Clean energy will be big business in 2021 with a Joe Biden administration in place at the White House. One fund, the iShares Global Clean Energy ETF (ICLN), is up over 100% thus far this year.

Per Morningstar performance figures as of November 29, the fund is up 101.63%. After making the standard dip all markets experienced back in March, ICLN took off a like a rocket.

ICLN seeks to track the S&P Global Clean Energy IndexTM. The fund generally invests at least 90% of its assets in the component securities of the index and in investments that have economic characteristics that are substantially identical to the component securities and may invest up to 10% of its assets in certain futures, options and swap contracts, cash and cash equivalents, as well as in securities not included in the index.

The index is designed to track the performance of approximately 28 clean energy-related companies. ICLN’s expense ratio comes in at 0.46%.

ICLN gives investors access to:

- Exposure to companies that produce energy from solar, wind, and other renewable sources

- Targeted access to clean energy stocks from around the world

- Use to express a global sector view

One of the areas that could help propel more gains for ICLN is big business involvement in clean energy initiatives.

More Corporate Investment in Clean Energy

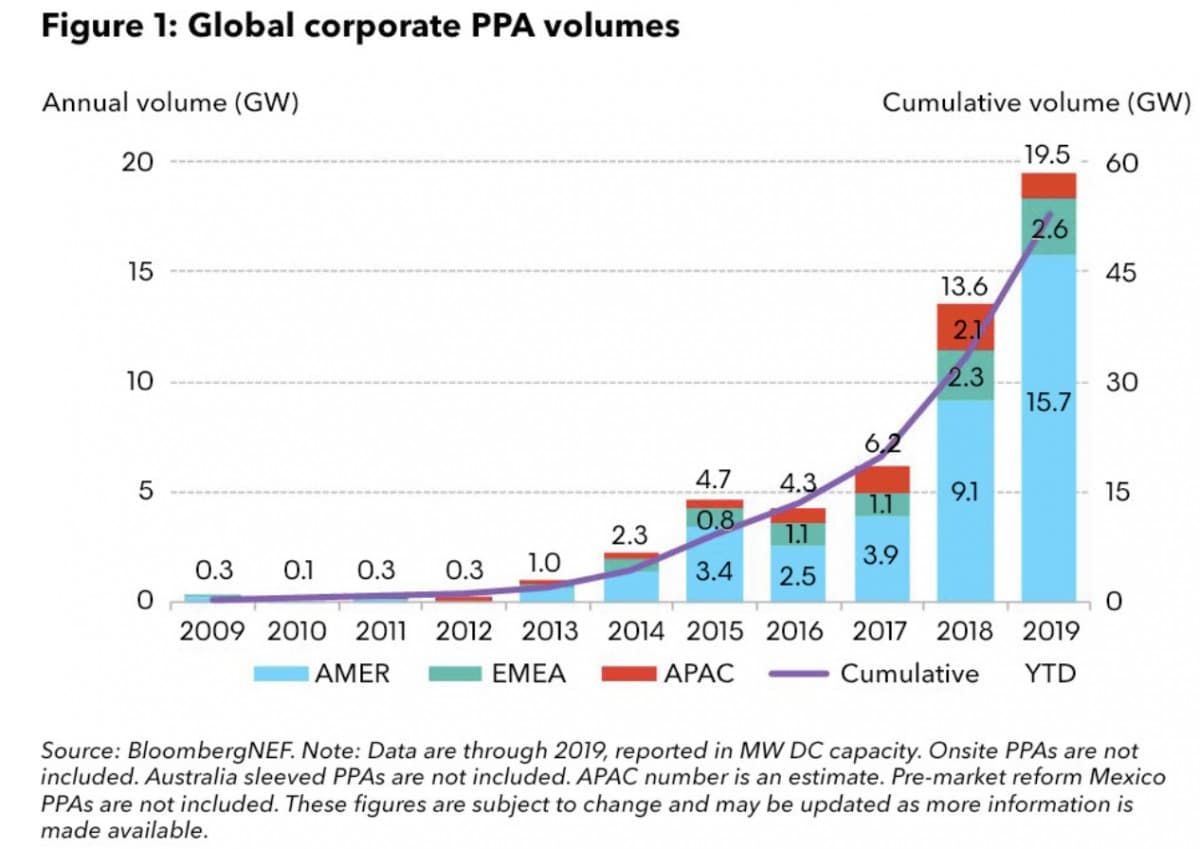

Per an OilPrice.com report, “global corporations have been striking a record number of clean energy power purchase agreements, or PPAs. In 2019, corporations purchased 19.5 gigawatts of clean power through long-term contracts, marking an impressive 40% Y/Y increase. Indeed, over the past three years, companies have quickly ramped up their clean energy purchases from 4.3GW in 2016.”

One of the shining stars in the push for clean energy has been big tech names.

“When it comes to which corners of the corporate world have been buying the most renewable energy, well, there are no surprises here as Big Tech easily takes the cake,” the article noted. “Over the past half-decade or so, tech giants Google, Amazon, Facebook, and Microsoft have been dominating clean energy procurement and are looking to continue being renewable energy’s biggest customers.”

“Last year, Google signed contracts to purchase over 2.7GW of clean energy globally, the biggest clean energy commitment by any company on the planet,” the article continued. “That included contracts to buy 1.9GW of clean energy in six countries. Google employs a unique reverse auction process when signing renewable energy contracts, with developers taking part in a live, public bidding process.”

For more news and information, visit the Equity ETF Channel.