Today, iShares launched a new suite of ESG Screened ETFs, designed exclusively to track underlying indexes from S&P Dow Jones Indices, to offer clients simpler ways to integrate ESG into their existing portfolios. These three new funds represent a greater option for investors who traditionally use S&P flagship indexes in the core of their portfolios to now having an ESG alternative, ultimately promoting greater standardization and transparency of sustainability benchmark methodology.

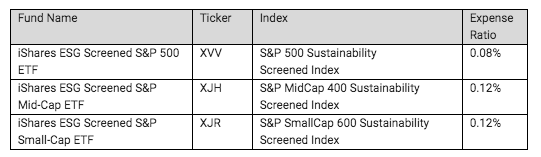

The new iShares S&P ESG Screened ETFs are:

These ETFs are differentiated from existing solutions by combining access to major benchmark exposures of the S&P 500, 400 and 600 with business involvement screens to help investors avoid companies with specific levels of involvement in certain industries such as fossil fuels, tobacco, small arms and controversial weapons[i]. In fossil fuels, for example, the underlying indexes for these ETFs screen out companies with specific levels of involvement in thermal coal, oil sands, and shale energy.

By working with S&P to add sustainable business involvement screens to well-known large-, mid- and small-cap indexes, iShares is helping to reshape sustainable investing by providing investors with sustainable alternatives to help build better risk-adjusted, long-term portfolios.

Armando Senra, Head of iShares Americas, said sustainable investing was historically a values-based exercise – it has evolved into an investment risk and performance-based decision.

“Expanding our suite of sustainable funds is critical to help clients integrate ESG into their portfolios,” Senra said. “Our product framework delivers clarity and options for clients to help achieve their investment objective(s).”

The launch of iShares S&P ESG Screened ETFs provides a third pillar of sustainable funds to complement iShares’ existing Aware and Advanced suites. These three ESG suites create a simplified framework for clients to make ESG investments in their portfolios.

Expanding Sustainable iShares and Providing Transparency of Sustainable Characteristics

To help investors access more sustainable options, iShares is working to expand its global ETF lineup to 150 globally and adding transparency of sustainable characteristics across all of its funds. In addition, for iShares ESG ETFs that seek to track indexes with business involvement screens, each product page now includes content to indicate what screens are part of the fund’s underlying index methodology. From each page, investors can click through to read in greater detail about the business involvement screens for each index to ensure it aligns with their investment objectives and risk preferences.

Carolyn Weinberg, Head of Global iShares Product, said to enable our clients to build better sustainable portfolios, earlier this year, we committed to doubling our ESG ETFs within the next few years to 150 products globally.

“We have partnered with index providers to innovate in both products and in analytics to construct ESG outcome-oriented portfolios with transparency into ESG risks and performance attribution,” Weinberg said. “We’ve added 38 sustainable ETFs this year globally, which sets the industry on a path to top $1.2 trillion in sustainable ETF and index mutual fund assets under management this decade.”

Growth of Sustainable Indexing

Growing prevalence of ESG risks and investor preferences continue to drive a significant reallocation of capital toward sustainable solutions. iShares’ work with S&P and other index providers is expanding the universe of sustainable indexes as the foundation for new product development.

Reid Steadman, Global Head of ESG Indices at S&P Dow Jones Indices, said the S&P Sustainability Screened Indices based on our flagship broad market benchmarks reflect investors’ growing appetite to incorporate ESG values into more mainstream equity investment strategies.

“We are very pleased that BlackRock has licensed our indices to develop sustainable versions of their iShares exchange-traded funds in the U.S.,” Steadman said.

As sustainable index development continues to advance in line with investor demand, we believe inflows into global sustainable ETFs are likely to continue growing. Industry assets in global sustainable ETFs rose to $14.8 billion in the first quarter of 2020. Across the U.S., Europe and Canada, BlackRock’s total assets under management (AUM) across its dedicated sustainable investing platform totaled $127.3 billion (as of June 30, 2020) with $9.9 billion in inflows during Q2 2020, bringing 2020 YTD NNB to $20.0 billion.

For more market trends, visit ETF Trends.