The price of silver futures and silver ETFs surged once again in the domestic market on Monday after President Trump signed a spending and pandemic aid bill, clearing the possibility for a veto from last week.

Just days after implying that he would veto the bill, citing its failure to provide sufficient direct assistance to Americans, the president signed a $900 billion Covid-19 relief bill into law, avoiding a government shutdown and augmenting unemployment benefits to millions of Americans. The bill is currently only providing $600 in direct payments to Americans, and the House is anticipated to vote on a $2,000 direct payment on Monday, although the GOP-led Senate is likely to resist the efforts.

“All the bluster neither significantly changed to outlook for stocks, as markets still expected (and ultimately received) stimulus of a minimum of $900 billion to pass,” wrote Tom Essaye, founder of The Sevens Report.

“The five pillars of the rally (Federal stimulus, FOMC stimulus, vaccine rollout, divided government and no double dip-recession) re-main largely in place, and until that changes, the medium and longer-term outlook for stocks will be positive,” Essaye added.

Can Silver Sustain Its Momentum?

Silver futures are 2.23% higher as of nearly 3PM EST Monday, while silver ETFs like the Aberdeen Standard Physical Silver Shares ETF (SIVR) are gaining too.

Traders and investors are also more optimistic as coronavirus vaccines continued to be rolled out in the U.S. and Europe, despite warnings from health pundits that January will be the worst month for Covid deaths yet. Restrictions on a plethora of businesses throughout the country also remain in place and may become more stringent in the new year.

Analysts continue to champion the upside for silver, another positive for silver ETFs.

“March silver futures prices were poised to close at a 13-week high close. Silver futures bulls have the firm overall near-term technical advantage amid a four-week-old price uptrend in place on the daily bar chart. Silver bulls’ next upside price objective is closing prices above solid technical resistance at the December high of $27.635 an ounce. The next downside price objective for the bears is closing prices below solid support at $25.00. First resistance is seen at today’s high of $26.98 and then at $27.635. Next support is seen at $26.00 and then at $25.50,” writes Kitco analyst Jim Wyckoff.

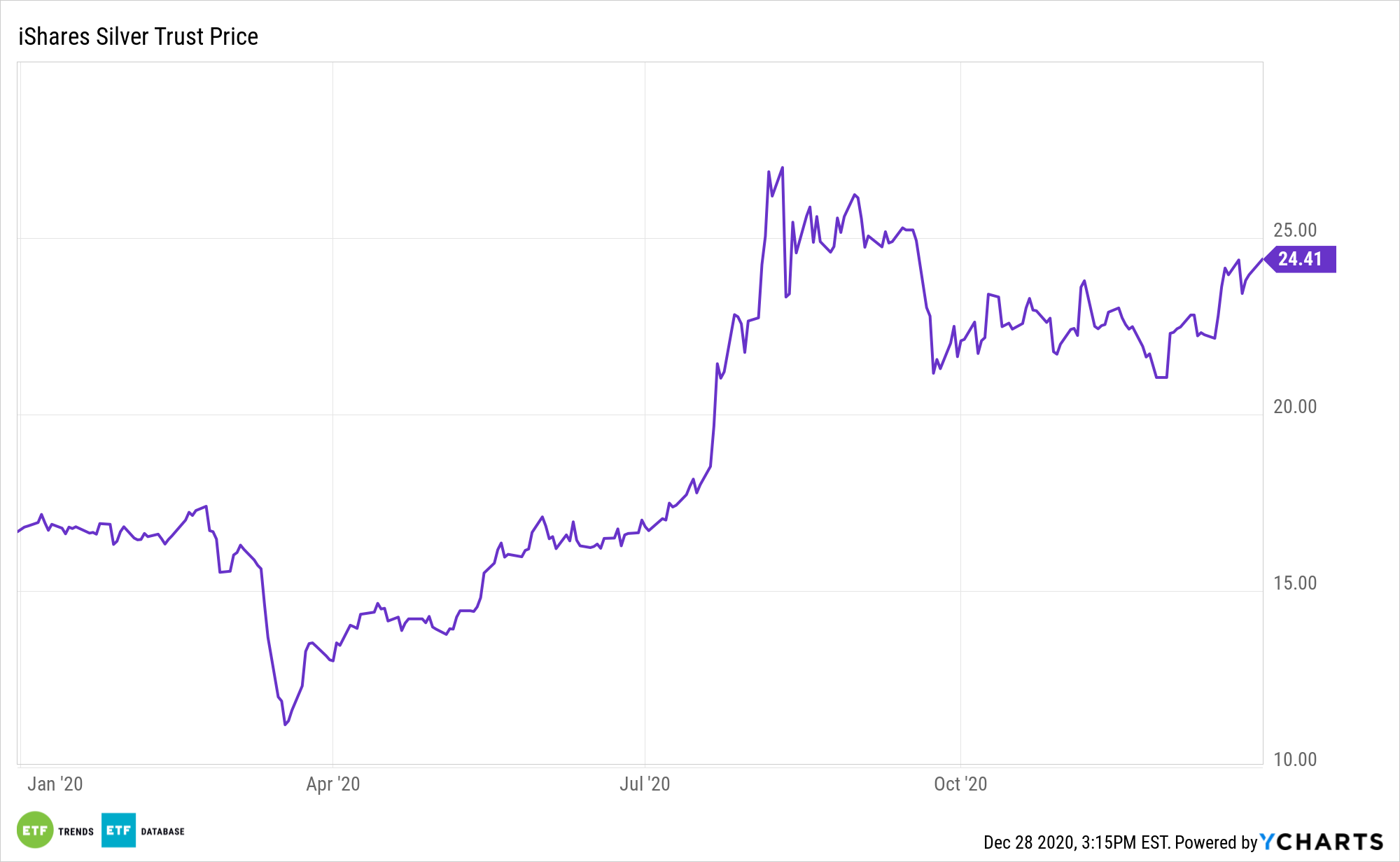

For investors looking for other ways to play silver, the iShares Silver Trust (SLV) is a popular option.

For more news, information, and strategy, visit the Equity ETF Channel.