By Todd Rosenbluth, Head of ETF & Mutual Fund Research, CFRA

Key Takeaways

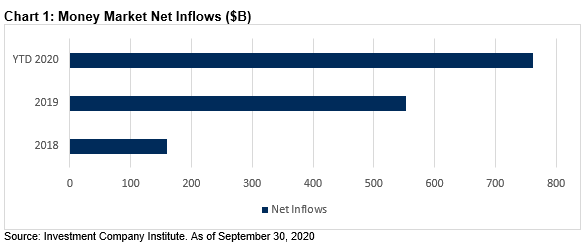

- More flows went into money market mutual funds in the first nine months of 2020 than all of 2018 and 2019 combined as investors sought the relative safety of cash equivalents.

- The five largest actively managed bond ETFs focus hold short-term securities that incur limited interest rate risk. Collectively they hold $46 billion in assets, aided by $10 billion of net inflows year-to-date through November 10 and growing liquidity.

- According to Jerome Schneider, Head of Short-Term Portfolio Management at PIMCO, active bond ETFs provide a combination of income generation and capital appreciation potential as the fund has the flexibility to trade before a bond holding matures.

Fundamental Context

Investors moved further to the sidelines in 2020 amid rising volatility. Money market mutual funds pulled in $762 million of net inflows in the first nine months of 2020, higher than combined inflows in 2018 ($159 billion) and 2019 ($553 billion) according to the Investment Company Institute. Such demand, coupled with Federal Reserve rate cuts, pushed yields to 0% and made it harder to justify the funds from an income generation perspective.

During a November 10 CFRA webinar, https://go.cfraresearch.com/pimco-cash, PIMCO’s Schneider explained that not only have money market investors’ purchasing power eroded but they are also incurring opportunity costs by not investing the cash at higher yields without incurring meaningful additional rate risk.

Furthermore, some of the benefits of a money market fund, including high liquidity and limited risks due to interest rate swings, are also provided by ultra-short bond ETFs. But money market funds are not free. For example, the $185 billion Fidelity Government Money Market Fund (SPAXX) charges a 0.42% expense ratio.

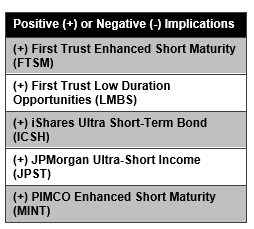

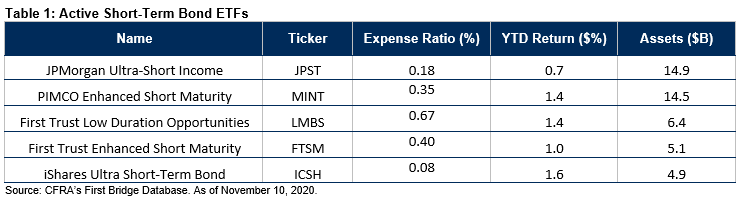

Actively managed ultra-short bond ETFs provide a strong alternative. The five largest actively managed bond ETFs hold $46 billion in assets and, year-to-date through November 10, gathered more than $10 billion of net ETF inflows according to CFRA’s First Bridge ETF database. All hold short-maturity bonds blending exposure to government and other investment-grade bonds and four of the five ETFs have expense ratios of 0.40% or less.

PIMCO’s Schneider highlighted that relative to money market funds, ETF investors can not only benefit from higher yields through positions in Agency and high-investment-grade corporate bonds, but also from some capital appreciation achieved by a portfolio management team actively trading bonds before they reach maturity. Indeed, PIMCO Enhanced Short Maturity ETF (MINT), rose 1.4% year-to-date through November 10 and had approximately half of fund assets in investment-grade corporate bonds at the end of October. MINT offers a 30-day SEC yield of 0.37%.

Another strong performing ultra-short bond ETF this year is iShares Ultra Short-Term Bond ETF (ICSH), which was up 1.6% and offers a 0.38% SEC yield. According to Karen Schenone, head of iShares Fixed Income Strategy, advisors had been building up ETF cash alternatives ahead of the election.

ICSH, MINT as well as First Trust Enhanced Short Maturity ETF (FTSM) and JPMorgan Ultra-Short Income (JPST) all incur an effective duration of less than one year, meaning that if interest rates were to rise in the near term, which CFRA thinks is unlikely, the ETFs’ net asset values would not fall much. A fifth actively managed offering, First Trust Low Duration Opportunities (LMBS), has an average duration of 1.6 years.

These five ETFs trade frequently throughout the day and provide enhanced liquidity for when investors want to move off the sidelines to generate higher income with their bond allocation.

Conclusion

In rating bond ETFs like ICSH, MINT and others, CFRA currently prefers funds that sport a higher perceived reward potential given the low-rate environment and the management costs incurred. However, for investors seeking an alternative to money market funds offering no income, we think actively managed ultra-short bond ETFs are worth a closer look.

Originally published by CFRA

All of the views expressed in this research report accurately reflect the research analyst’s personal views regarding any and all of the subject securities or issuers. No part of the analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this research report. For more information and disclosures, please refer to CFRA’s Legal Notice at https://www.cfraresearch.com/legal/.

Copyright © 2020 CFRA. All rights reserved. All trademarks mentioned herein belong to their respective owners.