There’s been more talk lately about aiming for diversification through international investing, which wasn’t a major topic of discussion for a while. What’s making investors pay more attention to that space and how should they approach it? Is it better to keep it simple and invest in a broadly based international fund or to get granular and invest in individual countries or regions? Developed Markets in particular have seen significant interest. How should investors view the non-U.S. equity space?

Todd Rosenbluth, director of research: I love it when the VettaFi Voices topic matches what I just wrote about. But why is international investing more compelling? Investors want to broaden exposure beyond the mega-cap growth U.S. stocks that have risen sharply. Investing internationally in a low-cost way became even easier last week when State Street cut the fees for the SPDR Portfolio Developed World ex-US ETF (SPDW) and the SPDR Portfolio Europe ETF (SPEU) down to 0.03% and 0.07%, respectively. That’s cheaper than the iShares Core MSCI Europe ETF (IEUR), the Vanguard FTSE Developed Markets ETF (VEA), and, well, pretty much anyone else.

These ETFs own the multinationals you are familiar with – names like LVMH, Nestle, Samsung, Toyota Motor, etc that are missing from an S&P 500 ETF. State Street is providing broad market exposure to help advisors broaden beyond their home bias. While SPEU and SPDW’s 14% and 12% year-to-date gains are less than the 17% gained by its sibling the SPDR Portfolio S&P 500 ETF (SPLG), advisors are getting broader market exposure.

Hedged ETFs Outperforming

But as I noted in my piece, the WisdomTree Europe Hedged Equity Fund (HEDJ) is performing even better. It’s up 20% for the year due to its currency hedging approach and focus on exporting, dividend-paying companies like L’Oreal and Banco Santander. For advisors looking to currency hedge broad international markets, the iShares Currency Hedged MSCI EAFE ETF (HEFA) is a good ETF that is up 14%. It’s simply hedging the exposure found in the iShares MSCI EAFE ETF (EFA), reducing the risk of a strong dollar vs. the yen, the euro, the pound, etc.

If you are looking at Japan, hedging has been even more important this year. Broad market cap weighted ETFs like Franklin FTSE Japan ETF (FLJP), JPMorgan BetaBuilders Japan ETF (BBJP), and JPMorgan BetaBuilders Japan ETF (EWJ) are all up 13-14%. The WisdomTree Japan Hedged Equity Fund (DXJ) is up 33% and the Xtrackers MSCI Japan Hedged Equity ETF (DBJP) is up 28%.

I’m beyond unqualified to comment on when this currency disparity versus the yen will persist into the fourth quarter and 2024. But investors are missing this. EWJ has added $3 billion of new money this year, while BBJP pulled in $1 billion. This is much stronger than DXJ’s $500 million intake and certainly DBJP’s $11 million.

In a recent ETF 360 video, I spoke to Dan Peterson of Index IQ who said “Most people don’t want to have a view or position in a passive nature when looking at ETF. Currencies actually have quite a substantial impact on international equity investing.”

One solution is to use the IQ FTSE International Equity Currency Neutral ETF (HFXI) which is 50% hedged, so a middle ground between unhedged EFA and HEFA.

A Question of Valuation

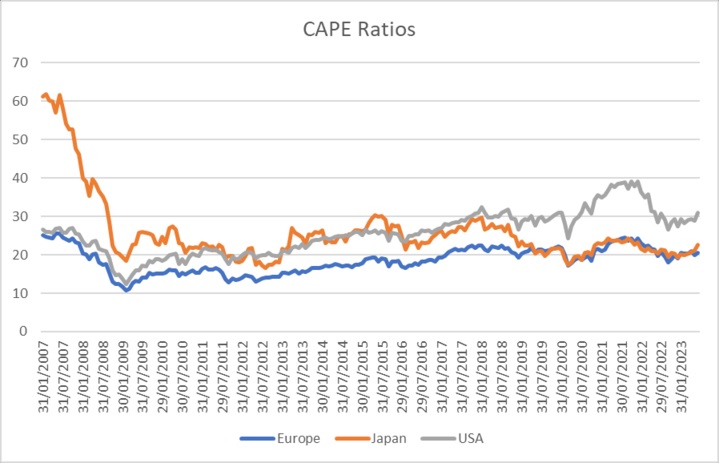

Dave Nadig, financial futurist: I think it’s easy to be a little too clever in understanding the interest here. Let’s just start with the basic valuation story. Here’s the CAPE ratio for the EU, U.S., and Japan since the Great Financial Crisis:

The U.S. has been a valuation outlier since before the pandemic, and the market responses around the world have been very U.S. favorable. You’ll recall at the time there was widespread discussion about how the U.S. was going to lead out of the crisis, how much money the U.S. had heli-dropped into the economy versus other developed markets, and so on. All of those led to a persistent relative overvaluation of U.S. stocks.

Fast forward, and while things in general look surprisingly good for the U.S. economy, more CIOs and advisors I talk to are trying to get back to a new baseline normal – where the bond portion exists, and international diversification is worth pursuing.

For perspective: International represents 22% of Equity AUM in the U.S. ETF Industry. It represents 38% of year-to-date flows. The reallocation is real.

