Earlier this week, we reminded advisors and end clients to do homework. Don’t just rely on an ETF’s descriptive name, like growth, to tell you what you own. It’s important to look inside the portfolio and see how one ETF is different than a peer. This due diligence also applies when adding an ETF tactically to complement the core of your portfolio.

How Advisors Are Using ETFs

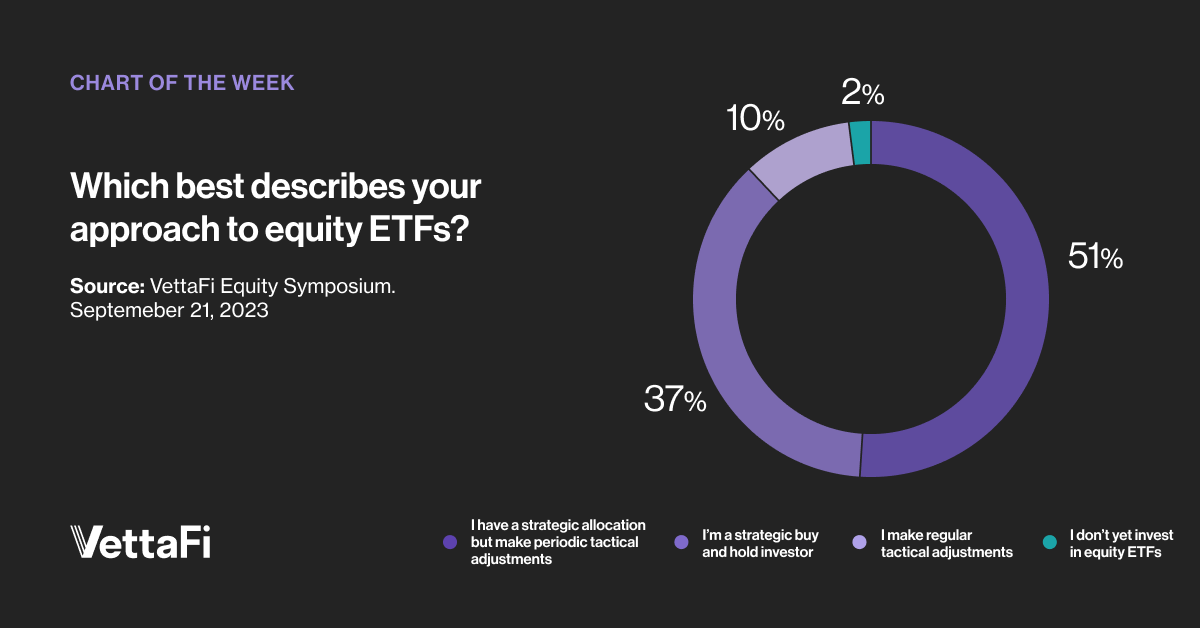

During last week’s well-attended VettaFi Equity Symposium with a range of ETF expert speakers, we asked the audience lots of questions. We learned that 51% consider their equity ETF approach as having a strategic allocation but making periodic tactical allocations. In contrast, just 37% were strategic buy-and-hold-investors, and 10% made regular tactical adjustments.

