Instead of investing in a broad sector ETF, investors may be able to enhance portfolio returns by being more selective with their energy exposure.

MLPs have handily outpaced other energy subsectors in 2023 to date, strengthened by midstream’s defensive qualities, M&A activity, and positive dividend announcements.

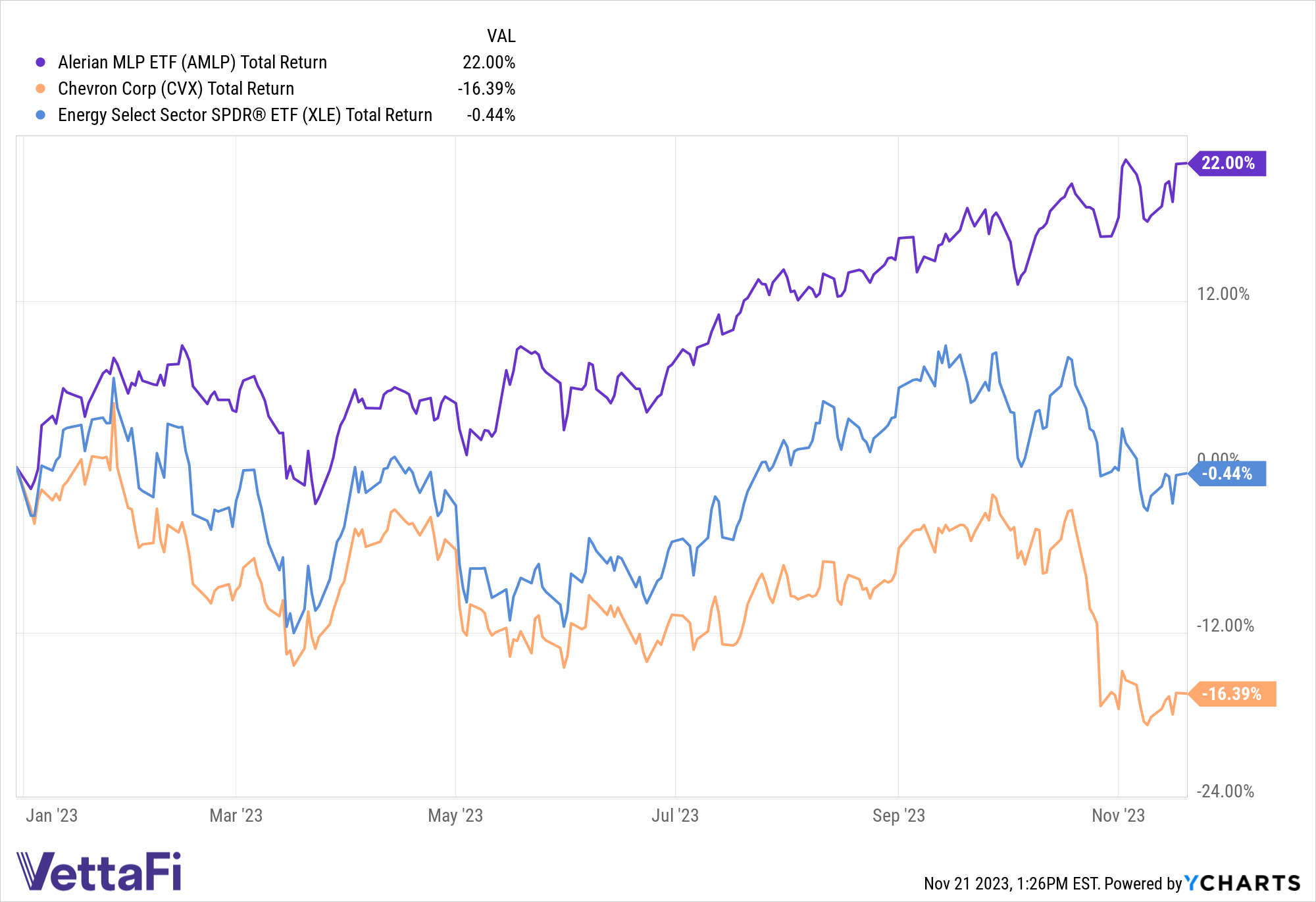

Despite volatility in energy commodity prices, the Alerian MLP ETF (AMLP) has provided attractive returns and income to investors. The fund is up 22.0% year to date as of November 20, dramatically outperforming broader energy. During the same period, the Energy Select Sector SPDR Fund (XLE) is down 0.4%.

AMLP’s underlying index is a capped, float-adjusted, cap-weighted composite of energy infrastructure MLPs. MLPs have shown strength recently as they have less sensitivity to commodity prices given their fee-based business models.

Additionally, MLPs are known for offering attractive income, and distributions can be particularly attractive in volatile markets.

Weakness in the Energy Sector

The broader energy sector, measured by XLE, has been weakened by its concentrated exposure to two names. Exxon Mobil (XOM) and Chevron Corporation (CVX) make up 40% of XLE’s underlying index by weight. This means the performance of the broad energy ETF is largely dependent on the performance of these two individual securities.

This has been particularly problematic as of late, as both companies have struggled in the current environment. Crude oil and natural gas prices are lower compared to a year ago, impacting profits for these names.

While Exxon is down 2.0% year to date as of November 20, Chevron has plummeted 16.4%. Last month, shares of Chevron fell 6.7% in one day in response to the company reporting third-quarter earnings that missed expectations and announcing delays and cost overruns with an expansion project in Kazakhstan.

It’s important to highlight that not only is AMLP outperforming its energy sector peers, it’s also outperforming the broader market on a total return basis. AMLP is on track to outperform the S&P 500 in 2023, which would mark the third consecutive year of outperformance.

For more news, information, and analysis, visit the Energy Infrastructure Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP, for which it receives an index licensing fee. However, AMLP is not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP.