Investors looking to access entrepreneurial companies through the ETF wrapper have an ally in the form of the ERShares Entrepreneurs ETF (ENTR).

Using a a bottom-up methodology, ENTR goes beyond traditional factor-based investing, leveraging artificial intelligence to deliver a basket of entrepreneurial companies spanning multiple sectors.

“With the aid of AI and Thematic Research, ERShares incorporates a macro-economic, top-down approach that integrates changing investment flows, innovation entry points, sector growth, and other characteristics into a dynamic, global perspective mode,” according to ERShares.

From a standard factor point of view, ENTR has a growth feel to it. But it also sprinkles some value into the mix.

“Growth stocks are stocks that offer a substantially higher growth rate as opposed to the mean growth rate prevailing in the market. It means that a growth stock grows at a faster rate than the average stock in the market and consequently, generates earnings more rapidly,” according to the Corporate Finance Institute (CFI).

The ENTR ETF’s Methodology

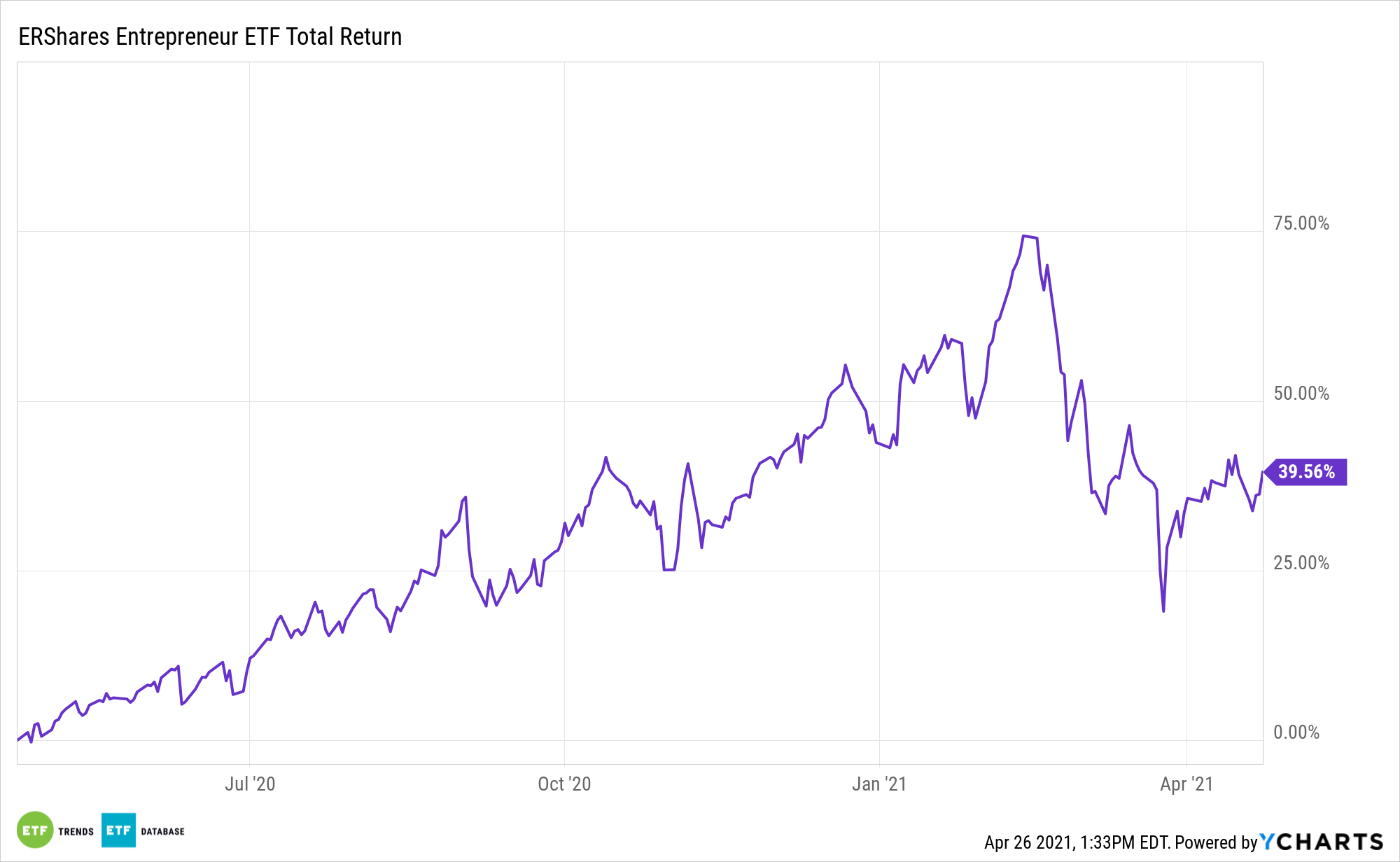

ENTR’s unique methodology bears fruit. For the 12 months ending March 31, 2021, the fund’s net asset value is up 51.43%, according to issuer data.

