Key Takeaways

As the never-ending battle to win the attention of cost-conscious investors continues, there are approximately 80 ETFs that have expense ratios of 0.05% or below.

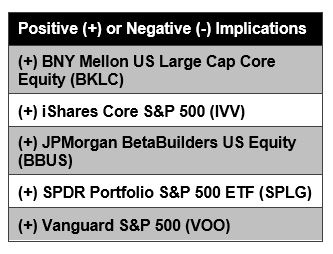

As the never-ending battle to win the attention of cost-conscious investors continues, there are approximately 80 ETFs that have expense ratios of 0.05% or below.- Morningstar’s index-based JPMorgan BetaBuilders US Equity ETF (BBUS) and BNY Mellon US Large Cap Core Equity ETF (BKLC) respectively charge 0.02% and 0.00% in fees and have been gathering assets during 2021, even as demand for slightly more expensive S&P 500 Index based funds is high.

- However, there’s a 265 basis-point spread between the one-year records of BBUS and BKLC due to differences in what’s inside the ETFs.

Fundamental Context

There are approximately 80 U.S. listed ETFs charging a minuscule fee of 0.05% or less. As record new money pours into ETFs in 2021, some asset managers are using their scale as an advantage to try to capture market share. For example, investors pay just a few basis points and can focus solely on ultra-short-term Treasuries, using iShares 0-3 Month Treasury Bond ETF (SGOV); corporate bonds, using SPDR Portfolio Corporate Bond ETF (SPBO); international equities, using BNY Mellon International Equities (BKIE); or small-cap U.S. stocks, using for Schwab U.S. Small-Cap ETF (SCHA). Meanwhile, there’s a variety of extremely low-cost (or no-cost) choices to fill the large-cap equity core portion of an asset allocation strategy.

SPDR S&P 500 ETF (SPY ) remains the ETF heavyweight, with over $400 billion in assets, but more investors are choosing cheaper large-cap alternatives. While SPY pulled in $6 billion of new money year-to-date through September 3, Vanguard S&P 500 ETF (VOO) and iShares Core S&P 500 ETF (IVV) gathered $37 billion and $16 billion, respectively, according to CFRA data. A third fund, SPDR Portfolio ETF (SPLG), added $2.8 billion. IVV, SPLG, and VOO each charge a 0.03% fee to track the same well-known S&P benchmark as SPY but for one-third the cost.

Investors have also saved during 2021 with newer, cheaper, yet different cap-weighted index ETFs. In March 2019, when BBUS came to market, CFRA was intrigued by the fund’s extremely low expense ratio of 0.02% along with the success JPMorgan Asset Management had in growing JPMorgan BetaBuilders Europe (BBEU), JPMorgan BetaBuilders Japan (BBJP ), and other broad market-cap weighted products into $1 billion offerings relatively quickly. While initial demand for BBUS was more modest than we expected, the ETF has grown to manage $725 million in assets, aided by $345 million of net inflows in 2021.

In April 2020, BKLC arrived, and we again were fascinated because the Bank of NY Mellon chose to charge no fee for this and one other of its fixed income offerings. Along with this, BNY Mellon has a strong wealth management presence through its subsidiary Pershing. While there were and still are other ETFs available for a zero fee, those other funds involve a fee waiver that could be revoked in the future, and they track more narrowly focused benchmarks. BKLC has grown to $360 million in assets, supported by $145 million of net inflows in 2021. Investor demand for BBUS and BKLC before they have even turned three years old further highlights that the due diligence process for ETFs is different than for mutual funds, as CFRA has long suggested.

While BBUS and BKLC track broad Morningstar indexes, they are different from one another as well as S&P-based ETFs. BBUS tracks the Morningstar U.S. Target Market Exposure Index and holds 609 positions with 27% of assets invested in the 10 largest. In contrast, BKLC seeks to replicate the Morningstar U.S. Large Cap Index, which owns just 230 holdings, with the top 10 representing 33% of assets. There are differences at the securities level as well. For example, BKLC’s 7.4% weighting in Apple (AAPL) is 130 basis points higher than BBUS. IVV has 505 total positions, with 29% of assets held in the top 10, and the fund has a 6.4% stake in AAPL.

Figure 1: What is inside large-cap equity ETFs drives performance

| Ticker/Expense Ratio | # of holdings | % held in top-10 | 1-year total return |

| BBUS / 0.02% | 609 | 27 | 34% |

| BKLC / 0.00% | 230 | 33 | 31% |

| IVV / 0.03% | 505 | 29 | 33% |

Source: CFRA ETF Database. As of September 3, 2021.

Not surprisingly given the distinct exposures, there are differences in the records of these ETFs that are greater than the three basis-point spread in fees that they charge. In the one-year period ended September 3, BBUS rose 34%, ahead of IVV’s 33% and BKLC’s 31%. As CFRA looks forward to using our star methodology, we find all three compelling from a risk and reward perspective despite what makes them unique.

Conclusion

CFRA believes all things being equal, investors should consider the cheap ETFs in a broad investment style. But with ETF investing, things are usually not equal. Investors or advisors who rely solely on one metric – whether that is an expense ratio or a three-year track record – could end up with a much different portfolio than the one they expected. Our star ratings combine cost and performance analytics with a holdings-based approach.

Todd Rosenbluth is Director of ETF & Mutual Fund Research at CFRA.