Hi VettaFi Voices, we are heading toward the last week of the Q2 earnings season. Now seems like a good time to assess how things have gone so far and what we can expect from next week. Has it been a strong or weak earnings season? And have the reported earnings shown any kind of trend or given any indications regarding the health of the U.S. equity markets and the U.S. economy?

Todd Rosenbluth, director of research: I saw as of this past weekend that 90% of S&P 500 companies reported results. Roughly 80% of companies are beating Wall Street EPS expectations. However, the main driver of positive earnings surprises has been cost cutting, not revenue growth. Eight of the eleven sectors were reporting year-over-year earnings growth, led by the Consumer Discretionary and Communication Services sectors.

That should be a good thing for sector ETFs like the Consumer Discretionary Select Sector SPDR Fund (XLY) and the Communication Services Select Sector SPDR Fund (XLC) that are offered by State Street Global Advisors but also Vanguard Consumer Discretionary ETF (VCR) and Vanguard Communication Services ETF (VOX) from Vanguard and the Invesco S&P 500 Equal Weight Consumer Discretionary ETF (RSPD) from Invesco. However, FactSet noted that stocks like Tesla (TSLA) are not responding well after strong earnings. Why? Because the growth outlook is not bullish for many companies. Upcoming quarterly results are for modest 1% revenue growth, which means more cost-cutting.

Inflation Fatigue

Heather Bell, managing editor: The Wall Street Journal published a similar article on Thursday about how a better-than-expected earnings season isn’t really enticing equity investors. Consumer confidence was pretty strong this past July. However, the WSJ article mentions “inflation fatigue” affecting consumers right now as a possible headwind for companies going forward. Does that mean things like Consumer Staples, health care, and utilities might benefit? The Sector SPDRs for those sectors are down year-to-date, with the Utilities Select Sector SPDR Fund (XLU) by far the worst performer among that lineup of funds.

Rosenbluth: Consumer staples and utilities tend to have slower earnings growth in good times. But yes, more stable earnings if a recession or an economic slowdown occurs. Healthcare tends to have a little bit more growth.

This is a good time to mention quality ETFs. Those like the iShares MSCI USA Quality Factor ETF (QUAL) and Invesco S&P 500 Quality ETF (SPHQ) have strong balance sheets and consistent earnings records. In addition, there’s the Pacer US Cash Cows 100 ETF (COWZ), American Century U.S. Quality Growth ETF (QGRO), and VictoryShares Free Cash Flow ETF (VFLO) that are more growth-oriented with cash flow as the focal point. These ETFs are diversified across sectors but are different. For example, QGRO owns Booking Holdings (BKNG), Synopsis (SNPS), and Ulta Beauty (ULTA) as top positions. VFLO has AbbVie (ABBV), Cigna (CI), and PulteGroup (PHM) as top positions.

I also like the WisdomTree U.S. LargeCap Fund (EPS), which is earnings weighted and has a fee of just 0.08%, less than the SPDR S&P 500 Index ETF Trust (SPY). Exxon Mobil (XOM) has a larger weighting in the WisdomTree ETF than SPY.

I pay less attention to energy earnings than Stacey Morris, and I am eager for her take on MLPs that are inside the index behind the Alerian MLP ETF (AMLP) and the Alerian Energy Infrastructure ETF (ENFR).

MLP Earnings Season Mixed

Stacey Morris, head of energy research: Thanks, Todd. The earnings season for the midstream space was generally more mixed this quarter. It had some strong results and some reports that fell short. Though earnings were mixed, companies continued to execute well in terms of returning excess cash to shareholders. We saw ongoing positive trends for distribution growth from MLPs, with ~40% of AMLP’s underlying index by weighting and increasing their payouts sequentially. The corporations in ENFR’s underlying index tended to be more active on the buyback front this quarter.

Rosenbluth: Stacey, are MLPs still buying back stock like they had been before, boosted by strong cash flow?

Morris: The midstream space collectively spent over $1 billion on repurchases in 2Q23, up from 1Q23 levels. However, MLPs have generally been less active with buybacks this year. This has to do with a combination of favoring distribution growth and few pullbacks creating windows of opportunity. Corporations like Cheniere Energy (LNG), Kinder Morgan (KMI), Targa Resources (TRGP), and Williams (WMB) have been leading the way on repurchases.

