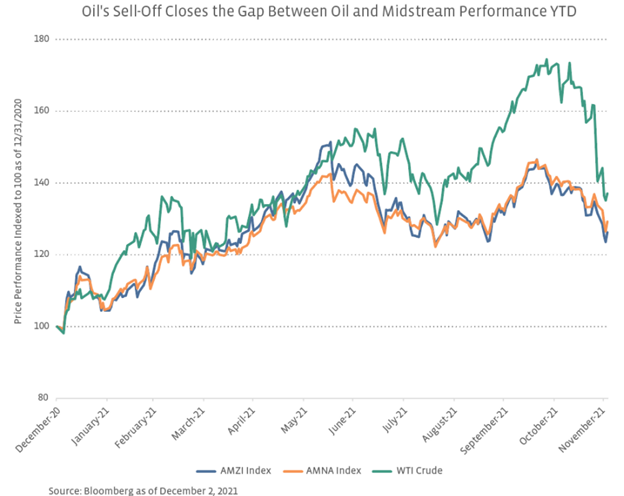

While midstream performance is somewhat correlated to the price fluctuations of oil, it continues to remain fairly insulated from the sharpest dips, instead relying on underlying fundamentals that help it chart its own course.

Midstream has been impacted by recent oil price volatility, but it is protected from the sharper drawdowns that oil experiences. Midstream also behaves similarly when oil prices rapidly peak, experiencing the rise but not as drastically, explained Stacey Morris, CFA for Alerian. The sector in general is much less volatile than the price movements of the products it carries, and that has been seen in recent weeks with oil in particular.

Oil price movement is something to be aware of, but midstream investors need to look beyond it, as midstream is more insulated and experiences less overall volatility than oil prices. Performance for midstream companies has been fairly resilient despite recent pullbacks in oil prices.

Omicron fears caused rapid losses in oil prices at the end of November; West Texas Intermediate oil prices were down greater than 15% between November 24 and December 2. In that same period of time, the Alerian MLP Infrastructure Index (AMZI) only dropped 6.4%, and the broader Alerian Midstream Energy Index (AMNA) fell just 5.6%.

Image source: Alerian

The prices of oil had rallied in the fall, hitting as high as $86 a barrel at the end of October, but it was such a sharp and rapid rise that Omicron’s pullback was a check that brought prices back down. Since then, sell-offs within oil holdings have occurred as investors were concerned about strategic oil releases and continued volatility with much still unknown about the newest COVID variant.

It’s a spike that Alerian believes doesn’t reflect any changes in the underlying fundamentals of oil, but instead was driven by fears and a “shoot first, ask questions later” mentality. Particularly within midstream, very little has changed, and there is much more stability as its business models rely on fees to generate free cash flow.

Midstream companies have experienced strong free cash flow this year, reducing their leveraged debt and increasing buybacks and dividend payouts. The industry should remain largely unaffected by the price of oil per barrel, as actual production is anticipated to remain the same.

Investing in midstream is also a great play for investors who are concerned about inflation, since the businesses transact in contracts that have built-in inflation adjustments, offering a further point of stability amidst uncertainty and oil price volatility.

For more news, information, and strategy, visit the Energy Infrastructure Channel.