By Dave Dierking, CFA

Summary

- DGRO has always made for a great long-term core portfolio holding, but it may be especially well-positioned to benefit from a global economic recovery.

- Its value-oriented portfolio and overweights to financials, industrials and other cyclicals could do very well over the next year or more if a post-COVID recovery scenario plays out.

- The 2% dividend yield won’t get income seekers excited, but it’s more about portfolio positioning here.

- Or you can just buy-and-hold DGRO indefinitely and likely not be disappointed with the results.

Investment Thesis

The recent market rally, fueled by optimism surrounding Pfizer’s (PFE) promising COVID vaccine, could make dividend stocks a big winner in a corresponding economic recovery. If proven effective, a vaccine could ignite a rally in value stocks, which, in turn, would benefit cyclicals, an area of the market that tends to be overweighted in dividend ETFs.

The iShares Core Dividend Growth ETF (DGRO) and its strategy of targeting companies with sustainable dividend growth streaks could be especially well-positioned to benefit from the return of value and cyclical leadership.

Background

Over the past several years, dividend income strategies, in general, have steadily underperformed the broader market. Some areas of the dividend stock universe, such as dividend growers, have performed relatively well, but high yielders have done quite poorly.

It kind of makes sense though. If the Fed is dropping trillions of dollars into the economy and keeping interest rates near zero, growth stocks are going to lead the market higher, which they have in a major way. Dividend yields of 2% or 3% just aren’t that enticing.

But events of the past week have changed the narrative.

If Pfizer’s COVID vaccine proves to be the real deal and becomes widely available over the next several months, it could be the catalyst the global economy needs to pull itself out of recession.

We know from history that value stocks and cyclicals tend to outperform coming out of economic troughs. We’ve seen early hints of that type of reaction in the immediate trading following the news.

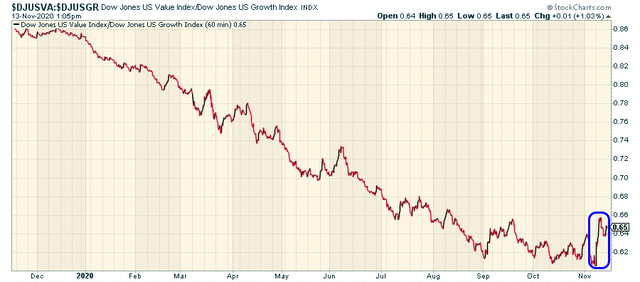

The value/growth ratio has retreated in recent days as investors have digested the news, but the initial reaction shows that maybe investors are willing to give value & cyclicals, and, by extension, dividend stocks, another chance if the economic comeback becomes a reality.

The iShares Core Dividend Growth ETF (DGRO) hits all of those areas. It trades at a discount to the broader market, it’s overweight to cyclical sectors and with a yield of around 3%, it could become appealing to dividend income seekers.

Objective

DGRO seeks to track the investment results of the Morningstar U.S. Dividend Growth Index. It’s a dividend dollars weighted index that seeks to measure the performance of U.S. companies selected based on a consistent history of growing dividends.

Eligible companies must:

- pay a qualified dividend

- have at least five years of uninterrupted annual dividend growth

- have an earnings payout ratio of less than 75%

Companies that are in the top decile based on dividend yield are excluded from the underlying index prior to the dividend growth and payout ratio screens.

Profile

As mentioned above, DGRO is a value-oriented portfolio since its focus on growing dividends, sustainability and healthy cash flows tends to lend itself to overweighting more mature, established companies.

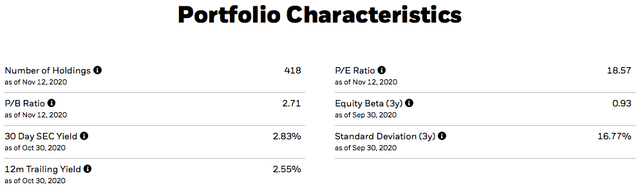

DGRO is currently trading at a discount to the broader market of about 22% using the P/E ratio and 27% using the P/B ratio. Additionally, it’s about 6% less risky than the S&P 500 (SPY).

Those valuation discounts shouldn’t be expected to close completely (or, in reality, even come close), but they are wider than average historically. In a cyclical or value rally, the relatively attractive value of this portfolio alone could make it an outperformer.

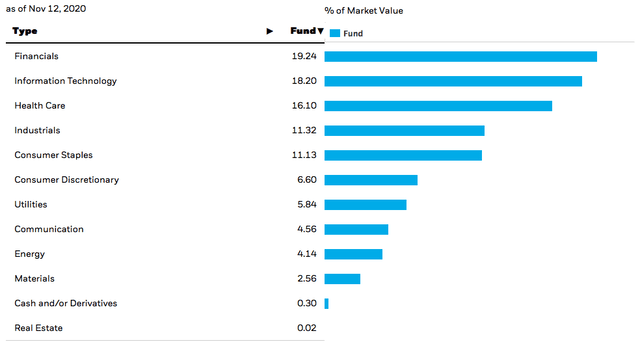

A deeper look at the portfolio itself shows that it doesn’t really look a whole lot like the S&P 500. It’s noticeably overweight in financials, industrials and consumer staples, while remaining underweight in the tech, communication services and consumer discretionary sectors.

In other words, the portfolio tilts towards some of the more unloved areas of the market.

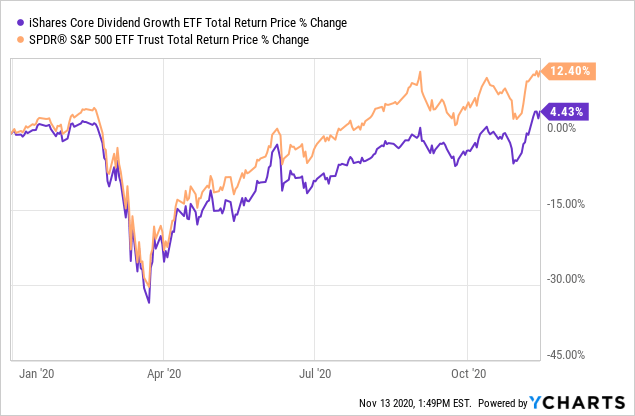

It’s been overweight all the sectors that have gotten hit especially hard in 2020 and has been underweight in the most outperforming sectors. It shouldn’t be surprising, then, that DGRO has significantly underperformed the broader market this year.

The 8% lag to the S&P 500’s performance is fairly expected, but this result is actually impressive compared to its peer group. Morningstar places DGRO in the Large Value category, where it currently ranks in the top 8% for year-to-date performance.

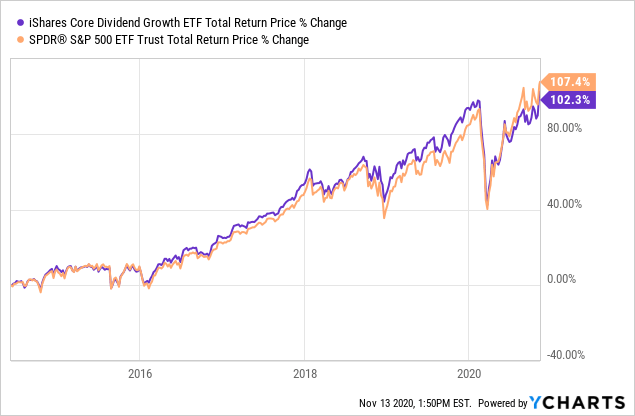

DGRO looks even more impressive when you pull the binoculars back to look at the long-term track record.

Before the 2020 bear market, DGRO was beating the S&P 500 since inception. Even after the pullback, the fund is still almost on par with the large-cap index’s returns. Comparing apples to apples, DGRO ranks in the top 2% of Morningstar’s Large Value category proving it can deliver outperformance in all types of markets.

Overview

A couple of things to note right off the bat.

I like the idea that the top 10% of potential components based on dividend yield are eliminated right from the start. I know yield seekers probably won’t appreciate that, but it does add a dividend quality twist to the fund’s objective. Throughout 2020, we’ve seen a lot of yields become artificially high as their share price has cratered. Some of those companies have been able to maintain their dividend payments, but many have not. Eliminating these potentially riskier yields removes a degree of risk from the portfolio and helps with the goal of identifying sustainable dividend growth profiles.

Also, the requirement that securities pay a qualified dividend essentially eliminates REITs as an option, as we can see from the sector allocation table above.

I know when I write about dividend ETFs, such as DGRO and others, I inevitably receive comments from readers mentioning the unattractiveness of the dividend yield. I’d agree that the fund’s 2% yield won’t get anybody excited, but adding DGRO to your portfolio is more about portfolio positioning as opposed to yield generation. If you’re a believer in Pfizer’s vaccine (or any others that are in the development stage), it’s easy to foresee a scenario in which the economy is moving quickly towards its pre-COVID days by the end of the 1st half of 2020.

But there’s definitely some risk involved in this trade. As one reader pointed out in my last article, “it takes a brave investor to bank on a reopening rally, with so many countries considering new lock-downs to stem rising COVID cases.” The short-term could indeed be painful if we’re looking at widespread lockdowns resuming over the coming weeks, an idea that has already been floated by the Biden camp. I don’t think this would necessarily result in the sharp and swift equity price declines we saw back in February and March, but a 10% pullback from current levels wouldn’t at all surprise me either.

Conclusion

If you’re a long-term investor and simply looking for a great ETF with a proven track record and appealing dividend growth strategy, there’s no reason you shouldn’t own DGRO and make it part of your portfolio’s core.

If you have a shorter-term focus, the idea of whether or not to be adding or overweighting DGRO here is likely dependent on your views of the global reopening trade. There’s no doubt that the short-term could be rough, especially if we’re looking at additional lockdowns that could pull the economy back into recession.

I think, however, if you’re looking a year out or more, odds are good that (hopefully) we’ll be in a better spot for containing the coronavirus’ spread. At that point, the prospects of a broad recovery should be good, offering an opportunity to benefit from what should be a good environment for cyclicals, value and dividend stocks.

DGRO is well-positioned for that type of scenario and could be a solid outperformer over the next year or more if that scenario ends up playing out.

Originally published by Seeking Alpha, 11/16/20

Disclosure: I am/we are long DGRO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.