There has been a significant shift in how companies conduct business over the last year, with many corporations transitioning their employees to home as more stringent regulations become commonplace in the coronavirus era. With this shift comes a need for innovation, with companies like Ring, Crowdstrike, Tesla, and Fiverr embracing this entrepreneurial mindset. Investors looking to get in on the action can look to the issuer ERShares.

ERShares selects companies from all over the globe and across capitalization levels to create an eclectic and well-balanced mix in its funds.

“We invest in publicly traded entrepreneurial companies, and by this we mean it’s more than just, you know, Amazon or Netflix. There’s some high-profile companies that people kind nod their heads, like Telsa or whatever, they say those are entrepreneurial companies. But we’ve got hundreds around the world, large caps, small caps, throughout Asia, Europe, Latin America, North America,” says Joel Shulman, Founder and Managing Director of ERShares.

Currently, ER Shares has two main ETF offerings: the ERShares Entrepreneur 30 ETF (ENTR) and the ERShares Non-US Small Cap ETF (ERSX).

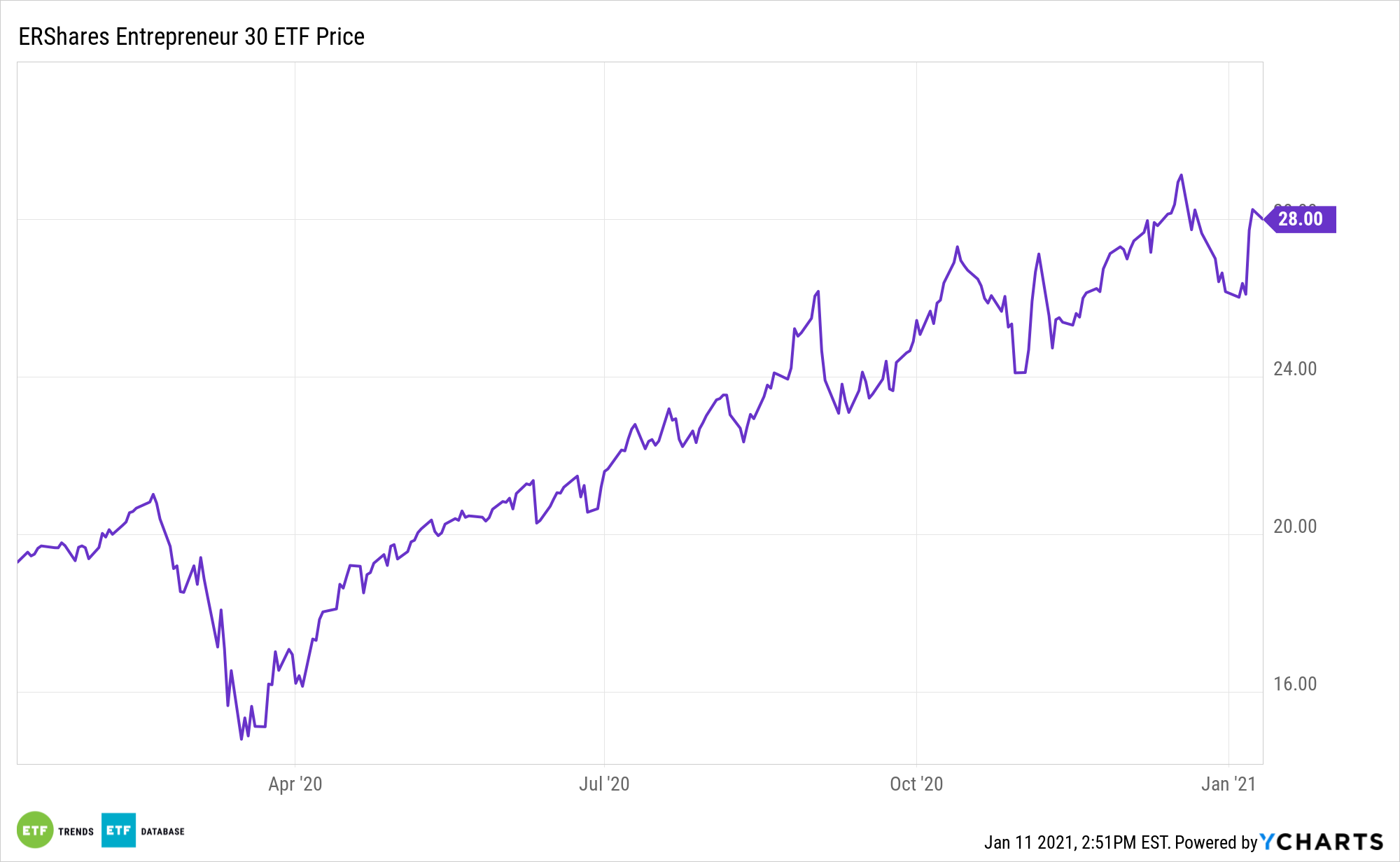

ERShares Entrepreneur 30 ETF (ENTR)

ERShares has created a rules-based methodology that selects publicly-traded entrepreneurial companies, applying this methodology in creating the Entrepreneur 30 Index. The Index is comprised of 30 US Large Cap Entrepreneurial Companies.