Some of the other benefits associated with entrepreneurial companies are rapid revenue growth and enviable competitive positioning.

“Growth companies usually demonstrate a significantly higher growth rate because they tend to possess some kind of competitive advantage over other companies in the same industry. The competitive advantage gives growth companies a unique selling proposition (USP), which helps them sell and grow better than other companies within the same industry,” notes CFI.

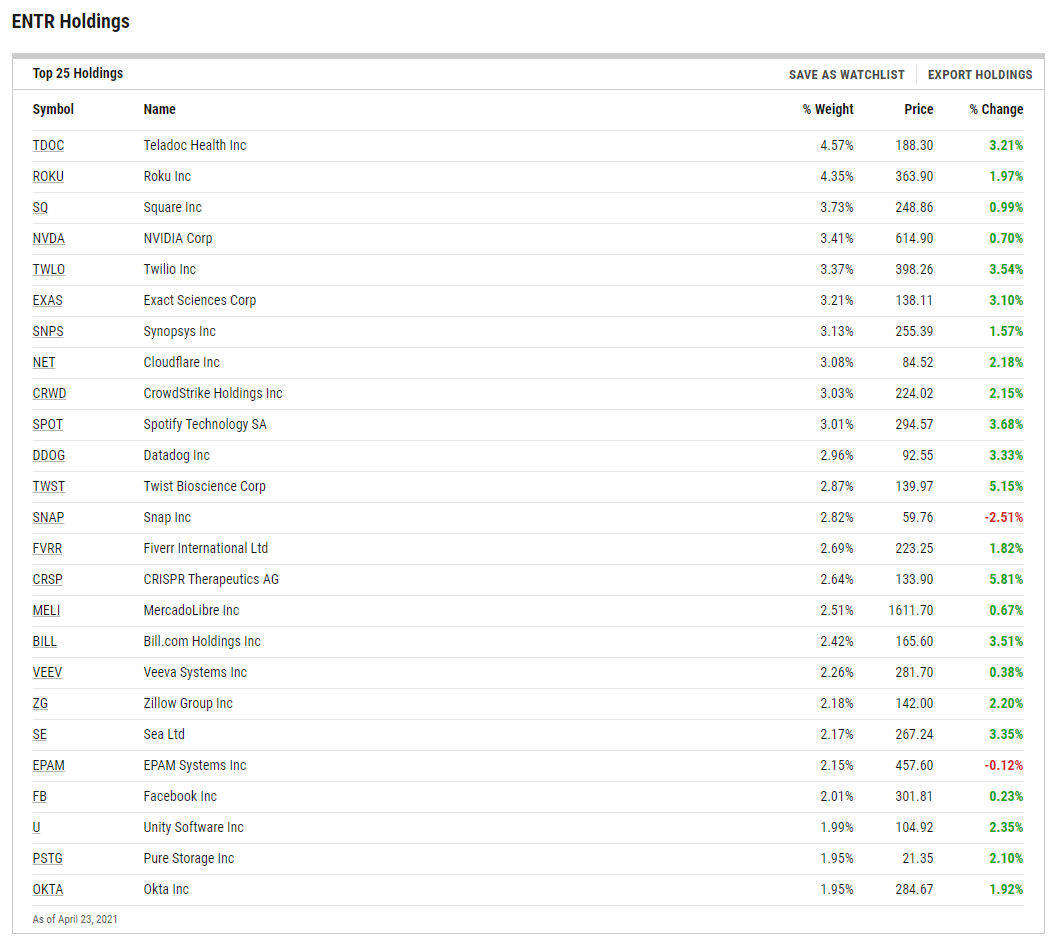

None of ENTR’s 50 holdings account for more than 4.65% of the fund’s roster, indicating single-stock risk is minimal.

At the sector level, ENTR is heavy on technology and healthcare stocks, among other groups, but its industry allocations are more important as they differentiate ENTR from old-school growth ETFs. For example, the fund features exposure to 3D printing, AI, genomics, and healthcare innovation names – stocks rarely found in traditional sector and growth funds.

For more investing ideas, visit our Entrepreneur ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.