Hundreds of new ETFs debuted in 2018, including a wide range of smart beta strategies. Plenty of multi-factor funds, those ETFs emphasizing multiple investment factors, were include in 2018’s crop of rookie ETFs.

One example is Global X Funds launching the Global X Adaptive U.S. Factor ETF (NYSE: AUSF), which tracks the Adaptive Wealth Strategies U.S. Factor Index. The index seeks to navigate various market conditions by dynamically allocating to sub-indexes representing three academically-backed factors: value, momentum, and minimum volatility. Each sub-index consists of 100 US mid and large cap stocks that represent a particular factor.

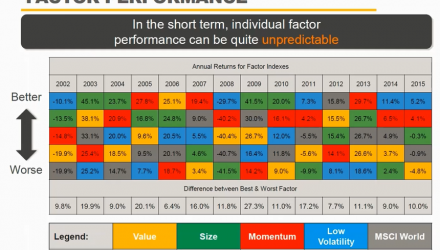

The index adjusts its factor exposures on a quarterly basis based on a mean-reversion methodology that seeks to access underperforming factors. At any given time, the index accesses two factors, equally weighted, or all three factors with a weighting of 40%-40%-20%, underweight or eliminating the most recent outperforming factor to protect against potential downside and manage risk more effectively.

In rotating its weightings to underperforming factors, the index associated with AUSF could potentially mitigate downside risks while attempting to generate outperformance versus cap-weighted benchmarks over the long run. The fund is up thus far in 2019 about 9.5 percent as of February 4, 2019.

If multi-factor ETFs sound like another language, then in the video below, Global X introduces investors to the world of multi-factor ETFs.

For more market trends, visit the Equity ETF Channel.