As for whether to hedge or not hedge – I remain convinced the right answer for long-term investors is to try and express these opinions as currency-neutral. So in that case, the answer is likely not either EWJ or DXJ (unhedged/hedged Japan), but a mix of the two which you rebalance whenever you rebalance the rest of the portfolio. That’s the only way to not have an opinion about currency impacts.

Smart-Beta Angles on International Equities

Rosenbluth: The Vanguard Total International Stock ETF (VXUS) is the most popular international equity ETF this year, Dave. It had $3.2 billion of net inflows. This is a peer of SPDW as referenced earlier.

There are also smart beta international equity ETFs worthy of consideration. For example, the ALPS International Sector Dividend Dogs ETF (IDOG) is a high dividend yield ETF that is an international version of the ALPS Sector Dividend Dogs ETF (SDOG).

The holdings like Nippon Steel and Sage Group are certainly different than EFA.

Nadig: Incidentally, the angle of playing for value in the EU makes a ton of sense – IDOG has beaten the broad international market by 9.6% this year so far. Even straight international value has been beaten by close to 8%.

Rosenbluth: The Hartford Multifactor Developed Markets (ex-US) ETF (RODM) is another under the radar smart beta ETF. It’s a multifactor ETF combining value, momentum, and quality factors. This is notably different than a single-factor ETF like the iShares MSCI EAFE Min Vol Factor ETF (EFAV) or the Invesco S&P International Developed Momentum ETF (IDMO).

Advisors have not focused on smart beta international ETFs as much as they have looked to the alternative weighting approach in the U.S.

Nadig: Again Todd, those products have definite use cases, but the core move here is simply “back to diversified” from the U.S.-centric window we went through. I would expect the bigger funds to continue to get model-driven flow (most model provider’s charts have EU and Japan at relative overweight), and more granular funds to slowly find traction with buyers with more distinct views. That’s sort of the model we’ve seen in this fixed income explosion this year too — first the allocations into the big giant passive beta, then the more sophisticated slicing and dicing follows.

Importance of Currency Hedging in International Investing

Rosenbluth: I agree, Dave. ETFs like VXUS, EFA, SPDW, and even HEDJ can and should be the core and get the most assets. But for risk-aware clients, a dividend ETF or a multifactor one can make sense.

Heather Bell, managing editor: You talked a lot about currency-hedged funds. How important is currency hedging when it comes to international? Should that be something on the investor radar right now?

Rosenbluth: Currency hedging through international equities has helped to generate stronger returns in 2023 and over the last three years. It might not again. But looking at HEFA and EFA, the currency-hedged product is up 13.5% over three years vs. 7.4% for the unhedged product.

Bell: Currency hedging was huge in 2015 – remember the flows HEDJ and DXJ got back then? Then it faded out of sight for years. It looks like if someone was invested in HEFA over the past nine years (HEFA launched in early 2014), they would have significantly outperformed EFA. Are the odds simply that a currency-hedged foreign equity ETF will perform better than an unhedged foreign equity ETF over the long term? Or is it much more complicated than that?

‘It Works Until It Doesn’t’

Rosenbluth: A few things, Heather, come to mind. Currency hedging works until it does not. It matters whether the dollar is strong or weak, something I’m not qualified to forecast and many advisors are likely not either.

Yes, I remember the WisdomTree commercials about ETFs that allow the investor to take the yen or the euro out of investing, They were on CNBC a lot. But when it stopped working, the money flowed out. Some people do not want to take a second chance. But you are right that they are missing out. According to Matt Bartolini of State Street Global Advisors, currency-hedged equity ETFs added $2.6 billion in the first 7 months of 2023, compared to $31 billion for developed international equity ETFs. Over the long term, currency hedging has worked for the buy-and-hold investor.

Bell: I remember that there were big discussions when HEDJ and DXJ were pulling in assets left and right about how hard it was to time currency hedging. Some products provided “dynamic hedging” and half hedges (only 50% currency hedged) but I’m not sure how many are around now.

Rosenbluth: For a while, asset managers were launching currency-hedged versions of most international ETFs, even single-country funds. Then many of them closed. Currency hedging has worked and remains unloved. But to the broader question at the top. Should advisors own international equity ETFs? Yes, there are great companies based outside of the U.S. Ignoring them creates holes in the portfolio.

What About Canada?

Bell: Absolutely. But do you invest in a global fund, a global ex-U.S. fund, or a developed markets ex-U.S. fund? And when it comes to EAFE strategies, how much are you missing out when you exclude Canada too?

Rosenbluth: Good point. VEA has exposure to Canada but EFA does not. Canada is not in Europe, Australasia, or the Far East. Canada was the third-largest country in VEA at just under 10% so it’s a big influence. The iShares Core MSCI Total International Stock ETF (IXUS), a smaller ETF than EFA, does have Canadian stocks inside. I can’t ignore a good “what’s inside your ETF” question!

Global funds or global ex-U.S. funds are going to have some Emerging markets exposure. This is a whole different topic of discussion.

Bell: I’ve learned a lot from you and Dave today – thank you!

For more news, information, and analysis, visit the Equity ETF Channel.