Given the propensity of Entrepreneurs to reside in certain sectors, the ER30 Index typically has higher concentration in three primary (entrepreneurial) sectors: consumer discretionary, information technology and healthcare.

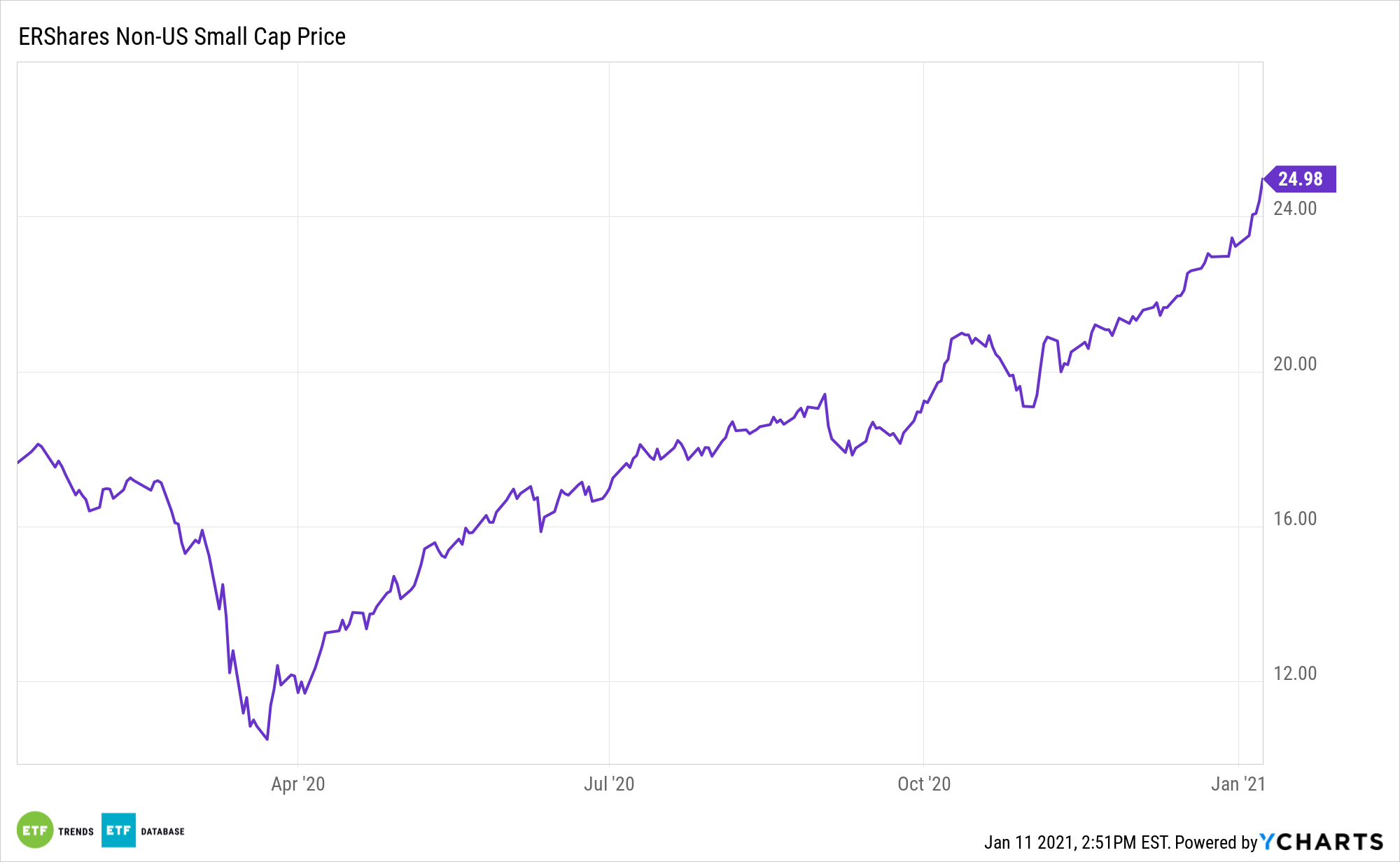

ERShares Non-US Small Cap ETF (ERSX)

The Entrepreneur Non-US Small Cap Index is comprised of 50 Non-US companies form around the world with market capitalization based between $300 million and $5 billion USD.

Breaking Down the ERShares ETFs

Unlike some of the more mundane business offerings, ERShares’ selection of companies is unique in that they are able to pivot quickly, like a Moderna or Wayfair, says the founder.

“These companies are innovators, they are disruptors, and they pivot very well during crises, as we saw in 2020,” he explains.

“Our strategy is proprietary and we have an entrepreneurial factor that goes back 15 to 20 years of solid, academically-tested evidence to show that we have an edge when it comes to investing in publicly-traded companies,” he added.

For more news, information, and strategy, visit the Entrepreneur ETF Channel.