A flight to safe haven assets and a backstop from the Federal Reserve saw bonds rise to new heights in 2020. That doesn’t mean bonds are no longer in play, as they still have their place in a portfolio today. Investors can start with ETF provider BlackRock.

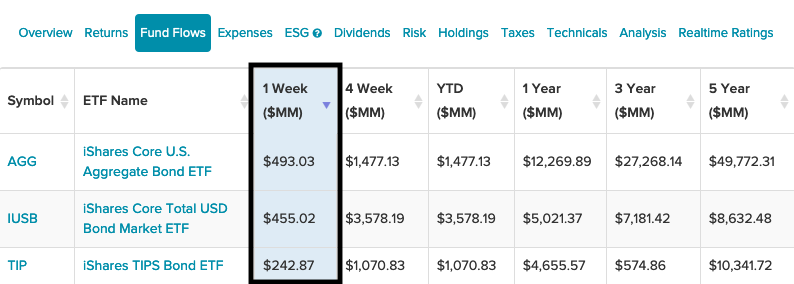

At the top is a tried-and-true fund that’s been the go-to for broad bond exposure: the iShares Core U.S. Aggregate Bond ETF (AGG). The fund offers broad-based exposure to investment grade U.S. bonds, making AGG a building block for any investor constructing a balanced long-term portfolio, as well as a potentially attractive safe haven for investors pulling money out of equity markets. While AGG can potentially be a one stop shop for fixed income exposure, a close look at the composition of this fund is advised.

Another fund with broad exposure to U.S. bonds is the iShares Core Total US Bond Market ETF (IUSB). IUSB seeks to track the investment results of the Bloomberg Barclays U.S. Universal Index.

The fund generally will invest most of its assets in the component securities of the index and may also invest in certain futures, options and swap contracts, cash and cash equivalents, including shares of money market funds advised by BFA or its affiliates, as well as in securities not included in the underlying index, but which BFA believes will help the fund track the underlying index.

Is inflation on the rise in 2021? If so, bond investors may want to look at the iShares TIPS Bond ETF (TIP), which seeks to track the investment results of Bloomberg Barclays U.S. Treasury Inflation Protected Securities (TIPS) Index (Series-L) which composed of inflation-protected U.S. Treasury bonds.

The fund generally invests at least 90% of its assets in the bonds of the underlying index and at least 95% of its assets in U.S. government bonds. It may invest up to 10% of its assets in U.S. government bonds not included in the underlying index, but which BFA believes will help the fund track the underlying index, and may also invest up to 5% of its assets in repurchase agreements collateralized by U.S. government obligations and in cash and cash equivalents.

TIP gives investors:

- Exposure to U.S. TIPS, which are government bonds whose face value rises with inflation.

- Access to the domestic TIPS market in a single fund.

- Protection against intermediate-term inflation.

For more news and information, visit the Equity ETF Channel.