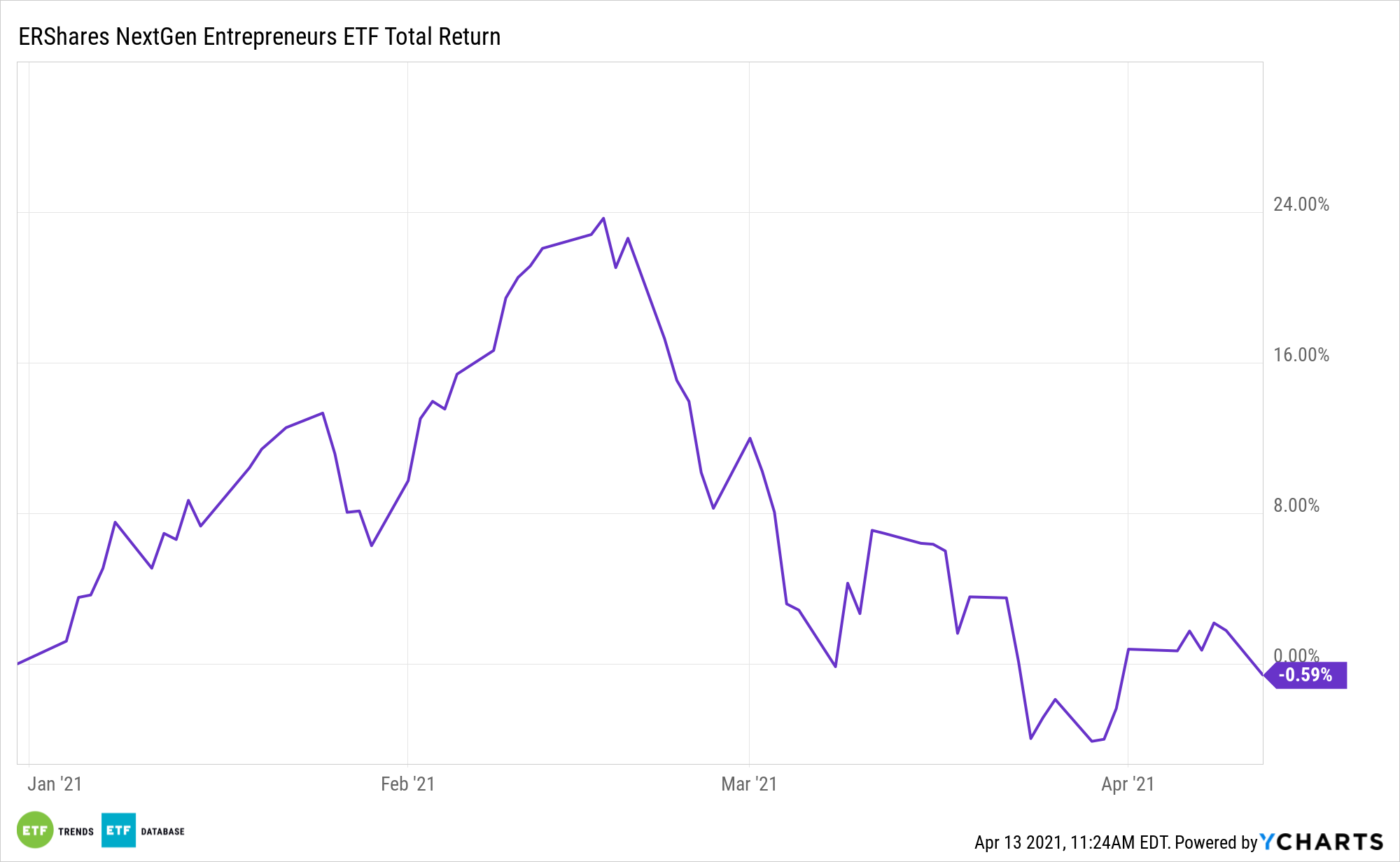

Some market observers believe the U.S. dollar is poised for upside, to the benefit small cap assets like the ERShares NextGen Entrepreneurs ETF (ERSX).

ERSX selects the most entrepreneurial, primarily non-U.S. small cap companies that meet the thresholds embedded in its proprietary Entrepreneur Factor (EF). ERShares’ ETF delivers compelling performance across a variety of investment strategies without disrupting investors’ underlying risk profile metrics. Their geographic diversity enables them to harness global advantages through additional returns associated with currency fluctuations, strategic geographic allocations, comparative trade imbalances, and relative supply/demand strengths.

See also: Leadership Matters: Why Strong Leaders Make Profitable Companies

A dollar rebound would also be supportive of ERSX upside.

“Since the beginning of the year, the US dollar has appreciated against the euro and the Japanese yen, reflecting the view that the US economy will outperform those of its trading partners because of its fiscal stimulus measures and faster progress with vaccinations,” according to Moody’s Investors Service. “The dollar has also appreciated against several emerging market currencies since early 2020.”

The Current Case for ‘ERSX’

Rate differentials could also be a spark for ERSX upside going forward.

“Over the next two years, cyclical factors and especially interest rate differentials versus major advanced economies will support capital flows into US dollar assets,” adds Moody’s. “We expect the US economy this year to outperform other developed markets, such as the euro area, because its economy will reopen earlier on account of its speedy vaccine roll-out and because of its massive fiscal response. The European Central Bank (ECB) and the Bank of Japan will likely maintain an accommodative policy stance for much longer than the Federal Reserve, giving the dollar the potential for additional appreciation.”

ERSX isn’t a traditional ETF. It blends domestic and international exposure, which is relevant at time when many markets are betting international smaller stocks will top U.S. equivalents. Non-U.S. equities are poised to take flight, and it’s possible that this asset class is in for a substantial period of out-performance.

“We expect global financial conditions to remain easy as major central banks including the Fed and the ECB, keep policy rates on hold and purchase assets. Stronger US growth should spill over to other economies, especially emerging market countries, but it will also inevitably drive a gradual increase in US interest rates,” finishes Moody’s.

For more investing ideas, visit our Entrepreneur ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.