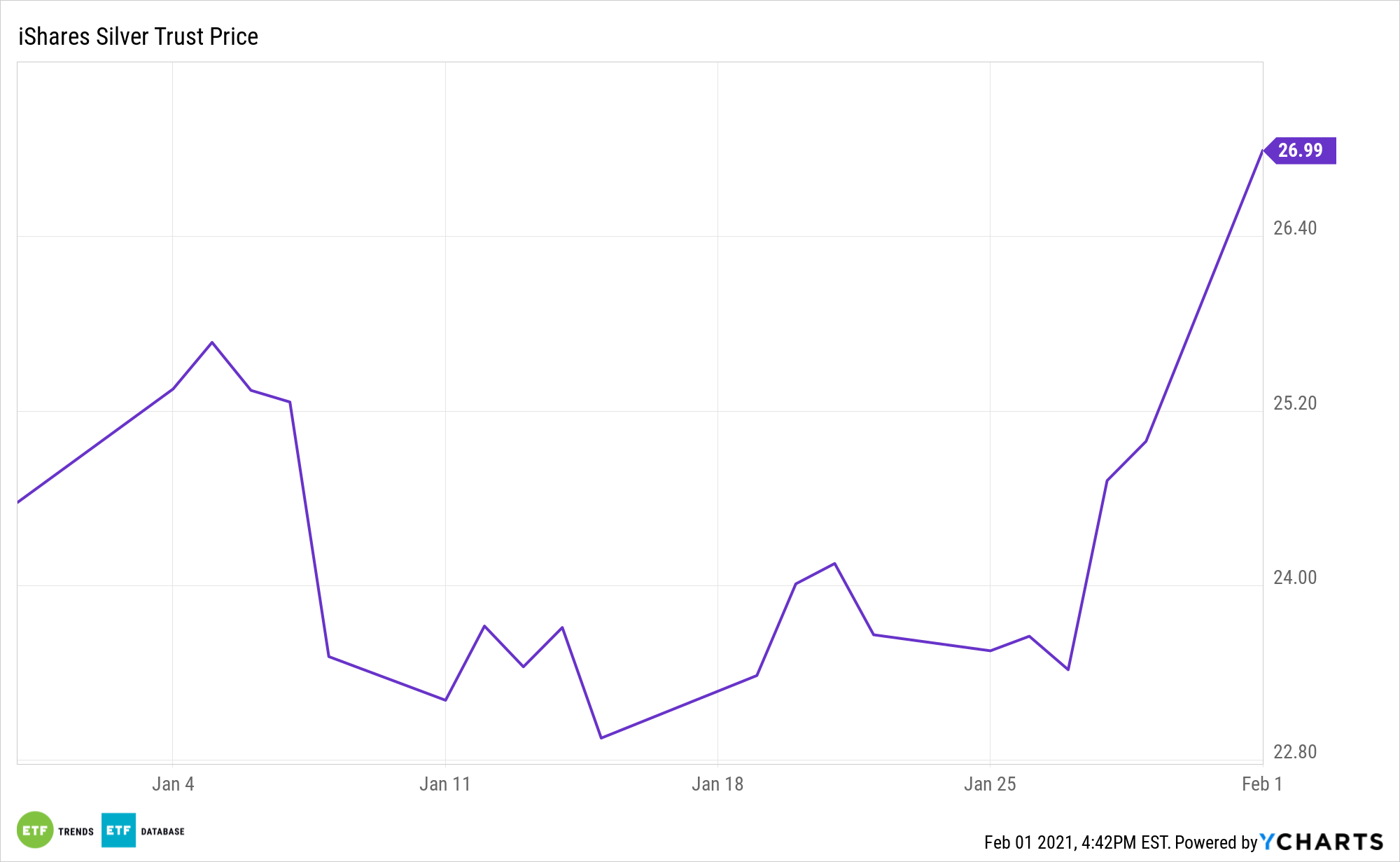

Silver futures for March spiked over 8.20%, hitting levels as as high as $30.35 an ounce on Comex on Monday, the highest intraday level since February 2013. Silver ETFs like the iShares Silver Trust (SLV) gained as well.

Unprecedented Price Moves for Silver

The move in silver came after futures prices last week advanced by over 5%. Silver gapped higher on Monday after an explosion in prices Thursday and Friday followed a posting by a Reddit user suggested executing a ‘short squeeze’ on the metal. The metal rallied from below $25 an ounce last week to top $30 an ounce briefly Monday, for a gain of nearly 23% in a few days.

The moves for the metal are “incredibly unusual — fair to say it’s unprecedented,” Zach Abraham, chief investment officer at Bulwark Capital Management, told MarketWatch.

“But we need to see if it can be done again. Remember, GME [GameStop] was a deeply undervalued and unique situation,” he said.

Financial pundits are comparing the move in silver to another spike in the metal that occurred in the early 1980s, when the Hunt brothers notoriously attempted to corner the silver market.

During the Hunt brothers’ accumulation of the silver, the industrial metal surged from $11 an ounce in September 1979 to $49.45 an ounce in January 1980 based on London PM Fix, according to The Silver Institute, which also said silver prices then tumbled to below $11 an ounce two months later.

“The difference between then and now in silver of course is that that was one family trying to orchestrate a short squeeze on the futures market, whereas now it’s like the financial equivalent of a Distributed Denial of Service attack — lots of people just independently deciding to go along with the crowd in a momentum trade,” said Marshall Gittler, head of investment research at BDSwiss Group.

For investors looking to allocate silver into their portfolios using ETFs, there are several strong options. The iShares Silver Trust (SLV) is a popular choice and boasted $171.1 million dollars in inflows late last year. Aberdeen also has quite a collection of metals ETFs, including those focused on silver. Aberdeen’s suite includes the Aberdeen Standard Gold ETF Trust (SGOL), which comes with a 0.17% expense ratio, and the Aberdeen Standard Physical Silver Shares ETF (SIVR), which has a 0.30% expense ratio. Additionally, the Aberdeen Standard Physical Precious Metals Basket Shares (NYSEArca: GLTR), which has a 0.60% expense ratio, offers a cornucopia of metals, including gold, silver, platinum, and palladium.

For more market trends, visit ETF Trends.