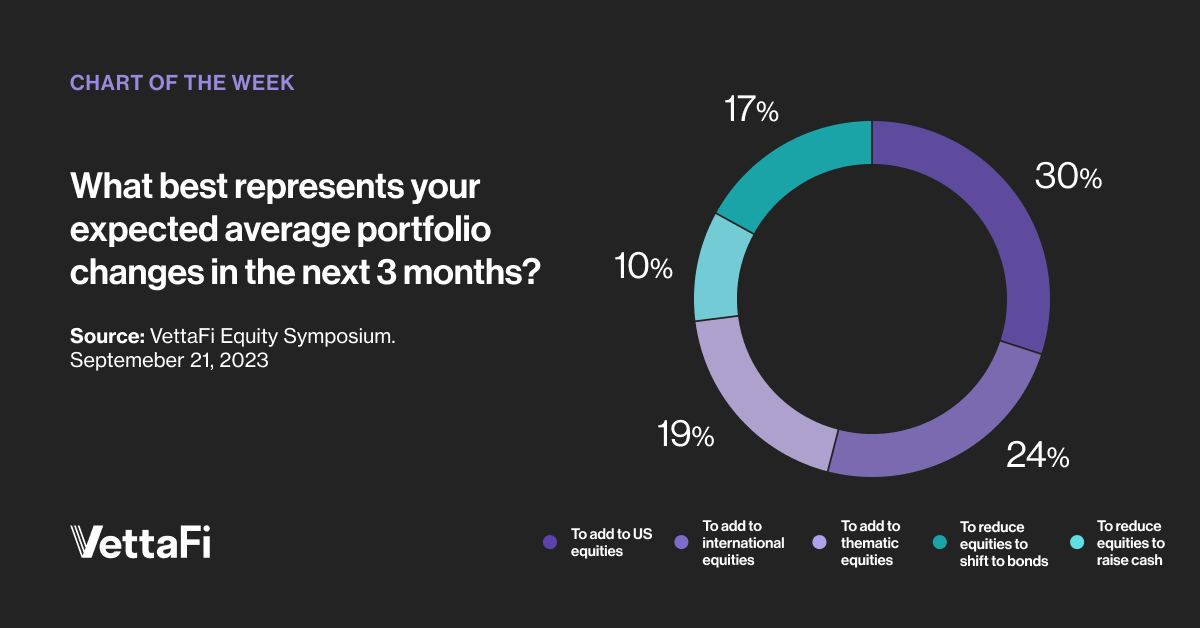

We also asked these respondents about their expected portfolio changes in the next three months. The most popular selection was to add to U.S. equities (30%). However, adding to international or thematic equities were 24% and 19%, respectively, of the results. Other respondents plan to reduce equity exposure.

Spending on Consumer ETFs Picked Up

Spending on Consumer ETFs Picked Up

Using VettaFI’s LOGICLY data, we can see some core U.S. equity ETFs were gathering assets in the last 30 days. The SPDR S&P 500 ETF (SPY), the Vanguard S&P 500 (VOO), and the Invesco QQQ (QQQ) were the most popular ETFs industrywide. However, two more tactical equity ETFs were also in the top 10 asset gatherers.

The Consumer Discretionary Select Sector SPDR (XLY) represents the consumer discretionary stocks in the S&P 500. The sector was the fourth largest in SPY and VOO, representing 11% of assets. This trailed information technology (27%), healthcare (13%) and financials (13%). Advisors and investors with confidence in consumer spending can tactically overweight exposure to the sector using XLY.

According to Capital IQ consensus estimates, the consumer discretionary sector is expected to generate 21% earnings growth in the fourth quarter of 2023. An additional 14% growth is forecasted for 2024. Both are higher than the broader S&P 500 index. While on a forward P/E basis, the sector is relatively expensive, on a P/E-growth basis, S&P 500 consumer discretionary stocks are at a discount.

A Cash Cow ETF Will Tilt Your Portfolio

The Pacer US Cash Cows ETF (COWZ) was also recently among the 10 most popular ETFs. This is impressive given the wave of new competing ETFs focused on high-quality stocks. COWZ holds Russell 1000 stocks with the highest free cash flow yield over the past 12 months. Free cash flow is the cash flow from operations minus capital expenditures. This fundamental metric is then divided by the company’s enterprise value to calculate free cash flow yield.

COWZ owns 100 stocks and is rebalanced/reconstituted quarterly. Energy (32% of assets), healthcare (18%), and consumer discretionary (15%) stocks make up most of the portfolio. AbbVie, CVS Health, Marathon Petroleum, and Valero Energy are some of COWZ’s top positions. Relative to the Russell 1000 Value index, COWZ had a much lower P/E ratio at the end of June. In addition, the 32% stake in energy was triple that of the iShares Russell 1000 Value ETF (IWD).

If you are looking to be tactical and add to your equity exposure, make sure you know what you are getting. Tilting your portfolio can add value but warrants awareness.

For more news, information, and strategy, visit the Equity ETF Channel.