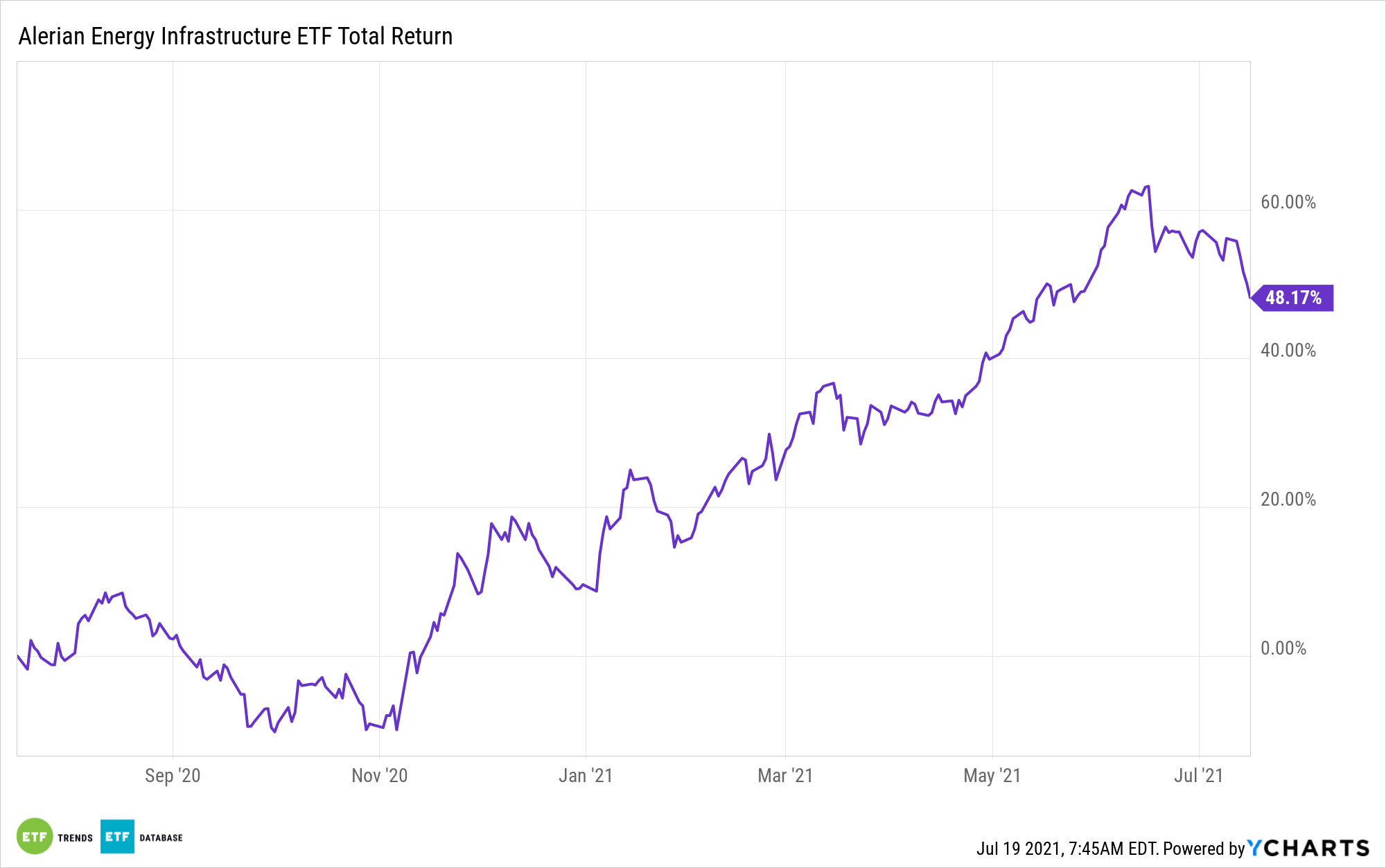

Investors considering ETFs like the Alerian Energy Infrastructure ETF (ENFR) typically do so to gain conservative exposure to the energy patch while garnering above-average levels of income.

However, the midstream energy infrastructure space is evolving with the times and getting in on the renewable energy transition. The latest example of that evolution is Kinder Morgan (NYSE: KMI) saying last Friday it’s acquiring Kinetrex Energy for $310 million.

“Kinetrex is the leading supplier of liquefied natural gas (LNG) in the Midwest and a rapidly growing player in producing and supplying renewable natural gas (RNG) under long-term contracts to transportation service providers,” according to a statement issued by Houston-based Kinder Morgan.

That stock accounts for 5.56% of ENFR’s roster and is the fifth-largest holding in the exchange traded fund.

“Kinetrex has a 50% interest in the largest RNG facility in Indiana as well as signed commercial agreements to begin construction on three additional landfill-based RNG facilities. Once operational next year, total annual RNG production from the four sites is estimated to be over four billion cubic feet,” said the buyer.

For those not familiar, RNG (renewable natural gas) is the very definition of a renewable energy source as it comes from agriculture waste, landfills, and and wastewater treatment facilities.

Kinder Morgan expects to ramp up three RNG facilities over the next 18 months.

ENFR tracks the Alerian Midstream Energy Select Index (AMEI), which is an increasingly credible play on renewable energy expansion. Carbon capture utilization and storage (CCUS), purveyed by some ENFR components, are vital to green energy.

“Notably, the IEA believes reaching net zero will be virtually impossible without CCUS. On June 17th , Pembina Pipeline (PPL CN, 5.00% wgt.) and TC Energy (TRP CN, 5.04% wgt.) announced their plan to jointly develop a large-scale carbon transportation and sequestration system in Alberta to transport more than 20 million tons of CO2 annually, combining PPL’s and TRP’s industry experience and leveraging their existing pipeline network to build the backbone for Alberta’s CCUS industry,” according to Alerian analyst Mauricio Samaniego.

Pembina and TC Energy combine for 12.55% of ENFR’s roster.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our Energy Infrastructure Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.