Rosenbluth: Back to consumer staples, Wal-Mart (WMT) reported strong results earlier today and raised its full-year guidance. E-commerce sales jumped 24%, which is a good sign. WMT is a key holding in the Consumer Staples Select Sector SPDR Fund (XLP) and the Vanguard Consumer Staples ETF (VDC). Interestingly, it has an 8% weighting in the VanEck Retail ETF (RTH). The company’s stock is down 2% as I type this on Thursday. Meanwhile, Target saw weaker earnings results on Thursday, including a 5% drop in sales. However, the stock is up 2%. This will likely shift as the day goes on.

It feels like a while ago, but Amazon.com (AMZN)’s second-quarter earnings crushed expectations. Alphabet (GOOGL) was strong too. Among the ETFs that were boosted by this were the growth-oriented Invesco QQQ Trust (QQQ) and iShares S&P 500 Growth ETF (IVW).

AI Companies Having a Strong Earnings Season

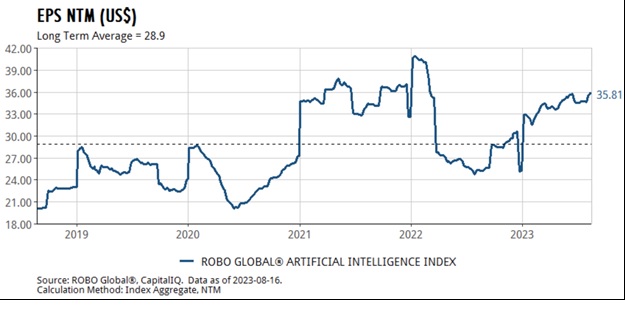

Zeno Mercer, research analyst, Robo Global: With 74% of companies in the THNQ Artificial Intelligence Index reporting, we’ve seen 62% beating expectations on revenue with an average surprise of 1.4% and growth of 11.2%. We’ve also seen 68% beating EPS expectations with an average surprise of 10.9% at 25.2% growth.

We’re definitely starting to see the AI play show signs of an upward trajectory across the different subsectors. Nine of the 11 subsectors grew year over year. Despite the inflow of attention given to AI this year, coming off of tough comps (2 years of post-COVID growth), we’re actually in a trough of sorts, currently led by companies like NVIDIA (NVDA), Arista Networks (ANET), Crowdstrike (CRWD), Samsara (IOT) and Snowflake (SNOW). Projections are pointing to a rebound to 13.2% the following year.

This all being said, earnings and sales growth are outpacing the overall market. They are expected to ramp up over the following two years as AI adoption drives demand and expands. Many semiconductor and semiconductor equipment manufacturers are still under pressure as a PC /mobile market slowdown hits globally. Additionally, Chinese restrictions are impacting +10% of revenues for many of these companies.

Data Analytics Firms Announce Slowdowns

Longer term, there is a lot of effort and capital being invested into expanding chip production into the EU and USA (such as via the CHIPS and Science Act). This, coupled with additional AI infrastructure investment, should more than offset the headwinds. Most surprising so far has been the slowdown and investor reaction regarding data analytics players like Alteryx (AYX) and Datadog (DDOG), which both announced slowdowns and more conservative guidance for the second half of this year.

Ultimately, however, the more AI integrates into the enterprise and life, the more important big data/analytics platforms become and the more money they will spend on them. Speaking of this subsector, we just had New Relic (NEWR) receive a take-private buyout offer from TPG and Francisco Partners a few weeks back.

Next week we have perhaps the biggest AI tell of them all–NVIDIA’s earnings on Aug 23. It’s clear that the demand for AI chips isn’t slowing down anytime soon. The same goes for accompanying AI software that not only relies on these chips but begets more demand as applications expand. Whether this translates to a short-term guidance raise to match the high valuations, we’ll have to see next week.

Rosenbluth: AI has been in focus this year, but especially in August. We have our AI Symposium on Aug 30 and then a webcast on Aug 31, Exploring the Impact of Generative AI on Robotics.

For more news, information, and strategy, visit the Energy Infrastructure Channel.