Art investors could care less about safe haven, short duration or high yield. For these niche-based, alternative asset connoisseurs, artwork is a better option than bonds–or is it?

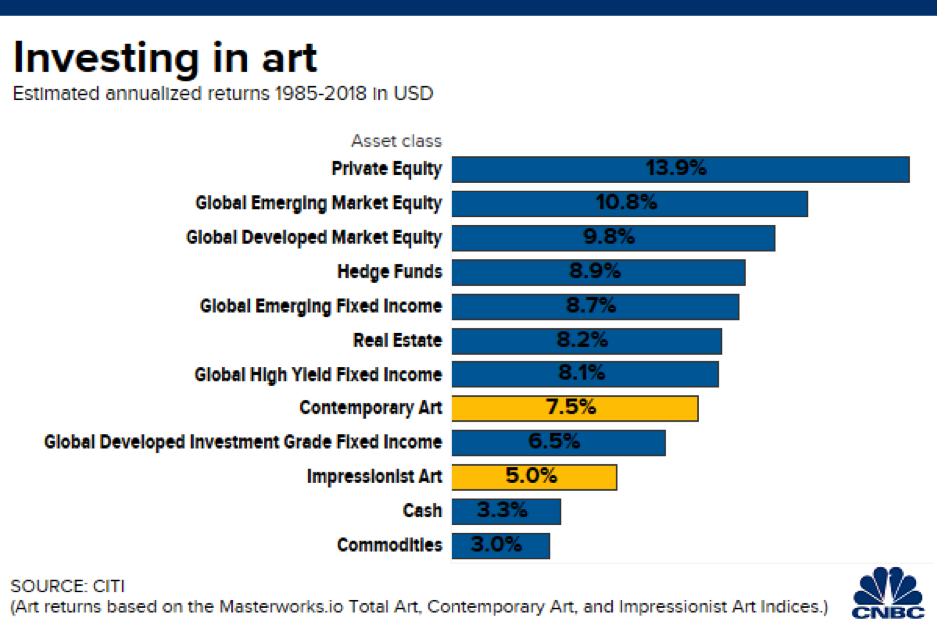

Per a CNBC report, since 1985, “contemporary art has been the best bet for investors of the asset class, returning an average of 7.5% per year, Citi said in a report using data from Masterworks.io. Impressionist art averaged 5.0%, while the art market as a whole returned 5.3% annually.”

While it’s difficult to fathom fixed income investors dumping their bonds and replacing them with fine art in a 60-40 capital allocation split, it’s certainly something to look at (pun intended) when it comes to diversifying assets.

However, unlike bonds, art can exhibit extreme volatility. If investors are willing to ride out of wild market swings, then potential gains could be had, but they’re subject to consumer tastes.

Nonetheless, the CNBC report also noted that the art market reached “$67.4 billion, according to estimates from UBS, which was the second highest on record. In May one of Monet’s haystacks went for $110.7 million, and Picasso’s “Young Girl with a Flower Basket” and a Modigliani painting of a reclining nude woman were among the works to top $100 million at auction in 2018.”

Furthermore, in a low interest rate environment, as we are in now, art prices tend to jump higher.

“While the relationship has been far from perfect, art prices have tended to move in line with broad shifts in real interest rates,” the firm said. “Periods of falling and/or low real rates have coincided with rising art prices.”

Art vs. Bonds

How has art fared against bonds over time? According to the CNBC report, CITI data showed that between 1985 and 2018, investment-grade bonds from developed countries returned 6.5%, while global high yield bonds returned 8.1%.

Furthermore, developed-market equities and private equity returns 9.8% and 13.9%, respectively. Meanwhile, art has fallen in line with contemporary art yielding 7.5% while Impressionist art returned 5%.

While there’s yet to be an art-focused ETF to hit the market, there are art investment funds that pool together investor capital to purchase high-profile work. A rise in volatility in stocks could trigger more interest in these alternative asset classes and furthermore, technology could help the space even further by automating certain tasks.

“Digital technologies such as blockchain could help automate vital processes, including establishing authenticity and performing valuations, as well as enabling share-based investment in individual works and collections,” the firm said. “More transparent pricing, more readily available data on sales, greater market liquidity, and lower transaction costs could result. If realized, such efficiencies would make the art market more attractive for collectors and investors alike.”

For more market trends, visit ETF Trends.