Investors seeking a unique factor-based strategy for 2021 may want to evaluate the entrepreneur factor, accessible via the the Entrepreneur 30 Fund (ENTR).

The Entrepreneur 30 Fund tries to reflect the performance of the Entrepreneur 30 Index, which is comprised of 30 U.S. companies with the highest market capitalizations and composite scores based on six criteria referred to as entrepreneurial standards. ENTR primarily invests in US Large Cap companies that meet the thresholds embedded in their proprietary Entrepreneur Factor (EF).

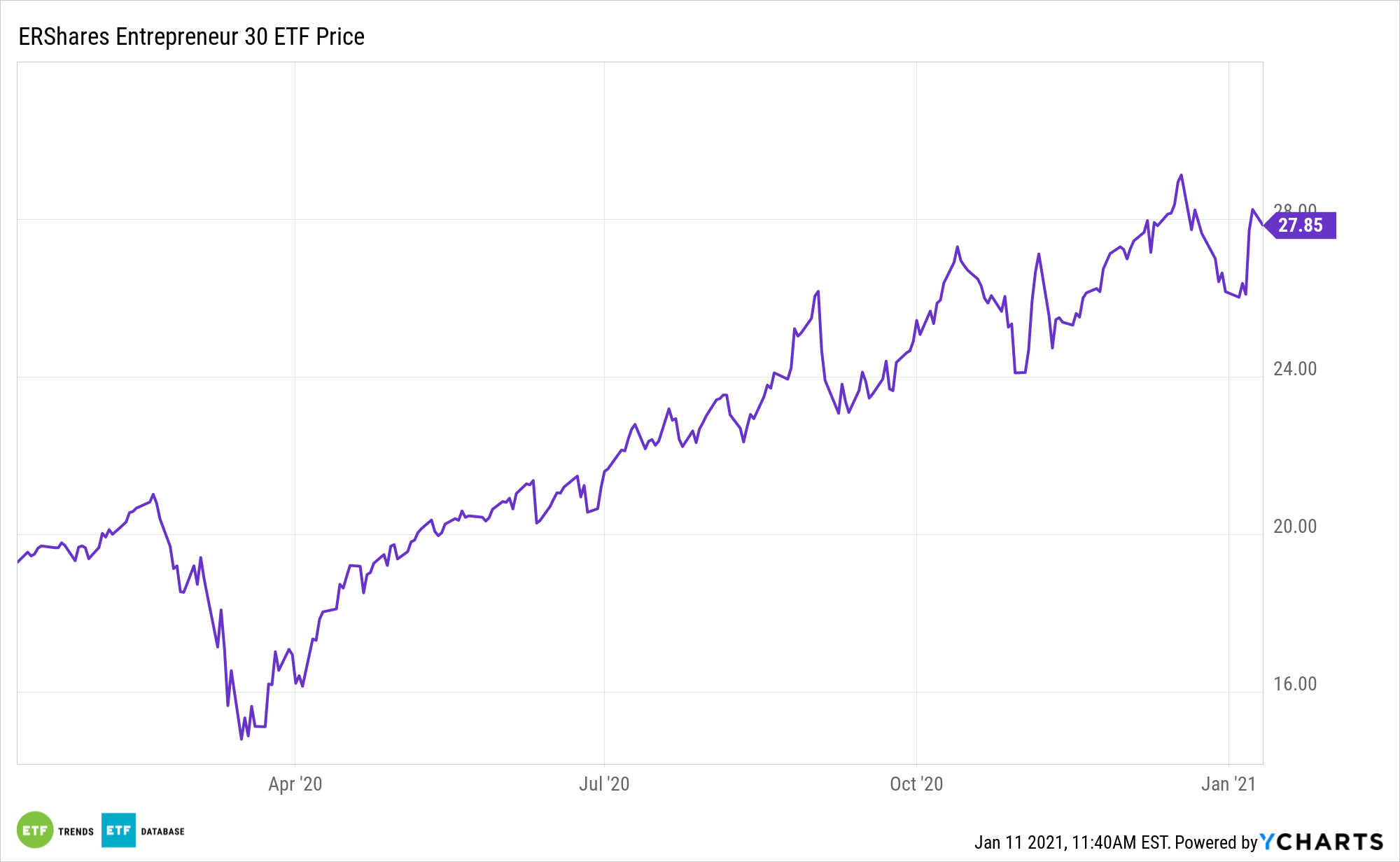

Coming off a strong 2020 performance, ENTR attributes extra risk-adjusted returns to the disruptive behavior of dynamic, entrepreneurial leaders.

“During the past year entrepreneurs generated lower risk and higher returns compared to the overall market. He believes 2021 will be a replay of the same situation due to the savvy nature in which entrepreneurs pivot. He also cites evidence of the ‘Entrepreneur Factor’ (EF) which is an investment model Shulman developed while he was at Harvard and Babson,” according to ERShares, citing founder Joel Shulman.

Embracing the ENTR Methodology

ERShares incorporates a bottom-up investment orientation powered by artificial intelligence that stands above other investment factors such as momentum, sector, growth, value, leverage, market cap (size), and geographic orientation. With the aid of AI and Thematic Research, ERShares incorporates a macro-economic, top-down approach that integrates changing investment flows, innovation entry points, sector growth, and other characteristics into a dynamic, global perspective model. The issuer backs the companies with the best entrepreneurial minds that invest in the right technology for a sustainable and better future.

“Shulman notes that 2020 returns were not generated uniformly across all stocks and sectors. In fact, more than 2/3 of the overall returns for the Russell 1000 index came from only 10 stocks. Moreover, the top 20 performers in the index were all entrepreneurial companies,” according to ERShares.

ENTR also includes sophisticated screens to weed out undesirable companies. The factors screened include management, which requires set factors regarding a company’s management, such as the turnover among the top five executives within a company compared to other companies in the broader universe. A profitability screen requires a company to meet predetermined criteria regarding net income over a static threshold to be included, including the company’s net income as compared to predetermined benchmarks.

For more on entrepreneurial strategies, visit our Entrepreneur ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.